Termination Meeting Sample For Internet Connection

Description

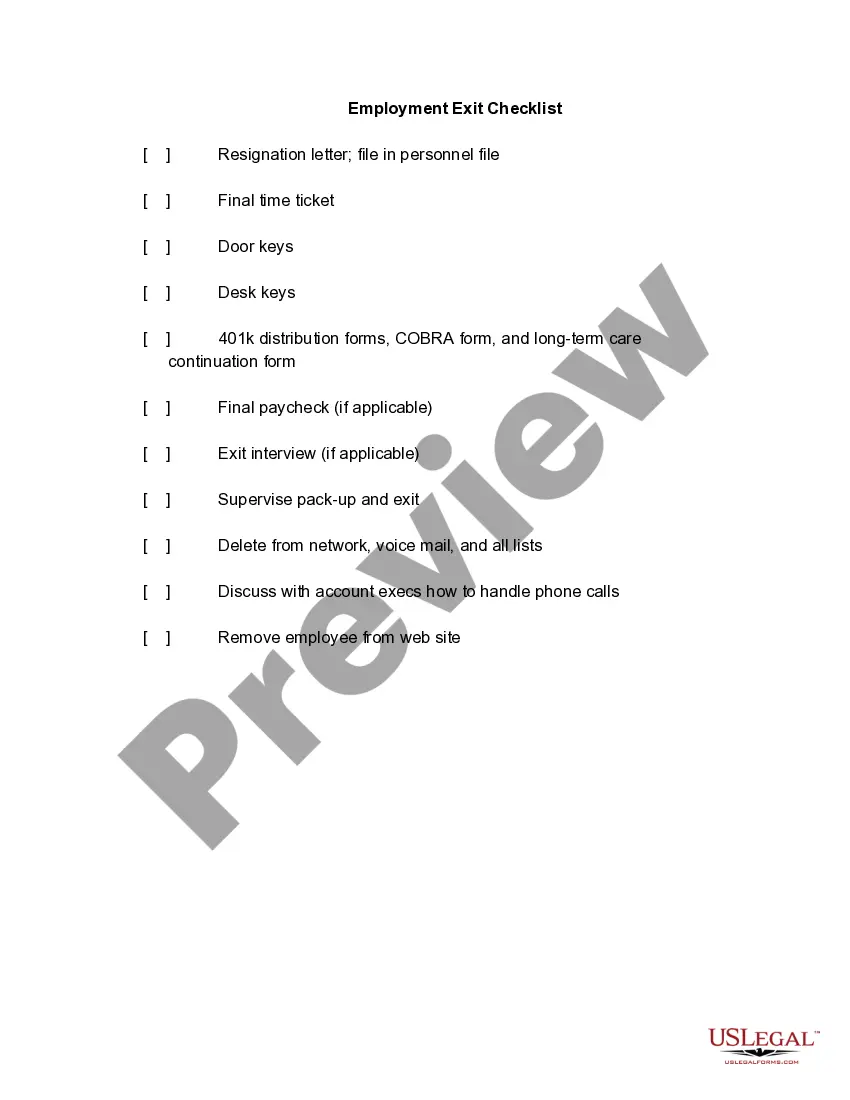

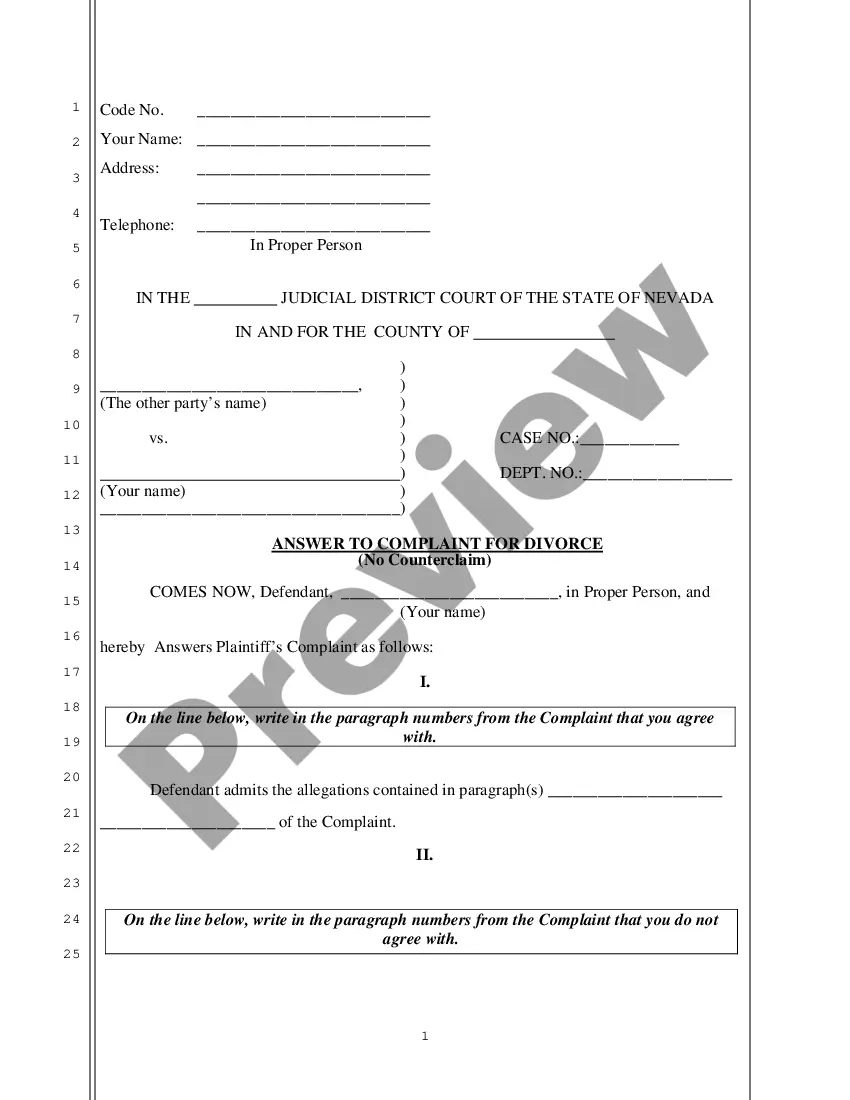

How to fill out Termination Meeting Checklist?

Managing legal documents can be daunting, even for the most experienced individuals.

If you're searching for a Termination Meeting Template For Internet Connection and lack the time to spend finding the correct and updated version, the process can be stressful.

US Legal Forms addresses all the needs you may encounter, ranging from personal to business documentation, all in one platform.

Leverage advanced tools to create and manage your Termination Meeting Template For Internet Connection.

Here are the steps to follow after obtaining the form you require: Verify that this form is the correct one by previewing it and reading the details. Ensure that the template is valid in your state or county. Click Buy Now when you are prepared. Select a monthly subscription plan. Choose the file format you desire, then Download, complete, sign, print, and send your document. Make the most out of the US Legal Forms online library, backed by 25 years of experience and reliability. Turn your routine document management into a straightforward and user-friendly procedure today.

- Access a valuable repository of articles, guides, and manuals pertinent to your circumstances and requirements.

- Conserve time and effort searching for the documents you need, and utilize US Legal Forms’ enhanced search and Preview function to locate the Termination Meeting Template For Internet Connection and download it.

- If you hold a monthly membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check out the My documents section to review the documents you have previously downloaded and manage your files as desired.

- If this is your first encounter with US Legal Forms, create an account and gain unlimited access to all the platform's features.

- A robust web form library can be transformative for anyone aiming to navigate these situations proficiently.

- US Legal Forms stands as a frontrunner in online legal forms, boasting over 85,000 state-specific legal documents accessible at any time.

- With US Legal Forms, you can access both state- and county-specific legal and business templates.

Form popularity

FAQ

The initial cost to set up an LLC in Nevada is $425. Then, the annual costs are $350 per year. In most states, you just have to file a single LLC formation document. However, in Nevada, you have to file an Articles of Organization as well as a State Business License and Initial List of Managers or Managing Members.

Some of the disadvantages are slightly higher filing and business license fees than other states, and the commerce tax for business with over $4 million of Nevada gross revenue.

Everything You Need to Know About Nevada LLCs: Name Your LLC. Designate a Registered Agent. Submit LLC Articles of Organization. Write an LLC Operating Agreement. Get an EIN. Open a Bank Account. Fund the LLC. File State Reports & Taxes.

The first step is to file a form called the Amendment to Articles of Organization with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in Nevada. The filing fee for an Amendment to Articles of Organization in Nevada is $175.

The Nevada Advantage Tax Breaks. Nevada has some of the most favorable tax laws in the United States. ... Asset Protection. One of the primary benefits of an LLC is its ability to protect the personal assets of its owners from business debts and liabilities. ... Flexibility. ... Ease of formation. ... Proximity to major markets.

You can get an LLC in Nevada in 1 business day if you file online (or 5-6 weeks if you file by mail).

Nevada is another state that makes it onto the ?best state to form LLCs? lists online. Similar to Wyoming, the state doesn't impose any income taxes, either personal or corporate, nor does it levy franchise taxes, although it does have a gross receipts tax.

Nevada LLC fees for registering a new business are $425, consisting of $75 for articles of organization, $150 for a list of members, and a $200 business license. The LLC must submit an annual list of members and pay $150. These fees are roughly the same for an LP or LLP.