Partial Distribution Of Estate Form Withdrawal

Description

How to fill out Petition For Partial And Early Distribution Of Estate?

Whether you frequently handle documentation or occasionally need to submit a legal paper, it is essential to have a resource containing all pertinent and current samples.

The first step to take with a Partial Distribution Of Estate Form Withdrawal is to verify that it is the latest version, as this determines its eligibility for submission.

To simplify your search for the most recent document examples, visit US Legal Forms.

To obtain a form without creating an account, follow these instructions.

- US Legal Forms is a collection of legal documents that includes almost every type of sample document you may need.

- Search for the necessary templates, instantly review their relevance, and discover more about their uses.

- With US Legal Forms, you can access approximately 85,000 forms across various fields.

- Find the Partial Distribution Of Estate Form Withdrawal samples with just a few clicks and store them in your account at any time.

- Having a US Legal Forms account grants you easier access to all the samples you need with less hassle.

- Simply click Log In in the header of the site and navigate to the My documents section where all your required forms are readily available.

- This eliminates the need to waste time searching for the correct template or assessing its suitability.

Form popularity

FAQ

The 3-year rule for a deceased estate generally refers to the timeframe within which certain tax matters must be settled. This rule can impact how quickly the estate is processed and distributed to beneficiaries. Understanding this timeframe is crucial, particularly when considering a partial distribution of estate form withdrawal, as it may affect when and how distributions can occur.

Yes, an executor has the authority to adjust the distribution of an estate, provided they act in accordance with the will and applicable laws. However, this change should be carefully documented to avoid potential disputes among beneficiaries. If a partial distribution of estate form withdrawal is involved, ensure any modifications align with the legal framework to maintain transparency.

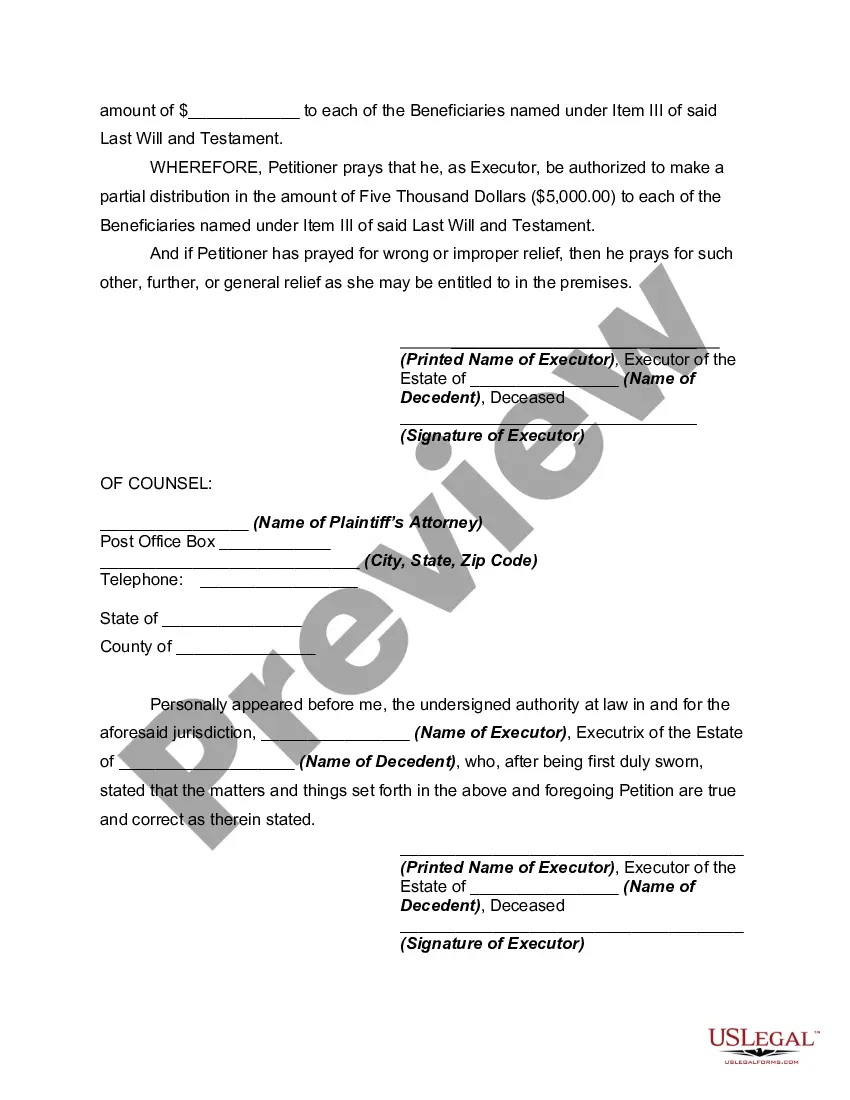

Absolutely, you can make a partial distribution of an estate if you have the proper authorization. This allows beneficiaries to receive their share of the estate sooner than the full settlement. Utilizing a partial distribution of estate form withdrawal can aid in organizing this process, ensuring compliance with legal requirements and the wishes of the deceased.

Yes, it is possible to distribute part of an estate to beneficiaries before the entire estate is settled. This is often referred to as a partial distribution of an estate, and it can be beneficial for providing immediate support to beneficiaries. By using a partial distribution of estate form withdrawal, you can manage this process clearly and effectively.

Distributing items from an estate typically begins with identifying all assets and determining their value. Once you have a clear inventory, you can utilize a partial distribution of estate form withdrawal to facilitate the legal sharing of selected items among beneficiaries. It's vital to ensure transparency and fairness during this process to uphold the wishes of the deceased.

Yes, you can perform a partial distribution of an estate. This process allows executors to distribute certain assets to beneficiaries before the estate is fully settled. Using a partial distribution of estate form withdrawal can simplify this process and ensure that distributions are done legally and efficiently.

Yes, estate distributions must be reported to the IRS. Beneficiaries may need to report income received from the estate, and the estate may file its own tax returns, depending on the income level. If you are involved in a partial distribution of estate form withdrawal, it is important to follow IRS guidelines to avoid penalties. Utilizing resources like US Legal Forms can help ensure you navigate these requirements accurately and efficiently.

Yes, an estate typically issues a 1099 form to the executor, especially if the executor has received payments that are taxable. This form informs the IRS of the payments made to the executor for their services. If you are managing a partial distribution of estate form withdrawal, clarity about each distribution is crucial for tax purposes. Ensure your records reflect any payments made and consult with a tax advisor if needed.

A preliminary distribution refers to an early distribution of funds or assets from the estate before final accounting is completed. Typically, this occurs when beneficiaries need immediate access to their share of the estate. It is important to document these preliminary distributions carefully, especially in the context of a partial distribution of estate form withdrawal. Doing so helps maintain transparency and accountability among all parties involved.

To report estate distributions to the IRS, you use IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. Along with this form, you will need to provide details about the distributions made to beneficiaries, including the amount and nature of the distribution. If your estate makes a partial distribution of estate form withdrawal, ensure you keep accurate records. This documentation will help when completing your tax returns and ensure compliance with IRS regulations.