Special Needs Trust Definition For Elderly

Description

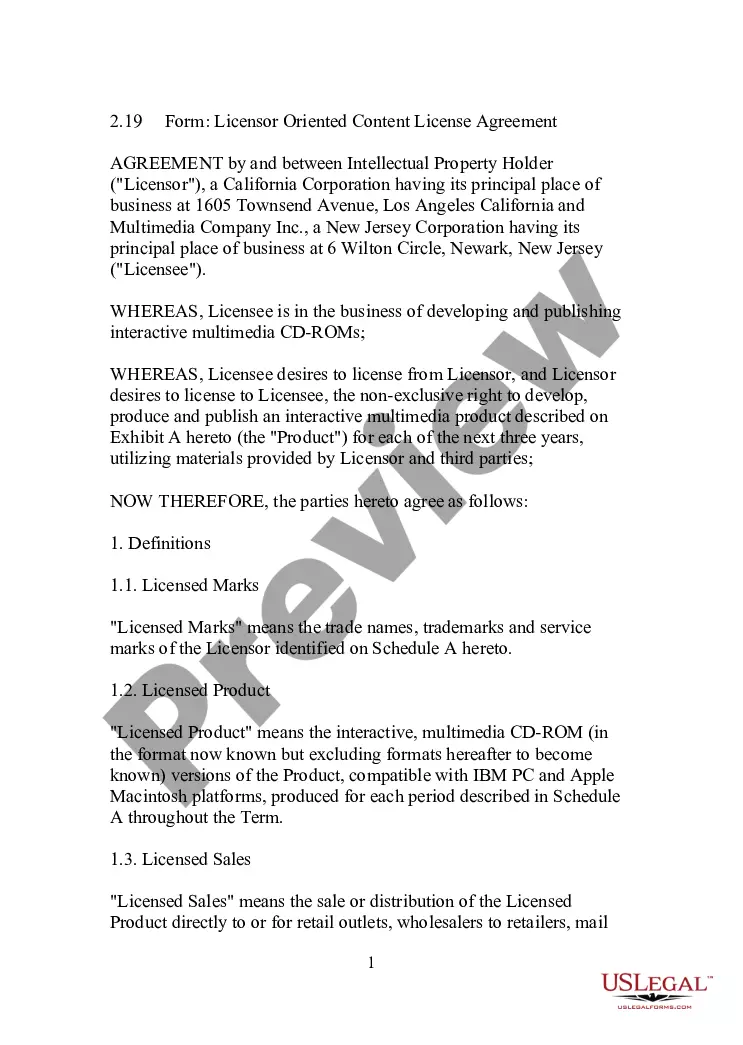

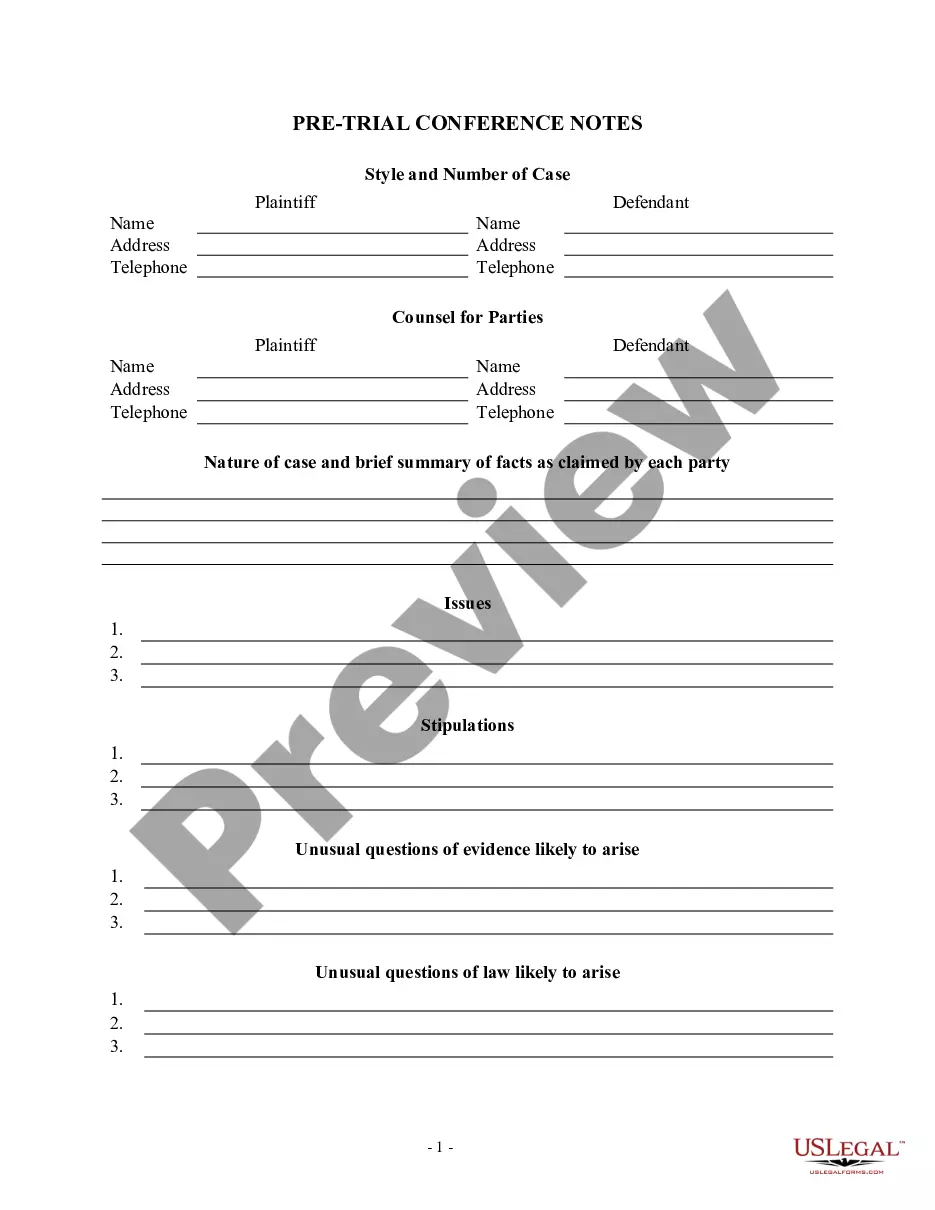

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

It's well-known that you cannot instantly become a legal authority, nor can you swiftly learn to draft a Special Needs Trust Definition For Elderly without a specific set of abilities.

Assembling legal documents is a labor-intensive undertaking that necessitates specialized education and expertise. So, why not entrust the creation of the Special Needs Trust Definition For Elderly to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can find everything from court documents to templates for internal communications. We understand how vital it is to comply with federal and state laws and regulations. That’s why all templates on our platform are tailored to your location and current.

You can access your documents again from the My documents tab at any time. If you are a returning customer, you can simply Log In, and find and download the template from the same tab.

No matter the reason for your documentation—whether it’s financial, legal, or personal—our website has everything you need. Experience US Legal Forms today!

- Locate the document you need using the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to ascertain whether Special Needs Trust Definition For Elderly is what you are looking for.

- If you require a different template, restart your search.

- Create a free account and choose a subscription plan to buy the template.

- Click Buy now. After your payment is processed, you can download the Special Needs Trust Definition For Elderly, fill it out, print it, and send or deliver it to the relevant individuals or organizations.

Form popularity

FAQ

When a beneficiary of a special needs trust reaches 65, the implications can vary based on individual circumstances. Generally, the trust can continue to function, providing support without affecting eligibility for certain benefits. However, it is essential to review the specific needs and options available to ensure compliance with regulations. Utilizing a platform like US Legal Forms can help you navigate these complexities and ensure that your trust continues to serve its intended purpose.

A special needs trust definition for elderly individuals focuses on preserving government benefits while providing additional financial support. Unlike a regular trust, which can be used for any purpose, a special needs trust is specifically designed to benefit individuals with disabilities without jeopardizing their eligibility for essential programs. This type of trust allows funds to be used for medical expenses, housing, and other needs that enhance the quality of life. By understanding these differences, you can make informed decisions about estate planning.

A special needs trust is a legal arrangement designed to benefit individuals with disabilities while preserving their eligibility for government assistance. Specifically, the special needs trust definition for elderly individuals involves setting aside funds to cover additional expenses without jeopardizing their access to essential programs like Medicaid or Social Security. This trust allows the elderly to maintain their quality of life by providing for their unique needs, such as medical expenses, housing, and personal care. By using resources from a special needs trust, you can ensure that your loved ones receive the support they deserve without losing vital government benefits.

What are the main benefits of an SDT? The asset value limit of $781,250 (indexed annually on 1 July) and income from the trust may be disregarded for the purposes of the principal beneficiary's income support payment. Assets above that limit are added to the assessable assets of the principal beneficiary.

SSDI does not depend upon having limited assets, and it is not affected by distributions from a Disability Trust.

A special needs trust, also known as a supplemental needs trust, is a type of irrevocable trust that can provide benefits to minors and physically or mentally challenged individuals.

The trustee works in very close contact with the beneficiary and/or their caregiver to manage the trust and its financial distributions to pay for these things. The main takeaway regarding distribution of SNT funds is this: The beneficiary never sees the money directly, but the money is used to pay for their needs.

Cons of Special Needs Trusts The trust must be maintained, and yearly management costs can be high. Depending on who manages the fund, there may be a minimum amount required to set up the trust. It may be financially difficult for the settlor to actually establish the trust, depending upon their circumstances.