Charitable Remainder Trust Form 5227

Description

How to fill out Charitable Remainder Unitrust?

Handling legal documents can be daunting, even for the most experienced professionals.

When you are in search of a Charitable Remainder Trust Form 5227 and lack the time to find the correct and updated version, the process can become taxing.

Access a valuable collection of articles, guides, and resources relevant to your situation and needs.

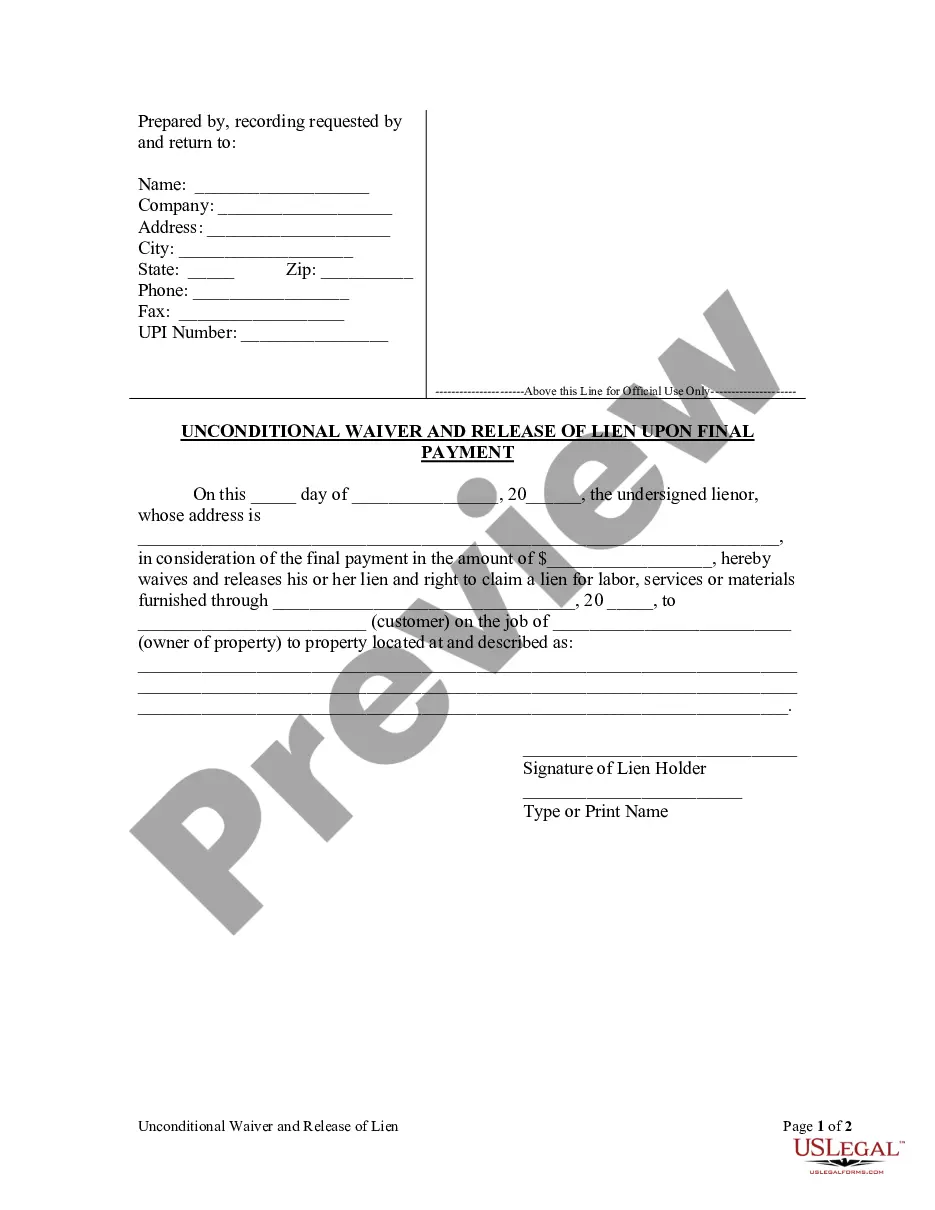

Conserve energy and time searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Preview feature to locate the Charitable Remainder Trust Form 5227 and obtain it.

Leverage the US Legal Forms online library, supported by 25 years of expertise and trustworthiness. Transform your daily document management into a seamless and user-friendly process today.

- If you hold a subscription, Log Into your US Legal Forms account, search for the form, and retrieve it.

- Visit the My documents section to review the documents you have previously saved, as well as to manage your folders according to your preferences.

- If you are using US Legal Forms for the first time, create an account to gain unlimited access to all the resources in the library.

- After retrieving the form you need, ensure to check it is the correct form by previewing it and reading its description.

- Confirm that the template is accepted in your state or county.

- Click Buy Now once you are prepared.

- Select a subscription option.

- Choose the format you desire, and Download, complete, eSign, print, and submit your document.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all your needs, from personal to corporate paperwork, all centralized in one location.

- Employ cutting-edge tools to create and manage your Charitable Remainder Trust Form 522.

Form popularity

FAQ

Beginning farmer qualifications A Ohio resident. Be looking to start or have been farming within the last 10 years. Not be related to the owner. Have a total net worth of less than $800,000. Provide the majority of labor and management of the farm. Have farming experience and or knowledge.

Agricultural assets include land, livestock, facilities, buildings, and machinery used in farming. In order for land to qualify as an agricultural asset, it must total at least 10 acres or produce an average annual income of at least $2,500 from farming.

FARM OPERATING PLAN FOR AN INDIVIDUAL This form is to be completed by, or on behalf of, an individual who is seeking benefits from the Farm Service Agency (FSA) as an individual (and not as part of an entity) under one or more programs that are subject to the regulations at 7 CFR Part 1400.

This form is used by program participants of the Noninsured Disaster Assistance? Program, Crop Disaster Program, Loan Deficiency Program, Marketing Assistance Program and Tobacco program. ? The purpose of the form is to collect acreage data to determine program eligibility.

Owner Occupancy Credit (formerly known as the 2 ½ % Tax Reduction) for Owner-Occupied Home: To receive the owner occupancy credit tax reduction you must: (1) own the home, (2) occupy the home as your principal place of residence and (3) apply with the County Auditor between January 1st and the first Monday in June.

Ohio's Right to Farm Law, also referred to as the ?Agricultural District Program,? provides immunity from a civil nuisance claim made by those who move near an existing farm.

The Beginning Farmer Tax Credit equals 3.99% of one of the following: In the case of a sale, the sale price. The credit must be claimed in the year of the sale. In the case of a rental, the gross rental income that the individual or business received during the first three years of the rental agreement.

Form FSA-510, Request for an Exception to the $125,000 Payment Limitation for Certain Programs. Form CCC-860, Socially Disadvantaged, Limited Resource, Beginning and Veteran Farmer or Rancher Certification, for the applicable program year.