Sale Storage Unit With Storage

Description

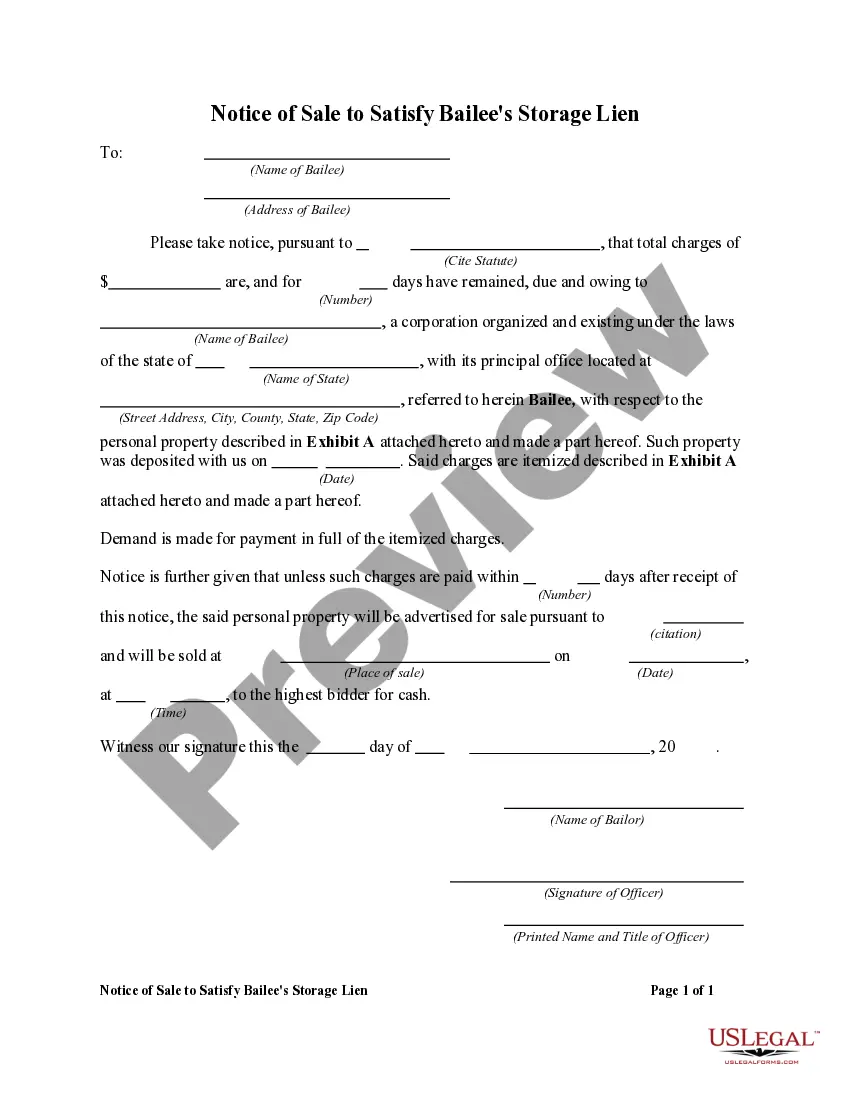

How to fill out Memorandum Of Sale Of Personal Property By Buyer In An Auction Of Property In A Storage Unit?

The Sale Storage Unit With Storage displayed on this page is a versatile legal template crafted by experienced attorneys in accordance with federal and local statutes and regulations. For over 25 years, US Legal Forms has supported individuals, enterprises, and legal professionals with over 85,000 verified, state-specific forms for various business and personal needs. It’s the fastest, most uncomplicated, and most reliable method to acquire the documents you need, as the service ensures bank-grade data security and anti-malware safeguards.

Obtaining this Sale Storage Unit With Storage will require just a few easy steps.

Register for US Legal Forms to have reliable legal templates for all of life’s circumstances readily available.

- Search for the document you require and review it.

- Browse through the sample you found and preview it or examine the form description to verify it meets your needs. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now once you’ve found the template you need.

- Register and sign in.

- Select the pricing plan that fits you best and create an account. Use PayPal or a credit card for a quick payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the fillable template.

- Choose the format you desire for your Sale Storage Unit With Storage (PDF, Word, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template for manual completion. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your form with a legit signature.

- Download your paperwork again.

- Reopen the same document whenever necessary. Access the My documents tab in your profile to redownload any forms that were previously saved.

Form popularity

FAQ

Firstly, investors form a DST by filing a Certificate of Statutory Trust with the Delaware Division of Corporations. Investors then choose to create a statutory trust that names a Delaware trustee or statutory trust that has become a registered investment corporation, along with a registered agent.

Delaware Trusts, made easy. Leave nothing to chance with a Revocable Trust built specifically for Delaware state laws. Get your Trust and other essential documents for just $500.

A DST is formed by filing a certificate of trust with the Office of the Secretary of State of the State of Delaware. This certificate states only the name of the trust and the name and address of the Delaware trustee.

Delaware has a state fiduciary income tax on income accumulated in a ?non-grantor? trust where the trust itself, and not the grantor, is taxed on income earned by the trust. However, there is a full exemption from this tax if the income is accumulated for beneficiaries who are not current Delaware residents.

A living trust is created in Delaware by signing a Declaration of Trust, which will name the trustee, beneficiary and terms of the trust. You need to sign the declaration in the presence of a notary. Once that is complete, the trust must be funded by transferring assets into it.

Tax Savings Delaware does not impose income tax on accumulated income or capital gains if the irrevocable Delaware trust has only nonresident remainder beneficiaries. In addition, Delaware imposes no income tax on required income distributions to beneficiaries not residing in Delaware. Transfer tax savings.

Trusts do not need to be registered with the courts, which maintains confidentiality. Also, Delaware allows non-disclosure of beneficiaries. IT'S EASY Decanting allows a trustee to move a trust's assets to Delaware and modify some provisions without judicial reformation.

Delaware Trusts, made easy. Leave nothing to chance with a Revocable Trust built specifically for Delaware state laws. Get your Trust and other essential documents for just $500.