Irrevocable Grantor Trusts With No

Description

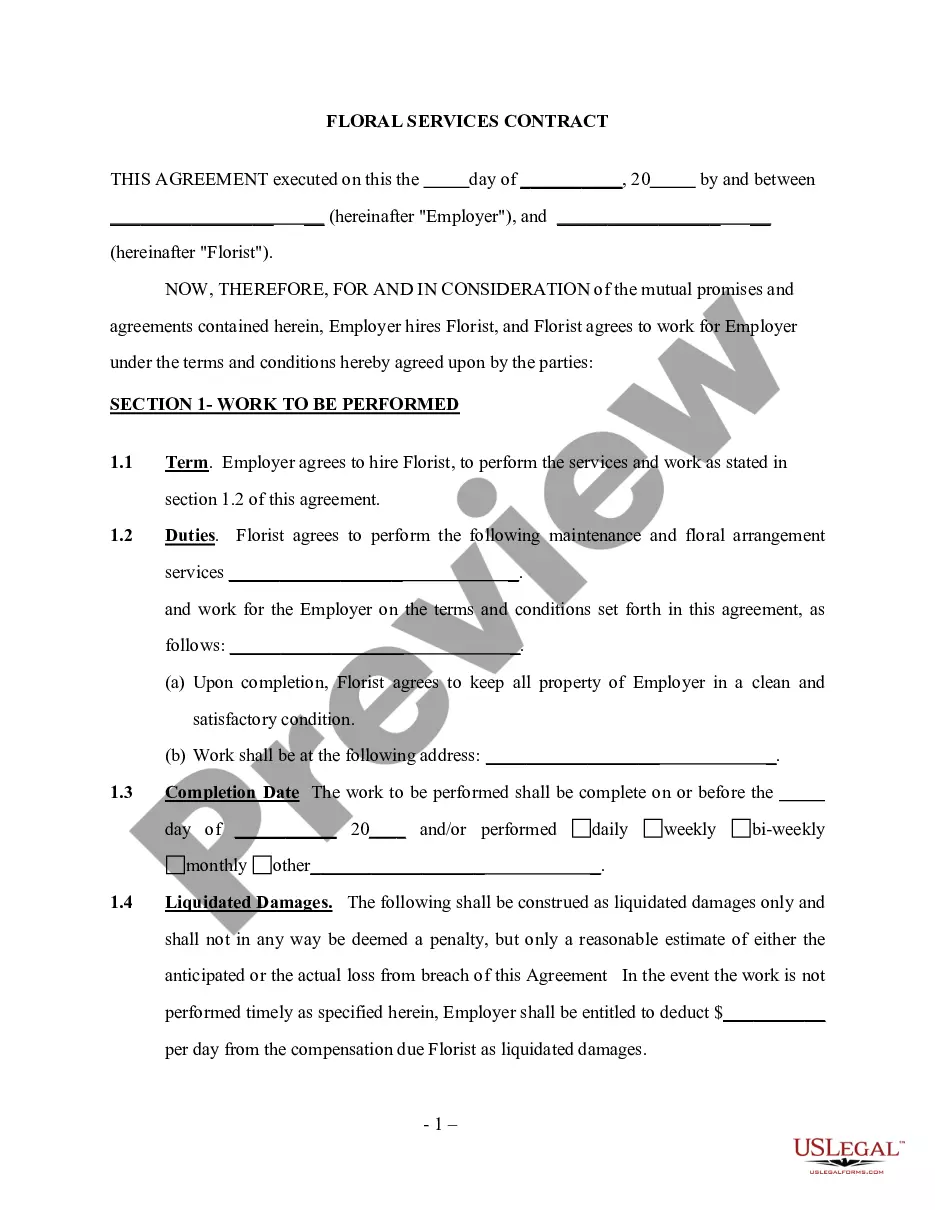

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren With Spendthrift Trust Provisions?

- If you're an existing US Legal Forms user, proceed to log in to your account. Ensure your subscription is active to access and download the required form template by clicking on the Download button.

- For first-time users, start by previewing the form and its description. Confirm that it's the correct template that matches your requirements and complies with local jurisdiction rules.

- If necessary, search for alternative templates. Should you find any discrepancies, utilize the Search bar at the top to locate a suitable document.

- Select your document by clicking the Buy Now button. Choose your preferred subscription plan, and remember to create an account to gain access to the complete resource library.

- Complete your purchase by entering your credit card information or utilizing your PayPal account to finalize the subscription.

- Once the transaction is complete, download your form to your device. You can revisit it anytime through the My Forms section in your account.

In conclusion, US Legal Forms allows you to easily create and manage legal documents efficiently. Their extensive library and expert help ensure you complete forms accurately the first time.

Don't hesitate; visit US Legal Forms today and streamline your legal document needs!

Form popularity

FAQ

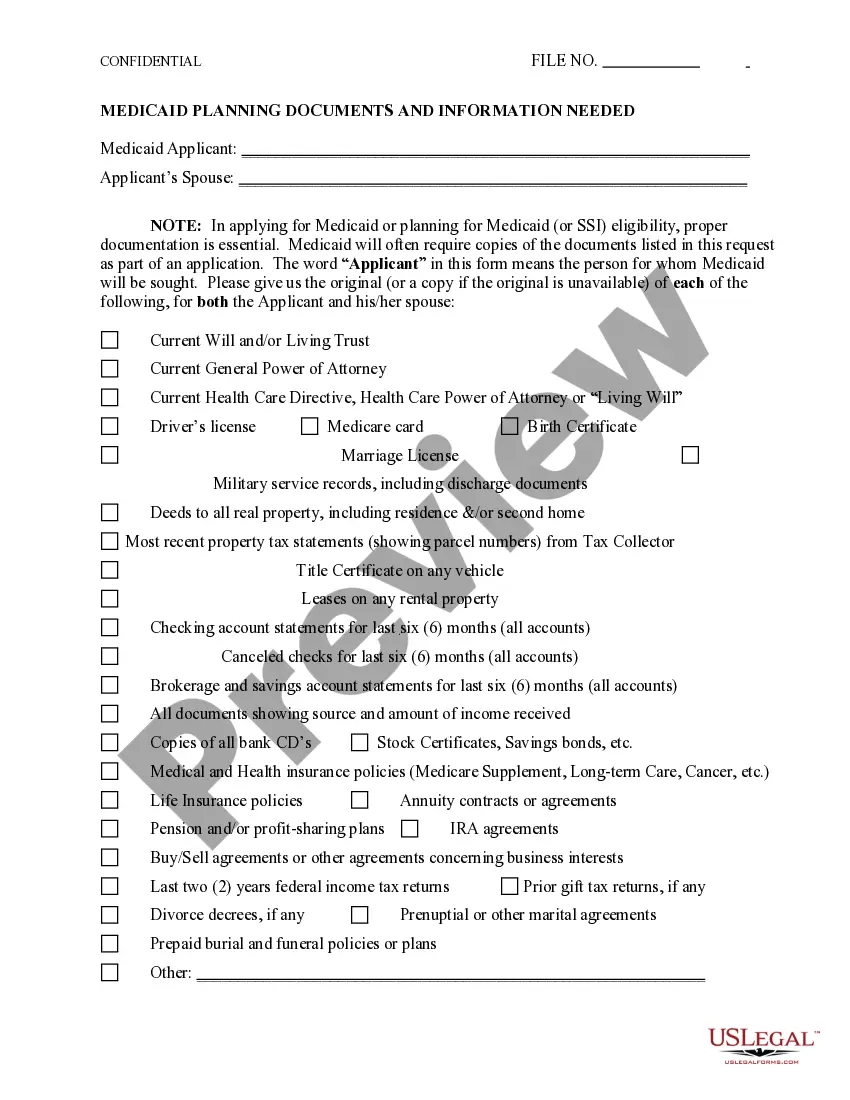

Filling out an irrevocable trust requires careful attention to detail. Start by gathering necessary information about the grantor, beneficiaries, and assets included in the trust. Clearly state the intentions for each beneficiary and outline distribution methods. Using USLegalForms can simplify this process, providing templates and guidance tailored to irrevocable grantor trusts with no complications.

One of the most common mistakes parents make when establishing trust funds is failing to clearly outline the terms and conditions of the trust. Without a clear plan, misunderstandings can arise among beneficiaries, leading to disputes. Additionally, neglecting to consult legal expertise can result in unintended tax consequences. Proper guidance from a platform like USLegalForms can help avoid these pitfalls.

Yes, irrevocable grantor trusts with no exceptions must file a tax return. The trust’s income is usually taxed on the grantor's personal tax return, as the grantor retains certain powers over the trust. It's crucial to keep track of all income and outgoings to ensure proper reporting. Tools like USLegalForms can assist you in organizing your documentation and staying compliant.

Once the grantor of a revocable trust passes away, the trust usually becomes irrevocable. At this point, the trust typically needs an EIN to continue managing tax obligations. This change in status helps the trust comply with tax laws, ensuring accurate reporting of any income or distributions. Using resources like USLegalForms can simplify this process for you.

Irrevocable grantor trusts with no exceptions typically require an Employer Identification Number (EIN). This is because they are recognized as separate entities for tax purposes. Obtaining an EIN helps manage the trust’s income and distributions, making your tax reporting smoother. It’s essential to ensure compliance and avoid any penalties during filing.

Yes, you can create an irrevocable grantor trust with no assistance, but it's recommended to seek professional guidance. While the process may seem straightforward, nuances in trust law can lead to complications. Using a platform like US Legal Forms can simplify document preparation and ensure compliance with legal requirements. Taking the right steps helps secure your assets and meet your estate planning goals.

The new rule on irrevocable grantor trusts with no exceptions clarifies the tax implications for grantors. Under this rule, the income generated by the trust will still be subject to your personal tax obligations. This can be beneficial, as it allows you to maintain control over the trust's assets while also taking advantage of tax strategies. Understanding these changes can help you navigate estate planning effectively.

Yes, grantor trusts can indeed be irrevocable. An irrevocable grantor trust allows the grantor to create a trust that is permanent and unchangeable, providing specific benefits like asset protection and tax advantages. This establishes a clear distinction between the grantor's assets and those held in the trust. If you're considering creating irrevocable grantor trusts with no flexibility, platforms like uslegalforms can guide you through the process smoothly.

Yes, an irrevocable grantor trust typically requires an Employer Identification Number (EIN) to properly manage its tax obligations. While the grantor is still considered the owner for income tax purposes, an EIN is necessary for the trust to file its tax return and handle various transactions. This requirement simplifies accounting and ensures compliance with IRS regulations. Utilizing irrevocable grantor trusts with no EIN may lead to penalties or complications.

In an irrevocable grantor trust, the trust itself is considered the owner of the assets. However, the grantor retains certain powers, such as the right to receive income generated by those assets. This unique arrangement allows the grantor to benefit from the trust while still classifying it as irrevocable. Therefore, understanding how irrevocable grantor trusts work is essential for effective estate management.