Beneficiaries

Description

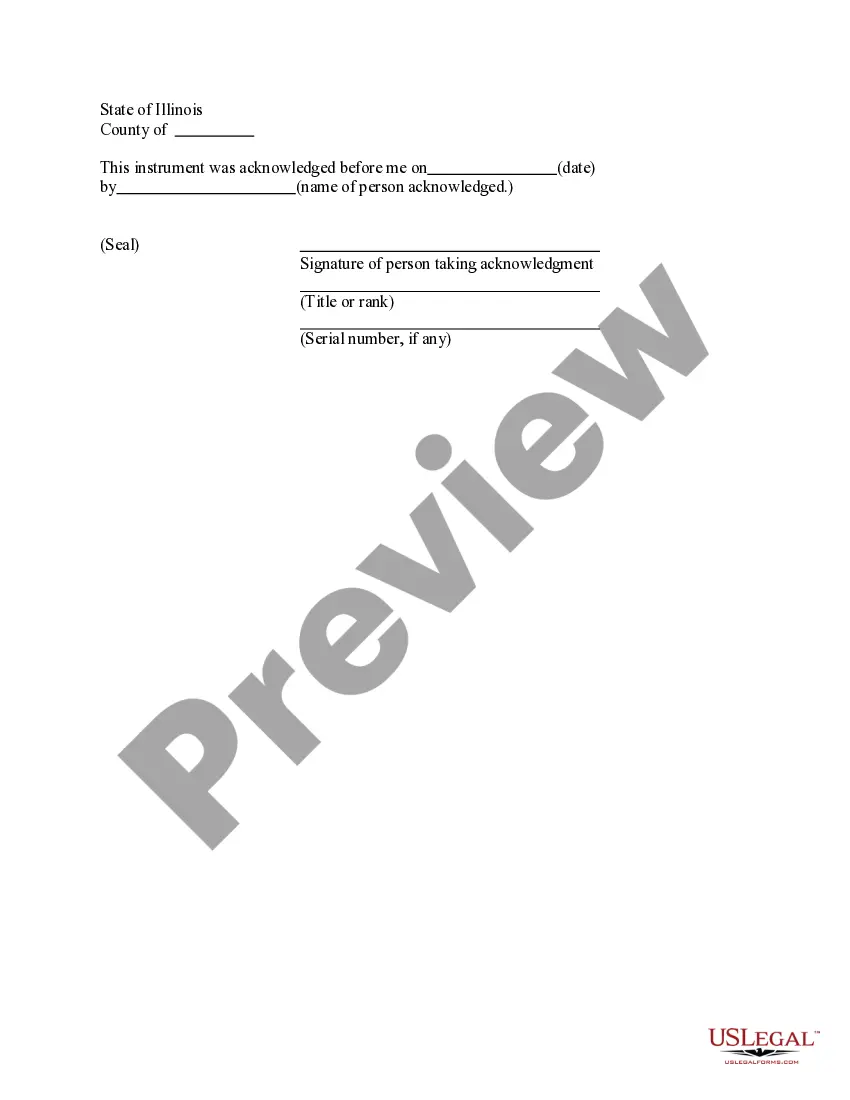

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

- If you're returning to US Legal Forms, log in to your account to download the necessary form template directly to your device. Ensure your subscription is active; if not, renew it according to your payment plan.

- For first-time users, start by reviewing the Preview mode and the form descriptions. Make certain that the form aligns with your needs and complies with local jurisdiction requirements.

- Should you need a different document, utilize the Search tab to find a suitable template. If you locate the correct form, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to create an account to gain full access to the resources available.

- Complete your purchase. Enter your credit card information or use a PayPal account to finalize the transaction.

- Download your form and save it on your device. You can easily access it later in the My Forms section of your profile.

Utilizing US Legal Forms enables beneficiaries to swiftly create legally sound documents, ensuring peace of mind throughout the process.

Take advantage of the extensive online library and expert assistance available to ensure your legal documents are accurately completed. Start using US Legal Forms today!

Form popularity

FAQ

Beneficiaries are individuals or entities designated to receive assets upon your death. They play a critical role in estate planning, ensuring that your wealth is distributed according to your wishes. By clearly defining your beneficiaries, you can avoid potential conflicts and ensure a smooth transfer of your assets.

Different types of beneficiaries include individuals, such as family and friends, and entities, such as trusts and charities. Individual beneficiaries can be further divided into primary and contingent categories. Understanding these distinctions is essential for effective estate planning, helping you direct your assets appropriately.

Consider placing individuals who rely on you for support as your beneficiaries. Common choices include family members like children or partners, but you could also include trusted friends or charities. By carefully selecting your beneficiaries, you ensure that your legacy aligns with your wishes and provides for those important to you.

A common example of a beneficiary is a spouse or child who automatically receives assets like life insurance proceeds. For instance, if you have a life insurance policy, naming your partner as the beneficiary allows them to receive the benefits directly. This demonstrates how beneficiaries play a crucial role in financial planning.

When choosing beneficiaries, consider individuals who depend on you financially, such as family members or close friends. You might also think about charities or organizations that you wish to support. Ultimately, the best beneficiaries are those who align with your values and goals, ensuring that your assets will be used in ways that matter to you.

Beneficiaries typically fall into three main categories: primary, contingent, and revocable. Primary beneficiaries receive assets directly upon your passing. Contingent beneficiaries will inherit only if the primary beneficiaries are unable to do so. Revocable beneficiaries can be changed at any time, providing flexibility as your circumstances evolve.

You should designate beneficiaries by clearly stating their names and relations to you on legal documents. Ensure that you keep this information current, as life changes may necessitate updates. Using online platforms like US Legal Forms makes this task more manageable, providing templates and guidance to help you designate beneficiaries accurately. Consistent reviews of your designations ensure that your intentions are always reflected.

The beneficiary account type pertains to how beneficiaries are associated with various accounts or assets. Common types include individual, joint, and trust accounts designated for beneficiaries. Each type affects how and when funds transfer to beneficiaries, so understanding these differences is crucial. US Legal Forms provides resources to navigate these account types effectively.

A beneficiary type refers to specific roles that beneficiaries play in receiving assets or benefits after your passing. The basic types include primary beneficiaries, who receive first claim, and contingent beneficiaries, who take over if the primary ones are unavailable. Clearly defining these types prevents disputes and ensures the smooth transition of assets. Evaluating these roles on platforms like US Legal Forms can help streamline the process.

You can list family members, friends, charities, or organizations as your beneficiaries. Choose individuals or entities you trust to manage the assets or funds responsibly. Always consider their financial stability and your wishes when designating beneficiaries. US Legal Forms can assist you in creating clarity around your choices.