Termination Trust Trustee Foreclosure

Description

How to fill out Termination Of Trust By Trustee?

Locating a reliable source for the most up-to-date and suitable legal templates is a significant part of managing red tape.

Identifying the correct legal documents requires accuracy and meticulousness, which is why it’s crucial to obtain samples of Termination Trust Trustee Foreclosure exclusively from reputable providers, such as US Legal Forms. An incorrect template will squander your time and delay the matter at hand. With US Legal Forms, you have little to worry about. You can access and review all the details regarding the document’s application and significance for your circumstance and in your jurisdiction.

Once you have the form on your device, you may edit it with the editor or print it and complete it manually. Eliminate the hassle that comes with your legal paperwork. Explore the extensive US Legal Forms library where you can locate legal templates, assess their relevance to your situation, and download them immediately.

- Utilize the library navigation or search bar to locate your template.

- Examine the form’s details to ensure it meets the standards of your state and locality.

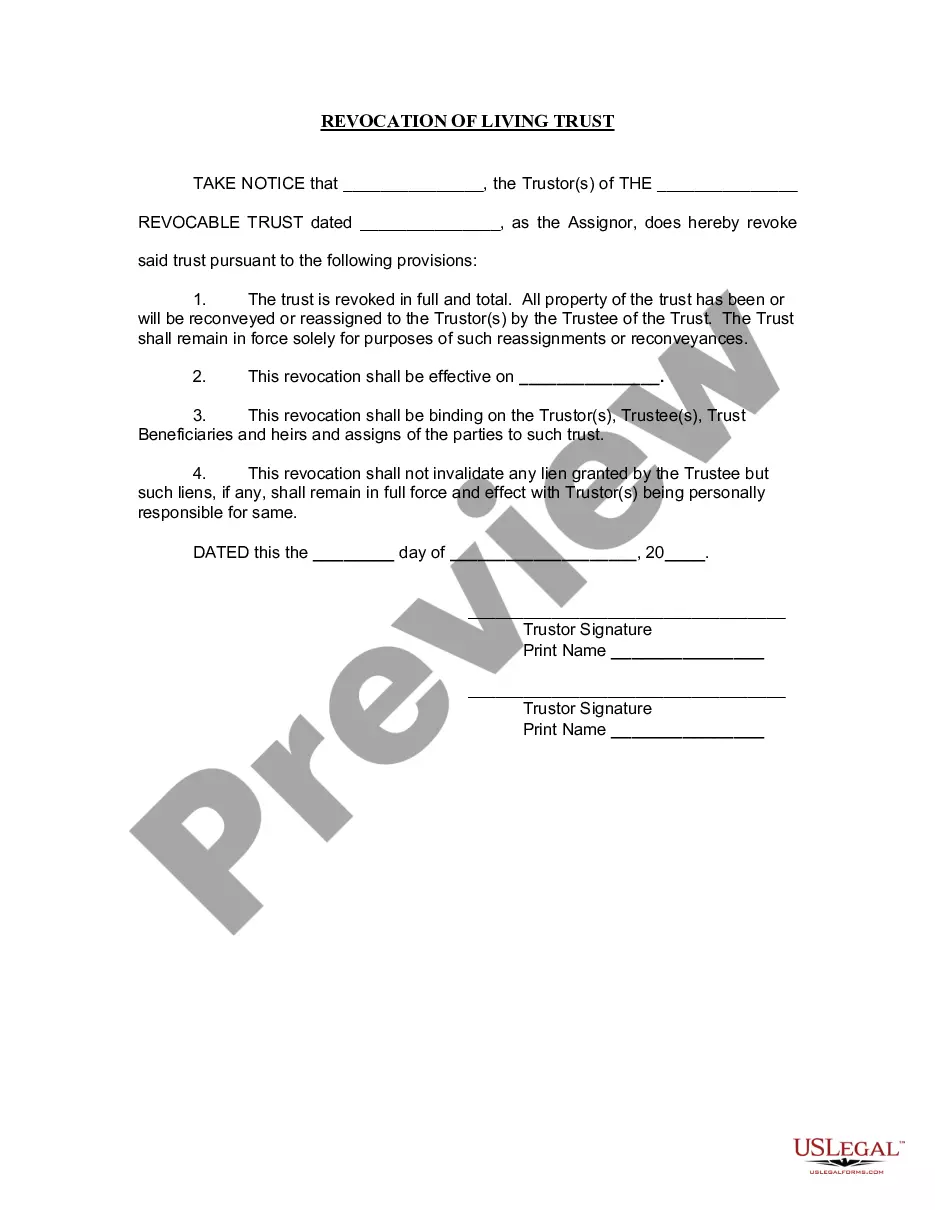

- View the form preview, if provided, to confirm the form is indeed the one you seek.

- Continue your search and find the appropriate document if the Termination Trust Trustee Foreclosure does not meet your needs.

- If you are confident about the form’s applicability, download it.

- As a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Select the payment plan that suits your requirements.

- Proceed with the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Termination Trust Trustee Foreclosure.

Form popularity

FAQ

Yes, a house held in a trust can go into foreclosure if the mortgage payments are not made. The lender can initiate foreclosure proceedings against the property, just as they would with any other home. Understanding the implications of a termination trust trustee foreclosure is vital for the beneficiaries involved. Consulting with experts or using resources from US Legal Forms can provide the clarity needed to navigate this situation effectively.

Firing a trustee can vary in complexity depending on the trust's terms and state laws. Generally, you must provide valid reasons for the removal, such as misconduct or failure to perform duties. It's crucial to follow the proper legal channels to avoid any potential termination trust trustee foreclosure complications. Utilizing US Legal Forms can guide you through the necessary steps and documentation to ensure a smooth transition.

However, with the promulgation of the Act in June 1988, Section 21 was introduced to allow a trustee to resign, subject to the following formalities being met ? they may ?resign by notice in writing to the Master and the ascertained beneficiaries who have legal capacity?, at any time and regardless of whether the trust ...

Reasons for removing a trustee They may choose to step down. Their circumstances may change in a way which stops them from continuing their role. For example, they may become unwell. In a membership charity they may be unsuccessful in seeking re-election.

Non-judicial Foreclosure To accomplish this, a power of sale clause is added to the mortgage, or deed of trust, which gives a third-party trustee the right to sell the property in the event the borrower does not make their payments.

The trustee then auctions off the property to satisfy the debt, the attorney fees and foreclosure costs. Following the sale, the owner must move out of the property within 10 days of the sale. This foreclosure process takes approximately 140 days.

Deeds of trust almost always include a power-of-sale clause, which allows the trustee to conduct a non-judicial foreclosure - that is, sell the property without first getting a court order.