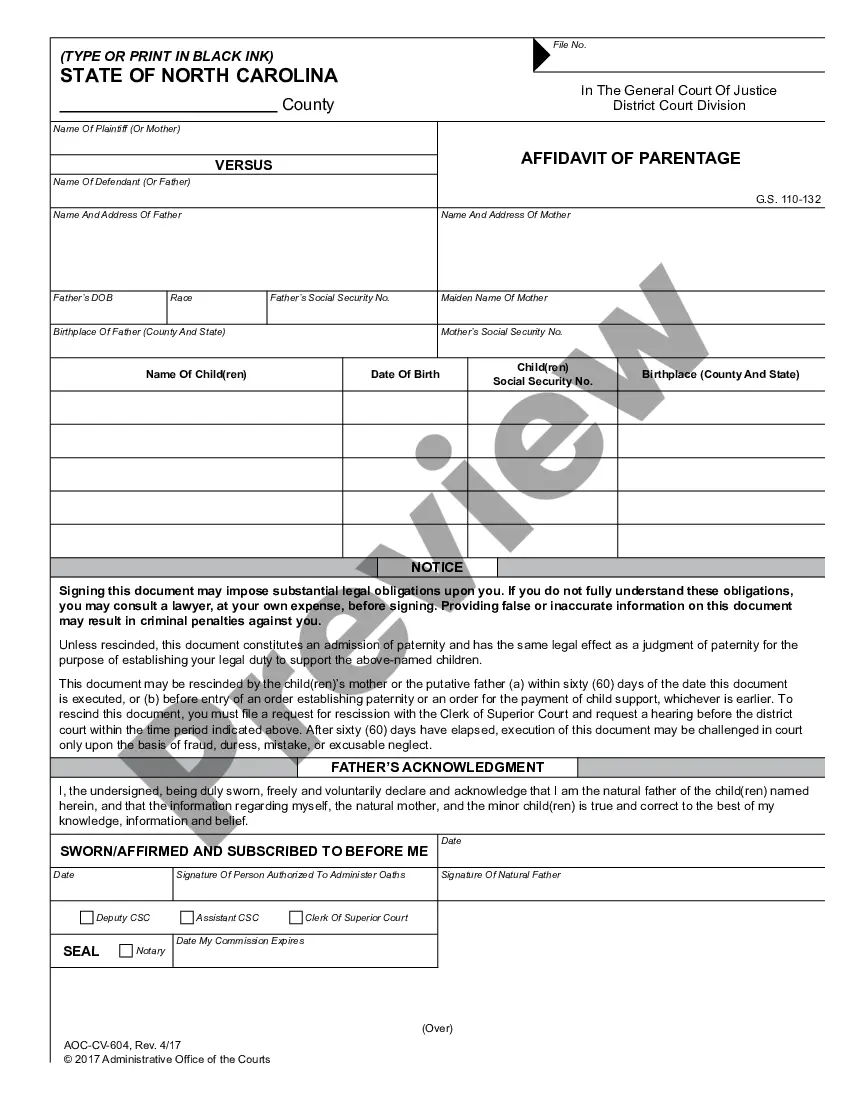

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Beneficiary Estate Disclaimers Form

Description

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

Whether you deal with documents often or need to submit a legal file occasionally, it is essential to have a source where all the samples are pertinent and current.

The first step you must take using a Beneficiary Estate Disclaimers Form is to verify that it is the most recent version, since it determines if it can be submitted.

If you wish to simplify your search for the latest document examples, look for them at US Legal Forms.

Use the search menu to locate the form you need.

- US Legal Forms is a database of legal documents featuring nearly any sample you might seek.

- Search for the templates you require, evaluate their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to approximately 85,000 document templates across various fields.

- Locate the Beneficiary Estate Disclaimers Form examples in just a few clicks and save them at any time in your account.

- A US Legal Forms account will aid you in accessing all the samples you need with more ease and less trouble.

- You just need to click Log In in the website header and visit the My documents section where all the forms you require will be at your disposal, eliminating the need to spend time searching for the correct template or checking its validity.

- To acquire a form without an account, follow these instructions.

Form popularity

FAQ

You have nine months to disclaim an inheritance, starting from the date of the decedent's death. Filing the Beneficiary estate disclaimers form within this window is crucial for ensuring your disclaimer is accepted by the court. If you need assistance with the process, consider using a professional service or platform like uslegalforms, which simplifies legal documentation and guides you through the requirements. Being timely in your actions can greatly affect your financial future.

A beneficiary disclaimer is a legal document that allows a person to reject an inheritance offered to them. By completing the Beneficiary estate disclaimers form, individuals can ensure that their share of the estate passes to other beneficiaries. This action can preserve relationships and minimize tax burdens. It is a powerful tool for those wishing to manage their inheritance strategically.

The 9 month disclaimer rule allows a beneficiary to legally refuse an inheritance within nine months of the decedent's death. To comply, beneficiaries must submit the Beneficiary estate disclaimers form during this period. This rule ensures beneficiaries do not face unintended tax liabilities. Understanding this timeframe can help beneficiaries make informed decisions regarding their inheritance.

If a beneficiary chooses to refuse an inheritance, they can use the Beneficiary estate disclaimers form to formally disclaim their interest. This process allows the inheritance to pass to the next eligible beneficiary without complications. Furthermore, disallowing the inheritance can help avoid potential tax implications for the disclaiming beneficiary. Always consider seeking legal advice to understand the implications fully.

A beneficiary typically has nine months from the date of the decedent's death to file the Beneficiary estate disclaimers form. This time limit is important to ensure the disclaimer is valid under the law. If you miss this deadline, you may lose your right to disclaim the inheritance entirely. It is essential to consult a legal expert to navigate the process efficiently.

A beneficiary can disclaim an inheritance by completing a Beneficiary estate disclaimers form, which officially communicates their desire to refuse the inherited assets. It's essential to provide detailed information about the estate and the specific assets being disclaimed. Once submitted, the estate can proceed to distribute those assets to the next rightful beneficiaries, ensuring a smooth transition.

An estate disclaimer might occur when a beneficiary does not want a specific asset, such as funds from a retirement account. They would fill out a Beneficiary estate disclaimers form, which legally asserts their choice to refuse that inheritance. This action allows the assets to be redistributed according to the estate plan, to other beneficiaries who may accept it.

A disclaimer statement typically outlines a beneficiary's intention to decline an inheritance. For example, it can state: 'I, Beneficiary's Name, hereby disclaim all rights to specific property or asset.' Using a Beneficiary estate disclaimers form ensures that this statement meets legal standards and provides clarity for all parties involved.

An example of a disclaimer of estate occurs when a beneficiary chooses to refuse their share of inherited property. For instance, if a person inherits a house but does not want it, they may fill out a Beneficiary estate disclaimers form to formally state their choice. By doing so, the property will pass to the next eligible heir, streamlining the estate distribution process.

To write a real estate disclaimer, start by stating your intention to disclaim any interest in a property. You should clearly identify the property and the reasons for your disclaimer. Using a Beneficiary estate disclaimers form can simplify this process, as it often includes all necessary legal language. Make sure to sign and date the form to make it valid.