Sample Motion To Vacate Default Foreclosure

Description

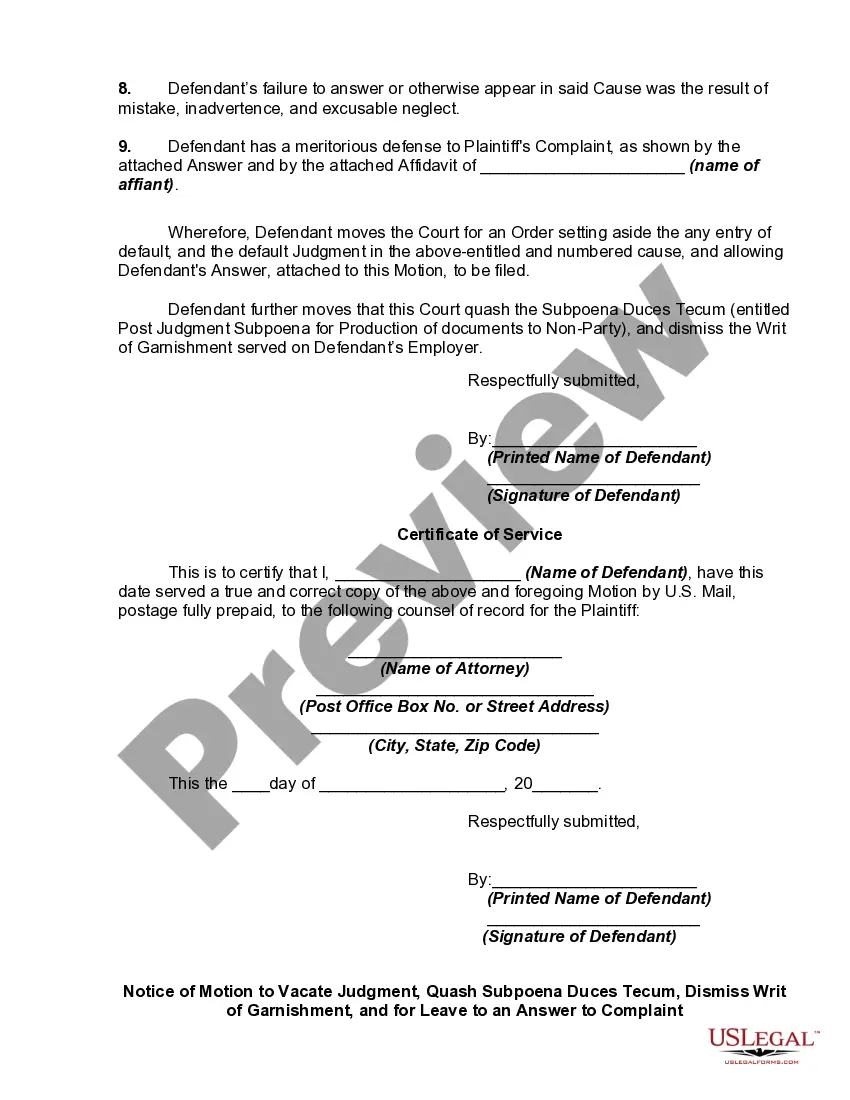

How to fill out Motion To Vacate Judgment, Quash Subpoena Duces Tecum, Dismiss Writ Of Garnishment, And For Leave To File An Answer To Complaint?

Legal management can be overwhelming, even for experienced professionals.

When you seek a Sample Motion To Vacate Default Foreclosure and lack the time to search for the appropriate and current version, the process can be challenging.

Utilize a valuable resource base of articles, guides, and materials related to your situation and needs.

Conserve time and effort searching for the documents you require, and take advantage of US Legal Forms’ advanced search and Preview feature to locate and download Sample Motion To Vacate Default Foreclosure.

Ensure that the sample is valid in your state or county and then select Buy Now when ready. Choose a subscription plan, select the format you wish, and Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and dependability. Improve your daily document management in a simple and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to view the documents you have previously saved and manage your folders as needed.

- If this is your first time using US Legal Forms, sign up for an account and gain unlimited access to all the benefits of the library.

- Follow these steps after downloading the form you desire.

- Check that this is the correct form by previewing it and reviewing its description.

- Access state- or county-specific legal and business documentation.

- US Legal Forms accommodates any needs you may have, from personal to corporate paperwork, all in one location.

- Employ advanced tools to complete and manage your Sample Motion To Vacate Default Foreclosure.

Form popularity

FAQ

To remove a default judgment, you must file a motion with the court asking to vacate the judgment. This motion should include reasons for your absence and any new evidence that supports your case. A well-prepared sample motion to vacate default foreclosure can guide you on how to present your situation clearly and convincingly.

Part-year Resident: An individual who is a resident of Vermont for only part of the year. Nonresident: An individual that has income earned in Vermont but who does not qualify as a resident of Vermont for any part of the year is a Nonresident.

To file your federal taxes, use Form 1040, U.S. Individual Income Tax Return, and supporting schedules if needed. To file your Vermont taxes, use Form IN-111, Vermont Income Tax Return, and supporting schedules if needed.

You must file an income tax return in Vermont: if you are a resident, part-year resident of Vermont, or a nonresident but earned Vermont income, and. if you are required to file a federal income tax return, and. you earned or received more than $100 in Vermont income, or.

You can contact the court by phone, in writing, in person, or by sending an email to JUD.VJB@vermont.gov. A motion is a request in writing asking the court to consider doing something specific in your case. All motions must identify the request and give specific reasons for the request.

To file your Vermont taxes, use Form IN-111, Vermont Income Tax Return, and supporting schedules if needed.

Ways to Get Your. Vermont Income Tax Forms. Download fillable PDF forms from the web. Order forms online. Order forms by email. Order forms by phone. For a faster refund, e-file your taxes! For information on free e-filing and tax assistance for qualified taxpayers, visit .tax.vermont.gov.

Which Are the Tax-Free States? As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.