Does Child Support Go On Taxes

Description

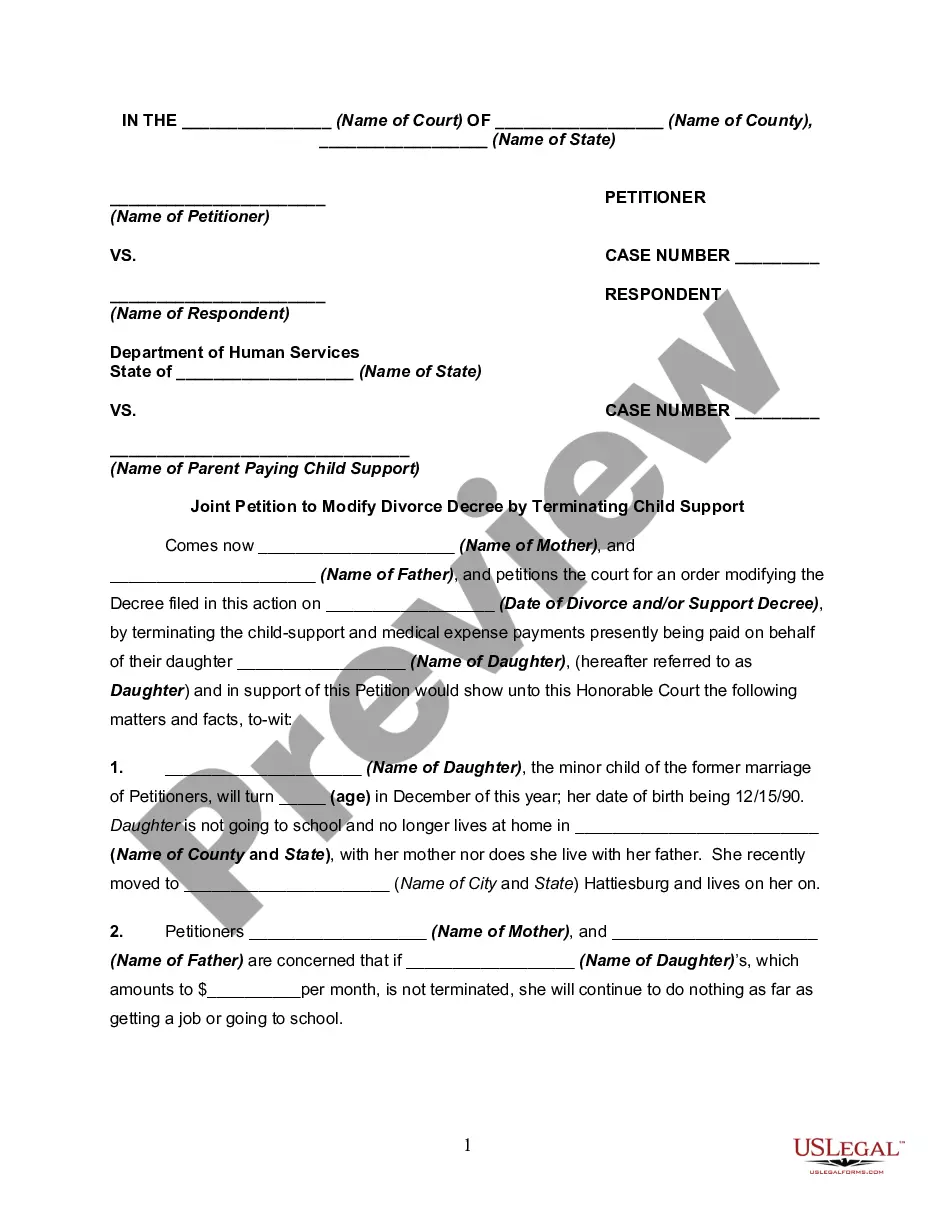

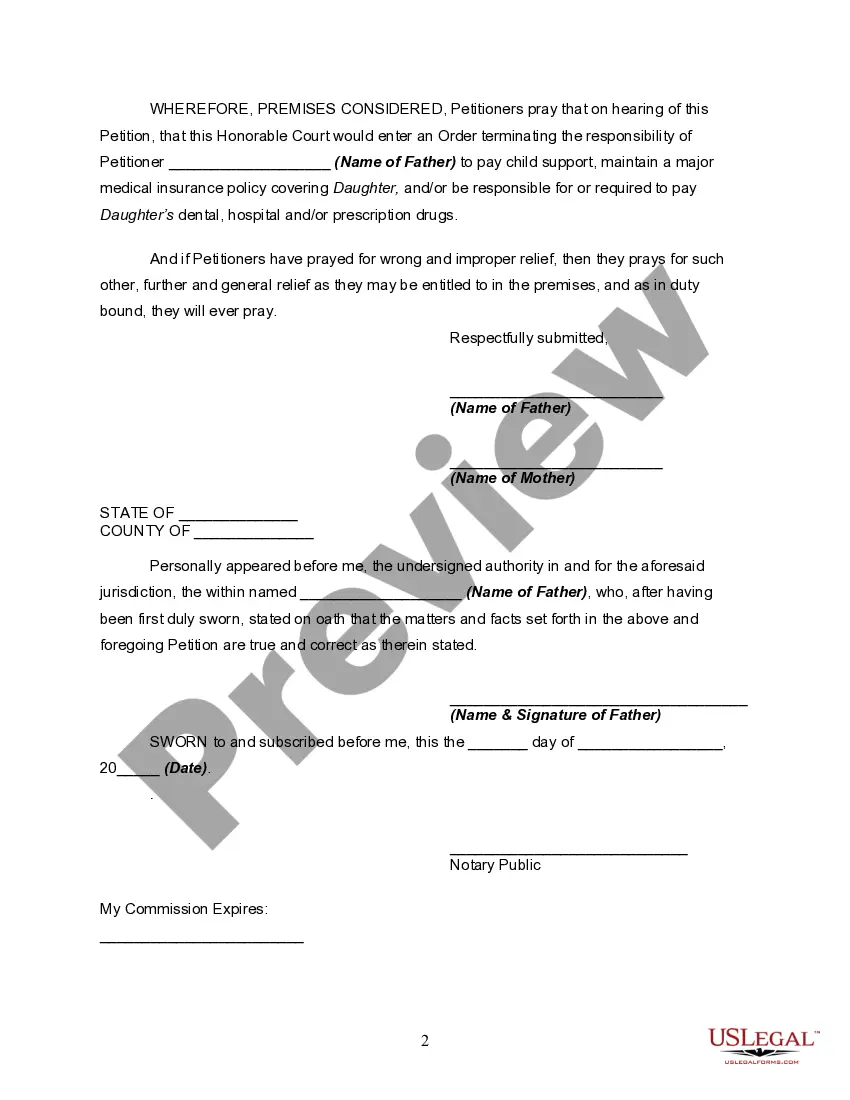

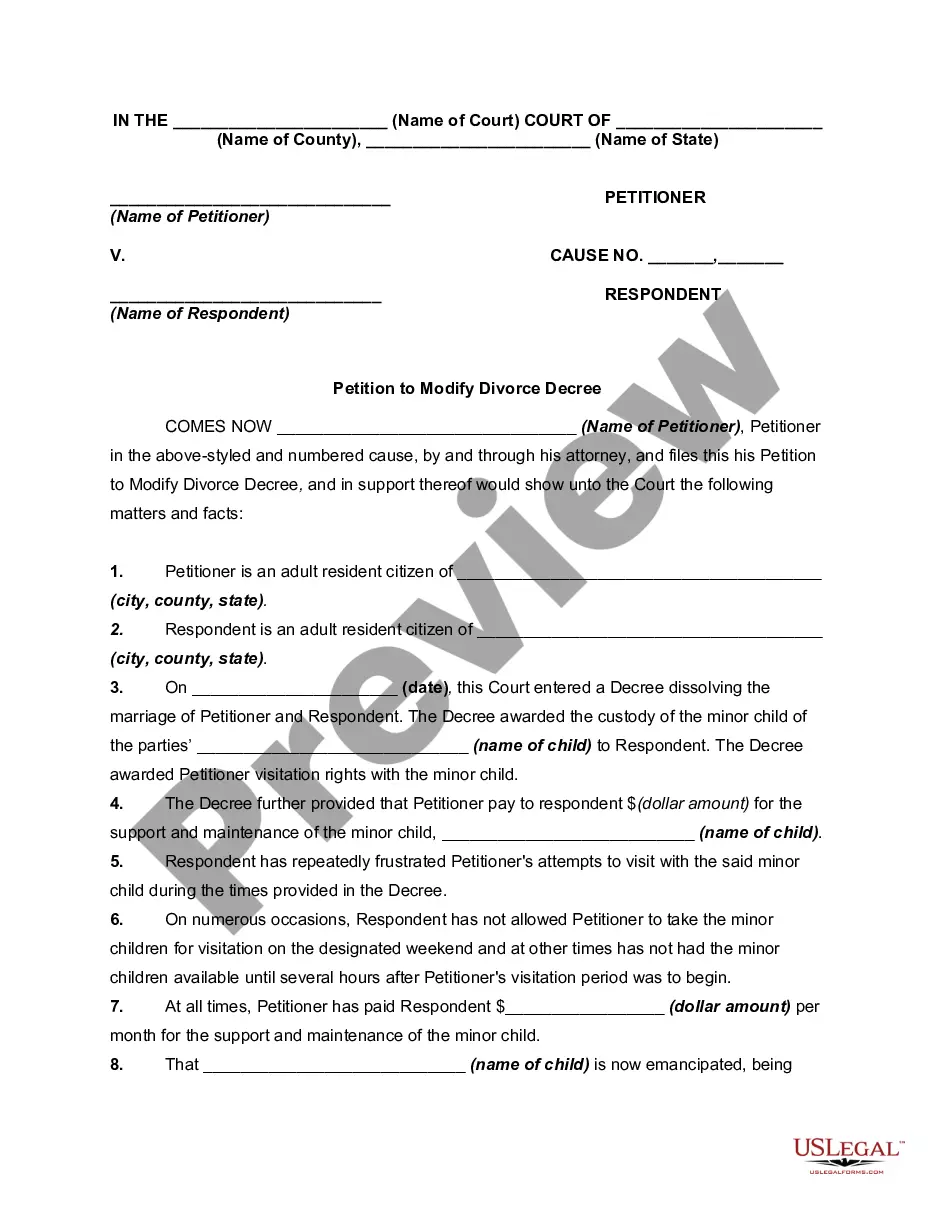

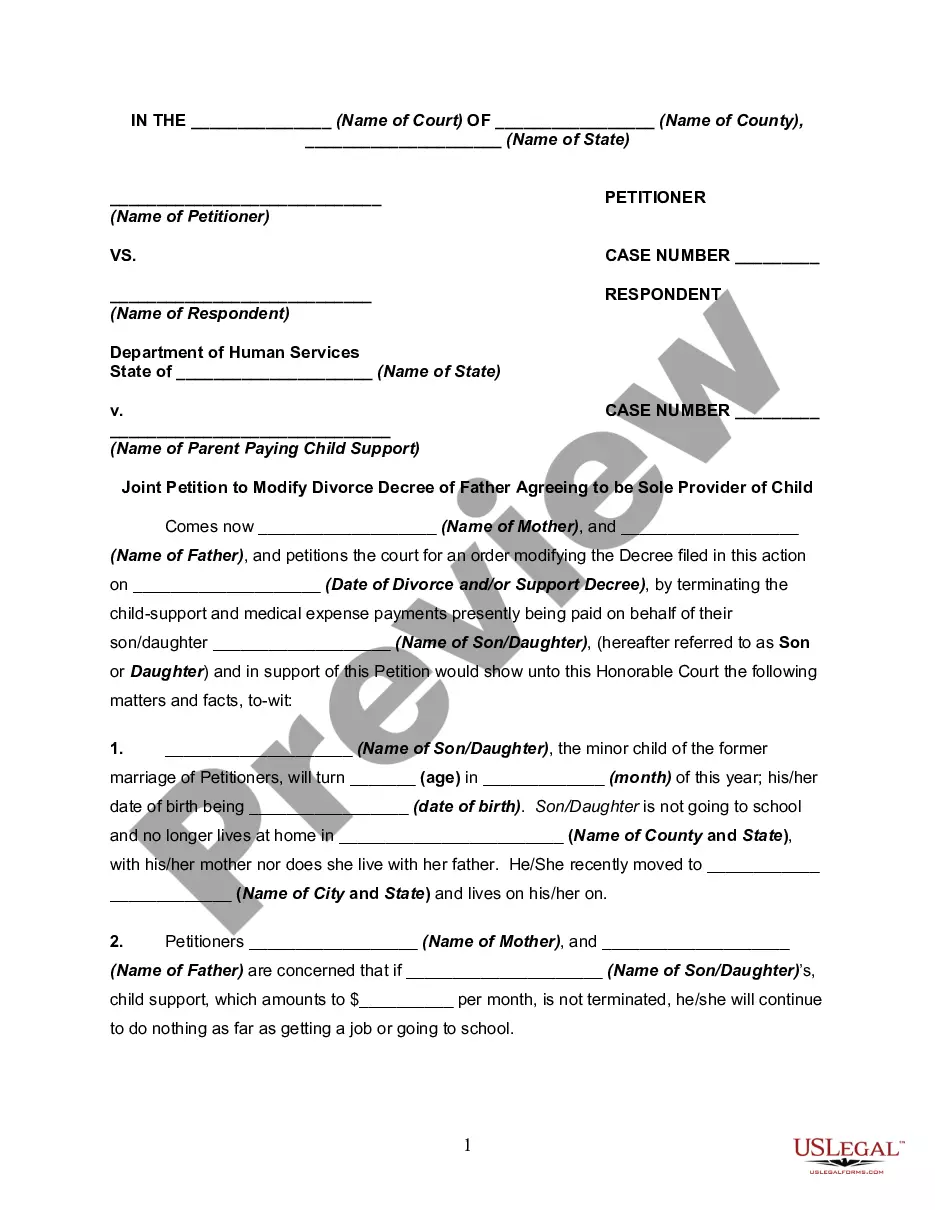

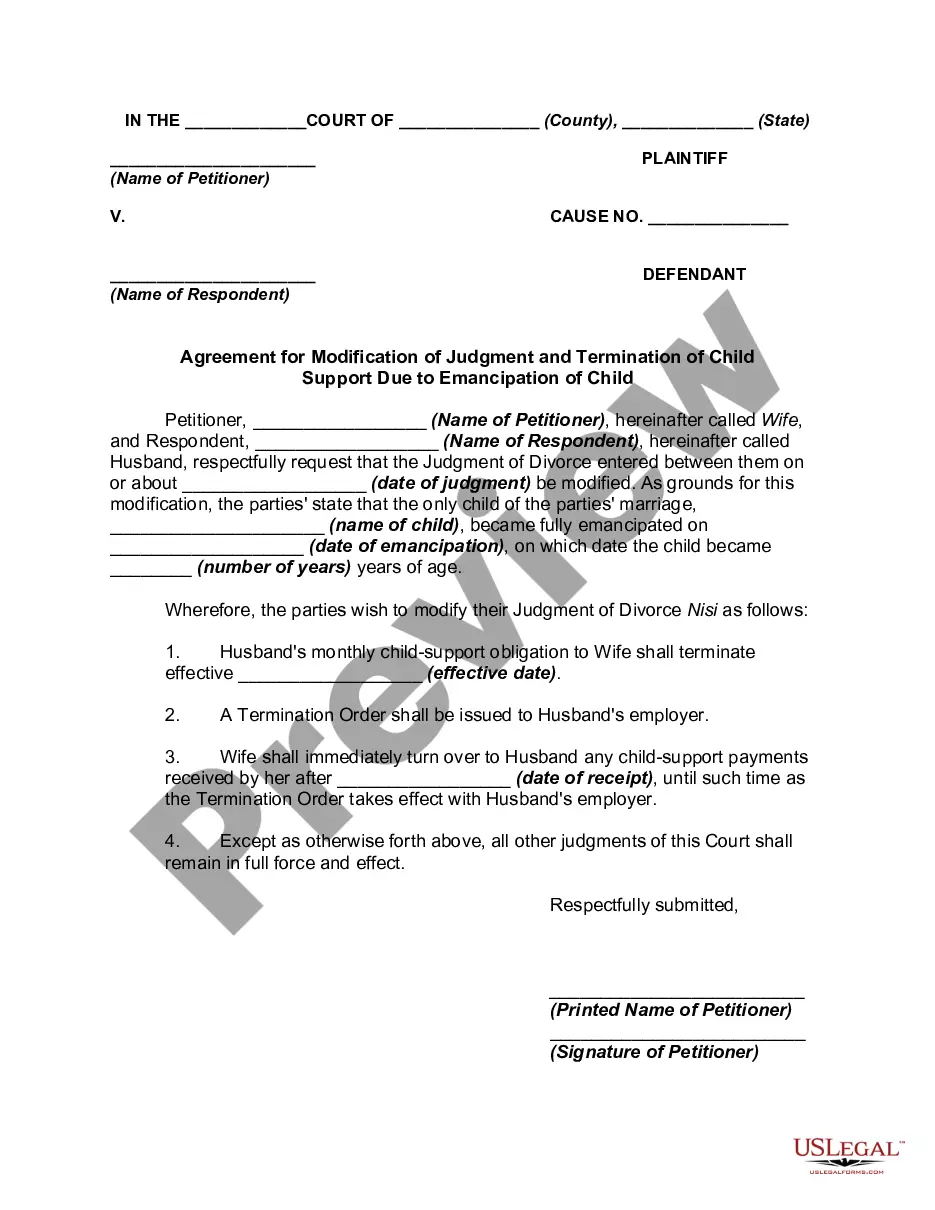

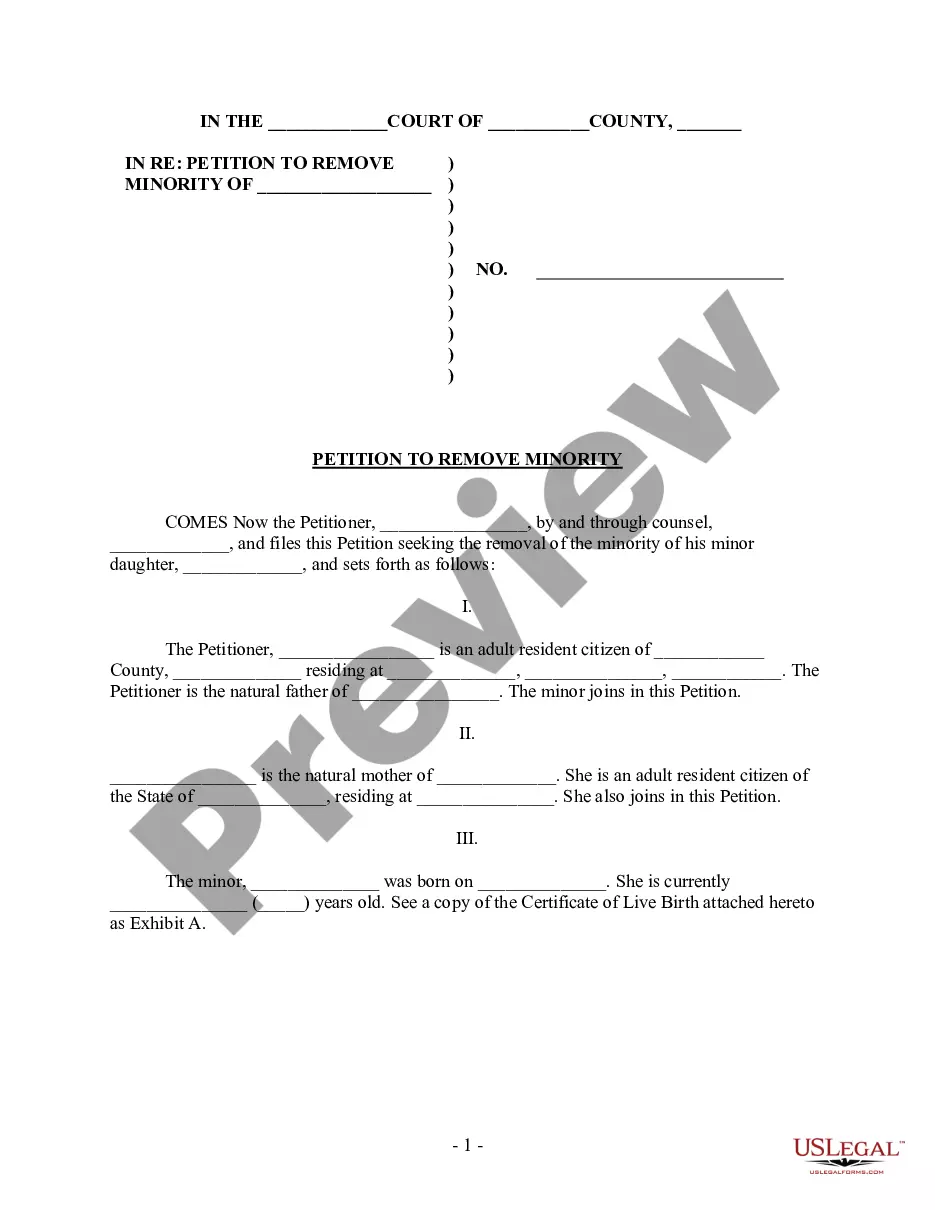

How to fill out Joint Petition To Modify Or Amend Divorce Decree By Terminating Child Support - Minor Left Home, Living Independently, Refuses To Work Or Go To School?

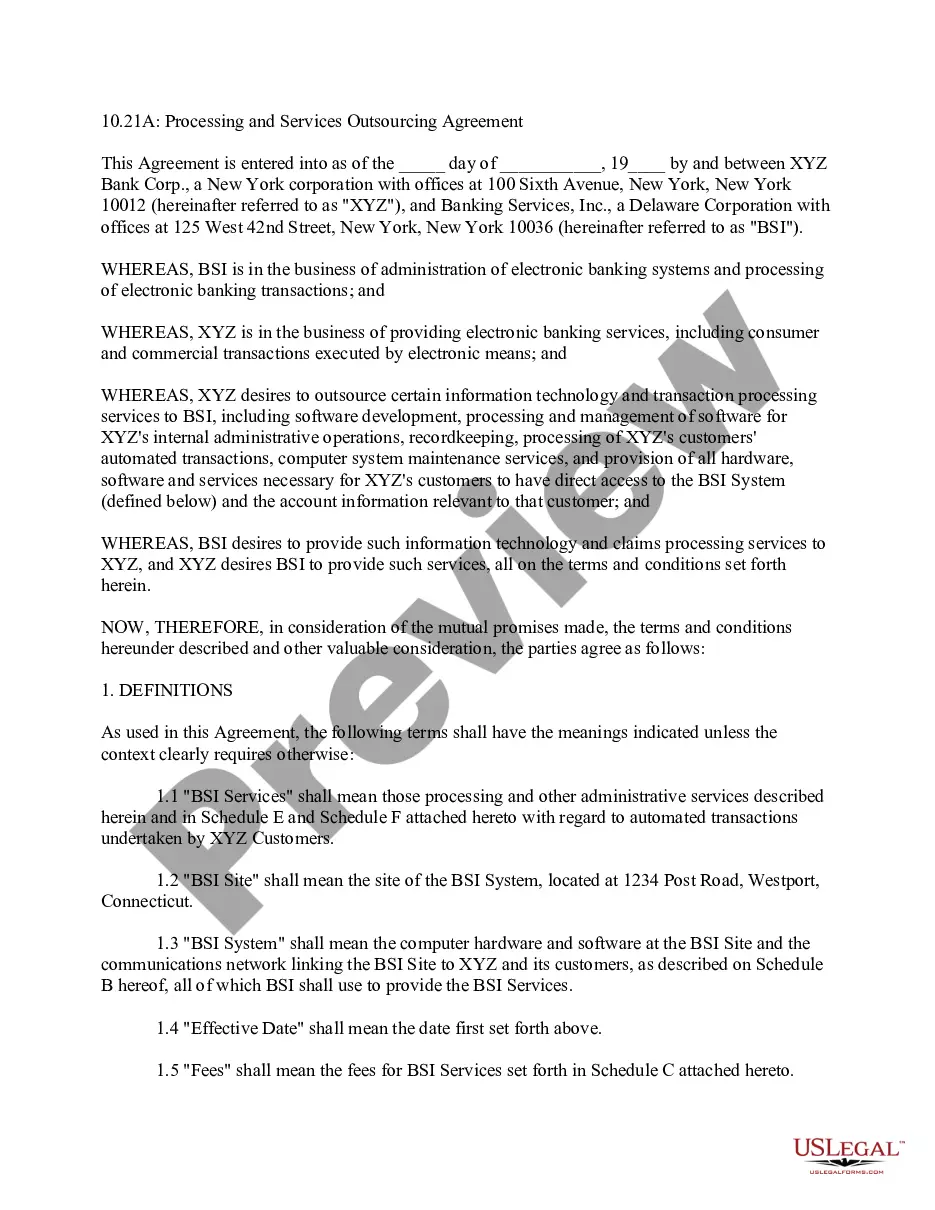

- If you're an existing user, log into your account to download the required form by hitting the Download button. Ensure your subscription is active, or renew it as per your billing cycle.

- For first-time users, begin by reviewing the form description and Preview mode. Confirm it aligns with your local jurisdiction and your specific needs.

- If adjustments are necessary, use the Search tab to locate another form that better represents your situation, and proceed if you find a suitable alternative.

- Once you've selected a form, click on the Buy Now button and select your preferred subscription plan. Registration is required to access the library.

- Complete your payment using either credit card information or your PayPal account to finalize the subscription.

- Download your chosen legal document and save it on your device. You can also access it later in the My Forms section of your profile.

US Legal Forms stands out with its extensive collection of over 85,000 legal document templates, providing a comprehensive solution for both individuals and attorneys. This user-friendly library ensures that you can find the correct forms quickly, streamlining your legal or financial tasks.

Ready to simplify your legal document needs? Start using US Legal Forms today for swift access to properly vetted forms and expert assistance!

Form popularity

FAQ

According to the IRS, child support is not considered income. Therefore, it is not subject to federal income tax. This distinction can be beneficial when following tax guidelines. If you have questions about how child support goes on taxes, consider using resources like US Legal Forms to navigate the complexities effectively.

On your tax return, child support is not included as income, so you will not enter it on the income section. Instead, focus on ensuring that any credits or deductions you claim are accurate. You should keep detailed records of these payments for your personal bookkeeping needs. Knowing how child support goes on taxes can simplify your tax preparation process.

Child support is not classified as federal income. It is a payment made to help cover the costs of raising a child, and it is not taxed as income by the government. Thus, it does not enter the equation when discussing federal income tax obligations. Understanding how child support goes on taxes can help you manage your financial responsibilities better.

Child support payments typically do not affect your tax refunds directly. Since child support is not considered taxable income, it does not influence your refund calculations. However, if you owe back taxes, your support payments might be seized to cover those debts. It's crucial to stay informed about how child support goes on taxes, especially if this is a concern for you.

No, child support does not count as income for the child tax credit. This means it will not affect your eligibility for this tax benefit. When considering tax obligations, it's essential to understand the distinction. Therefore, you can confidently claim the child tax credit without worrying about child support impacting it.

Support for a dependent generally includes various necessities like food, shelter, clothing, and education expenses. If you provide over half of a dependent's support, they may qualify for your tax benefits. Additionally, any direct financial assistance you give contributes to this support calculation. Being informed about these definitions can help you better understand how child support interacts with taxes.

Paying child support does not qualify as a dependent. Instead, child support payments are viewed as a legal obligation and do not affect your dependent status. Therefore, even if you provide support, it does not mean you can claim the child as a dependent on your taxes. Clarifying these details is vital for managing your tax liabilities related to child support.

Generally, if your child earns income, it might need to be reported on your tax return, especially if they are still a dependent. However, there are certain exclusions for low-income earners. It’s crucial to clarify whether your child's income falls under the necessary reporting requirements. Understanding these nuances helps you ensure compliance and correctly address how child support goes on taxes.

When filing taxes, it's important to know how child support influences your tax return. Child support payments are not deductible for the paying parent, nor are they considered income for the receiving parent. To correctly file, you simply report your income and expenses without including child support on your taxes. For further assistance, platforms like US Legal Forms can provide resources to better understand your obligations.

Several factors can disqualify a person from being claimed as a dependent. For instance, if the individual earns a substantial income that exceeds the IRS threshold, or if they file a joint tax return with their spouse, they might not qualify. Furthermore, if a parent fails the residency requirement, they cannot be claimed as a dependent. Knowing these factors is essential when discussing how child support and taxes interact.