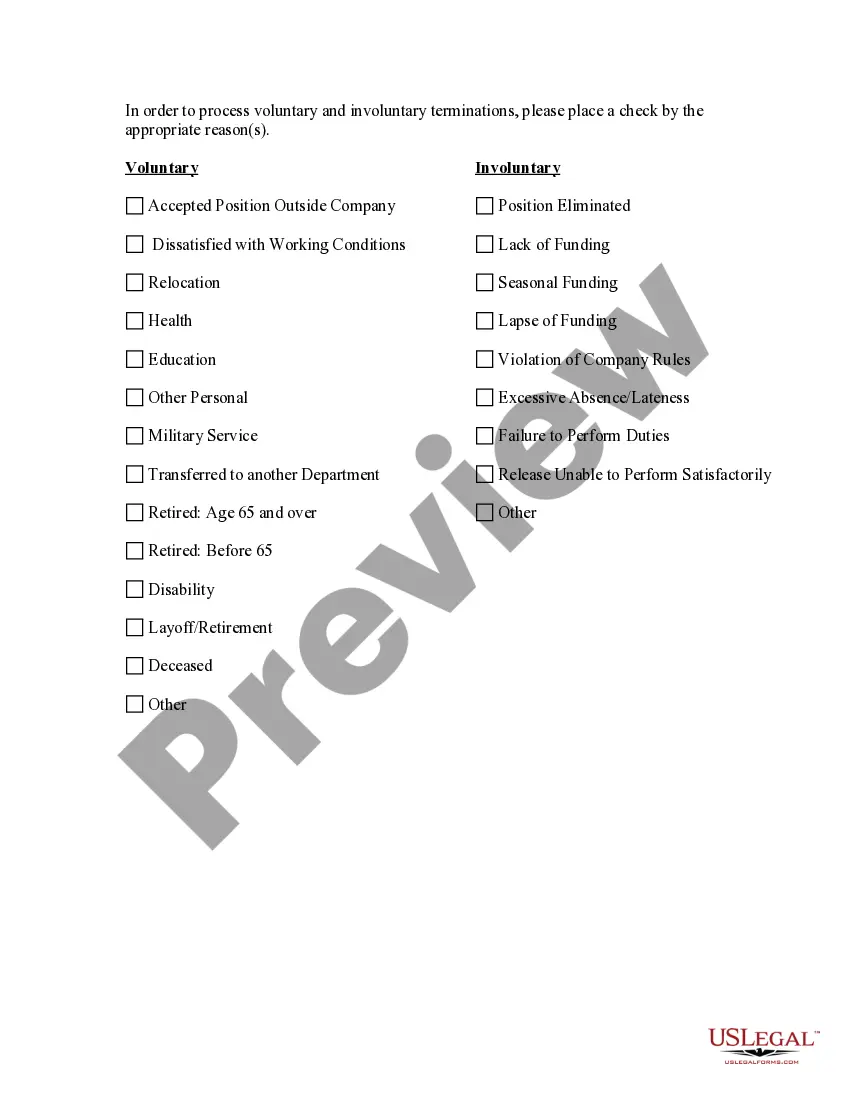

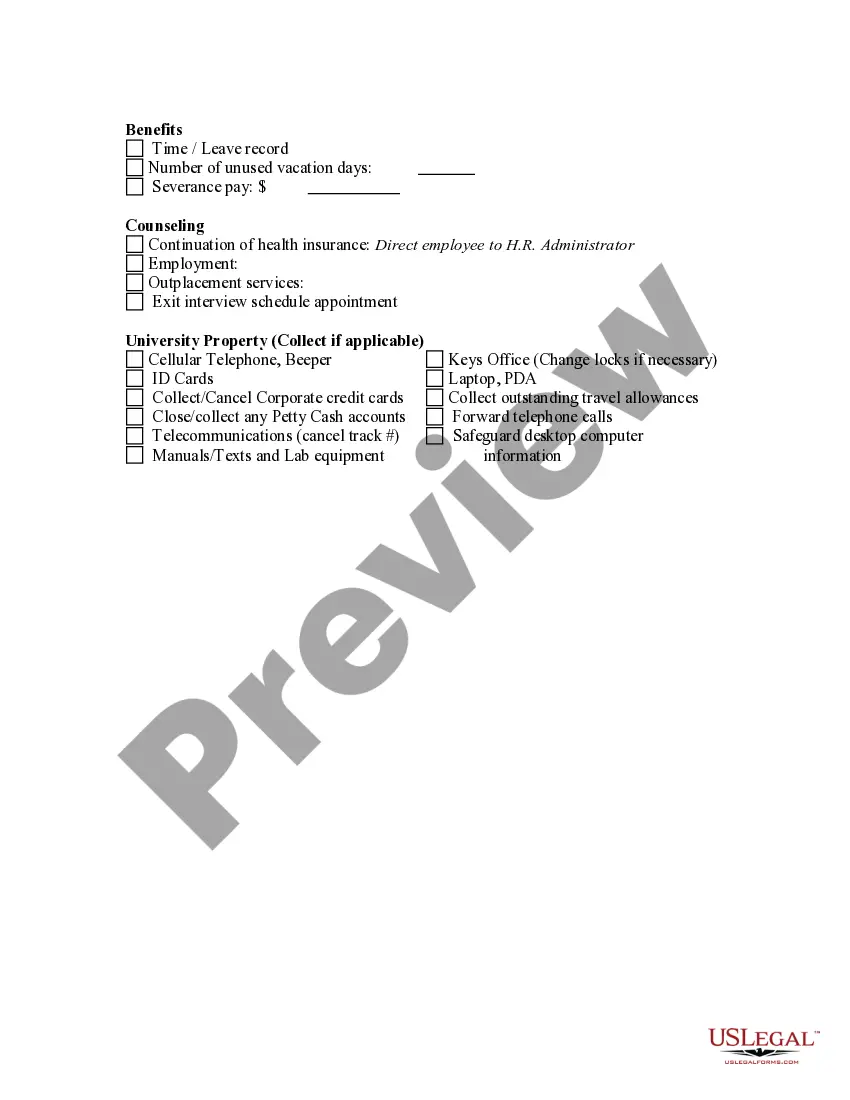

Employee Termination Checklist For Information Technology

Description

How to fill out Exit - Termination Checklist?

Dealing with legal documents and processes can be a lengthy addition to your day.

Employee Termination Checklist for Information Technology and similar forms typically necessitate searching for them and figuring out how to fill them out correctly.

As a consequence, whether you are managing financial, legal, or personal affairs, utilizing a thorough and accessible online repository of forms nearby will be very beneficial.

US Legal Forms is the leading online service for legal templates, boasting over 85,000 state-specific forms and a variety of tools to help you complete your documentation with ease.

Simply Log In to your account, locate Employee Termination Checklist for Information Technology, and download it immediately from the My documents section. You can also access forms you've downloaded previously.

- Explore the collection of pertinent documents available to you with a single click.

- US Legal Forms provides you with state- and county-specific forms that can be downloaded at any time.

- Protect your document management processes with first-rate support that helps you prepare any form in minutes without any extra or concealed charges.

Form popularity

FAQ

Okay, off to the races: Let's show you how to start an LLC in Indiana. Step 1: Name Your Indiana LLC. Choose a name for your Indiana LLC. ... Step 2: Appoint a registered agent in Indiana. ... Step 3: File Indiana LLC Articles of Organization. ... Step 4: Create an operating agreement. ... Step 5: Apply for an EIN.

Establishing Your Indiana LLC The cost for domestic LLC formation is $100 by mail or $95 online. There's a small payment processing fee if filing online. Foreign entities registering an LLC must likewise complete a Foreign Registration Statement. The filing fee is $125 to $250 by mail or $105 to $240 online.

Indiana LLC Articles of Organization Filing Fee ($95) The Articles of Organization are filed with the Indiana Secretary of State Business Services Division. And once approved, this is what creates your LLC. The $95 fee is a one-time fee. You don't have to pay any monthly (or annual) fees to start your Indiana LLC.

File Articles of Organization An LLC is created in Indiana by filing Articles of Organization with the Indiana Secretary of State Corporations Division. Filing the articles can be done online or by postal mailing. The filing fee is $100 and payment can be made by credit card.

The articles of organization document contains all the information needed to establish your LLC in Indiana. Including: The name of your LLC. The street address of your LLC's registered office and the name of the registered agent at that office.

Starting an LLC costs $95 in Indiana. This is the state filing fee for a document called the Indiana Articles of Organization. The Articles of Organization are filed with the Indiana Secretary of State Business Services Division. And once approved, this is what creates your LLC.

You can register a foreign LLC in Indiana by submitting a Foreign Registration Statement to Indiana's Secretary of State, Business Services Division and paying the state filing fee of $108 for online filings, or $125 for mail filings.

Establishing Your Indiana LLC The cost for domestic LLC formation is $100 by mail or $95 online. There's a small payment processing fee if filing online.