Texas Trust Code Powers Of Trustee

Description

How to fill out Blind Trust Agreement For Private Individual As Opposed To Government?

Regardless of whether for commercial reasons or personal issues, everyone must handle legal circumstances at some time in their lifetime.

Filling out legal documents requires meticulous care, starting with selecting the correct form example.

With an extensive US Legal Forms collection available, you won’t need to waste time searching for the correct example online. Utilize the library’s straightforward navigation to find the right template for any event.

- For example, if you choose an incorrect version of a Texas Trust Code Powers Of Trustee, it will be rejected when submitted.

- Thus, it is crucial to have a reliable source of legal documents such as US Legal Forms.

- To obtain a Texas Trust Code Powers Of Trustee template, follow these simple steps.

- Acquire the template you need using the search bar or catalog browsing.

- Review the document’s details to confirm it aligns with your situation, state, and area.

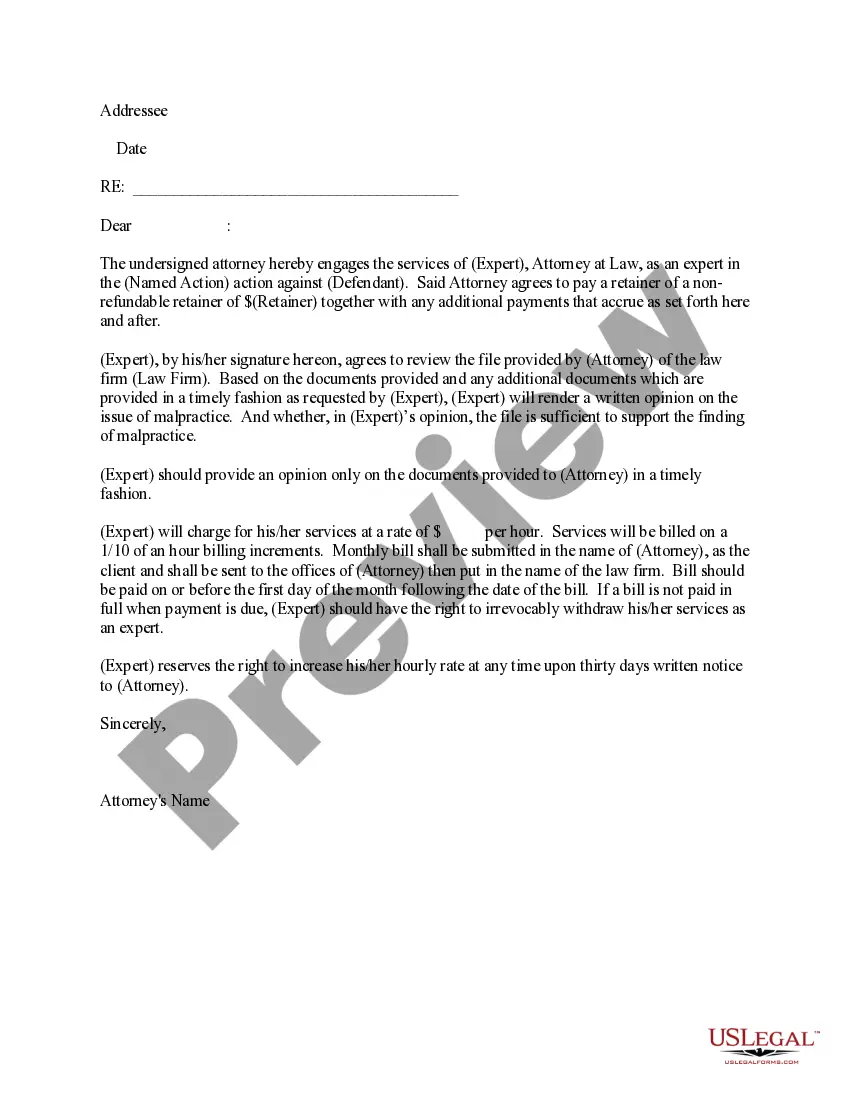

- Click on the document’s preview to inspect it.

- If it is the incorrect file, return to the search option to locate the Texas Trust Code Powers Of Trustee template you need.

- Obtain the file when it meets your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can download the document by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you desire and download the Texas Trust Code Powers Of Trustee.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Power of delegation ? a trustee is able to instruct professional advisers where necessary and appropriate. Power of insurance ? a trustee has the power to insure any trust asset against damage. Power of advancement ? a trustee has discretion to advance capital of the trust to a beneficiary.

What Are the Duties of Trustees in Texas? Document Management (Record Keeping) A trustee should keep records of everything they do in their role as trustee. ... Accounting. ... Asset Distribution. ... Trustee Meetings. ... File and Pay Taxes. ... Asset and Property Management. ... Breach of Trust. ... Misappropriation of Trust Funds.

For example, a power of appointment can allow a grandchild to decide who will receive the family vacation home after their grandparents pass away. If the grandchild has a power of appointment, they can decide to give the vacation home to their siblings, sell it and divide the proceeds, or keep it for themselves.

When Is Delegation Allowed? Simply put, Texas law allows a trustee to delegate duties and powers that a similarly situated trustee with similar trust property would employ an outsider to carry out.

EXAMPLE: Creator establishes a lifetime trust for a beneficiary, which then passes assets to such descendants of the beneficiary as he shall appoint in trust. The beneficiary appoints to his child (unborn at creator's death), for life, remainder to the beneficiary's grandchildren.