Title: Understanding Florida's Child Support Calculator: Types and Detailed Explanation Keywords: Florida child support calculator, child support guidelines, income shares model, shared parenting, sole parenting, child custody arrangements, child support payments, legal obligations Introduction: The child support calculator for Florida is an invaluable tool that assists in determining the financial responsibilities of parents towards their children. Established by the Florida Legislature, the calculator follows specific guidelines and factors to ensure accurate and fair calculations. This article aims to provide a comprehensive understanding of the child support calculator, its types, and relevant considerations in Florida. 1. Child Support Guidelines in Florida: The state of Florida relies on the income shares model, a widely adopted method nationwide. This model strives to ensure that the child receives the same proportion of parental income that they would have had if the parents lived together. The guidelines primarily take into account the income and expenses of both parents, the number of children, and time-sharing arrangements. 2. Sole Parenting Calculator: In cases where one parent has physical custody of the child, the sole parenting calculator is used. It aims to calculate the amount of child support the non-custodial parent should provide to the custodial parent based on their income, expenses, and the number of children. 3. Shared Parenting Calculator: When both parents have substantial caregiving time and responsibilities, the shared parenting calculator comes into play. This calculator accounts for the amount of time the child spends with each parent and the income of both parents. It ensures child support payments are calculated in consideration of shared expenses and shared parenting obligations. 4. Factors Considered in Child Support Calculations: a) Income: The calculator considers net income, including wages, self-employment earnings, bonuses, overtime pay, disability benefits, and more. b) Deductions: Certain deductions, such as taxes, healthcare premiums, mandatory retirement contributions, and child support from previous relationships, can affect the final amount. c) Parenting Costs: Additional factors include child care expenses, health insurance premiums, extraordinary medical expenses, and special needs of the child. d) Time-Sharing Arrangements: The number of overnights spent with each parent plays a role in child support calculations, significantly impacting the final amount determined. Conclusion: Understanding Florida's child support calculator is crucial for parents involved in child custody cases. Whether it's the sole parenting calculator or the shared parenting calculator, accurately calculating child support payments is essential to ensure the well-being of the child. By incorporating parental income, deductions, expenses, and the time children spend with each parent, the calculator ensures a fair and equitable distribution of child support obligations for Florida parents.

Child Support Calculator For Florida

Description

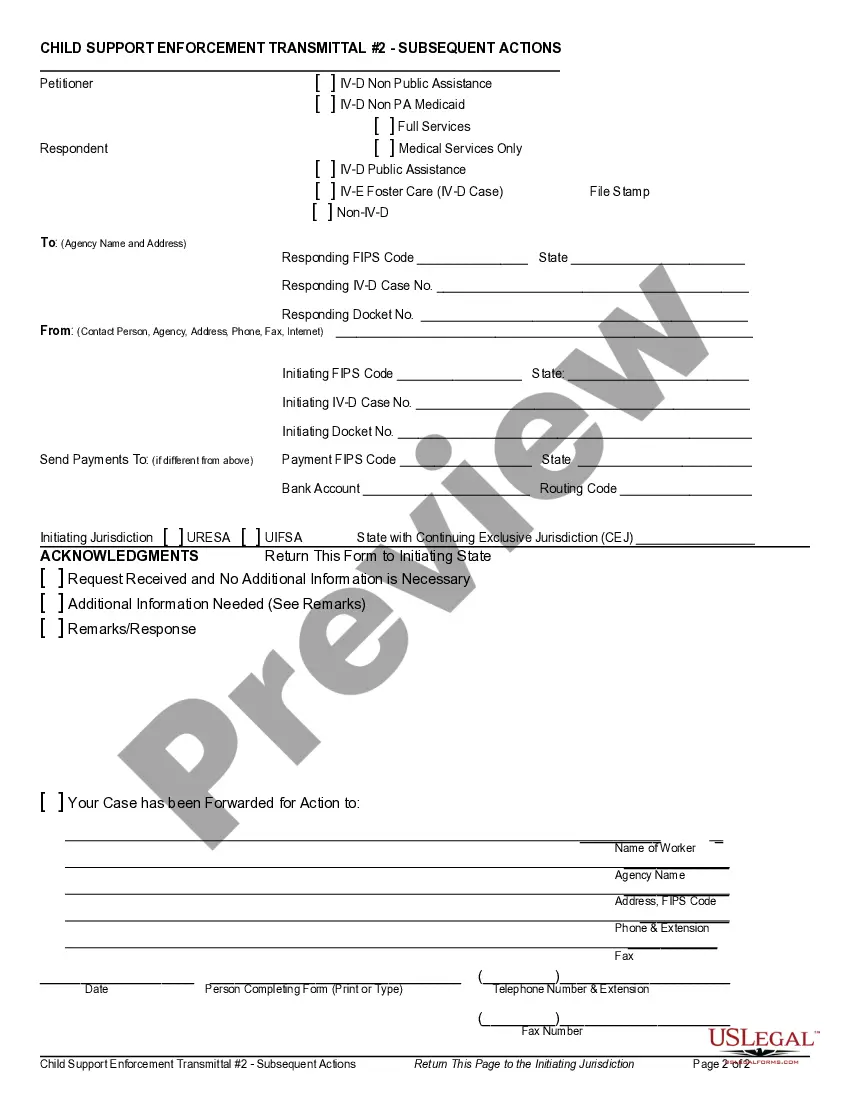

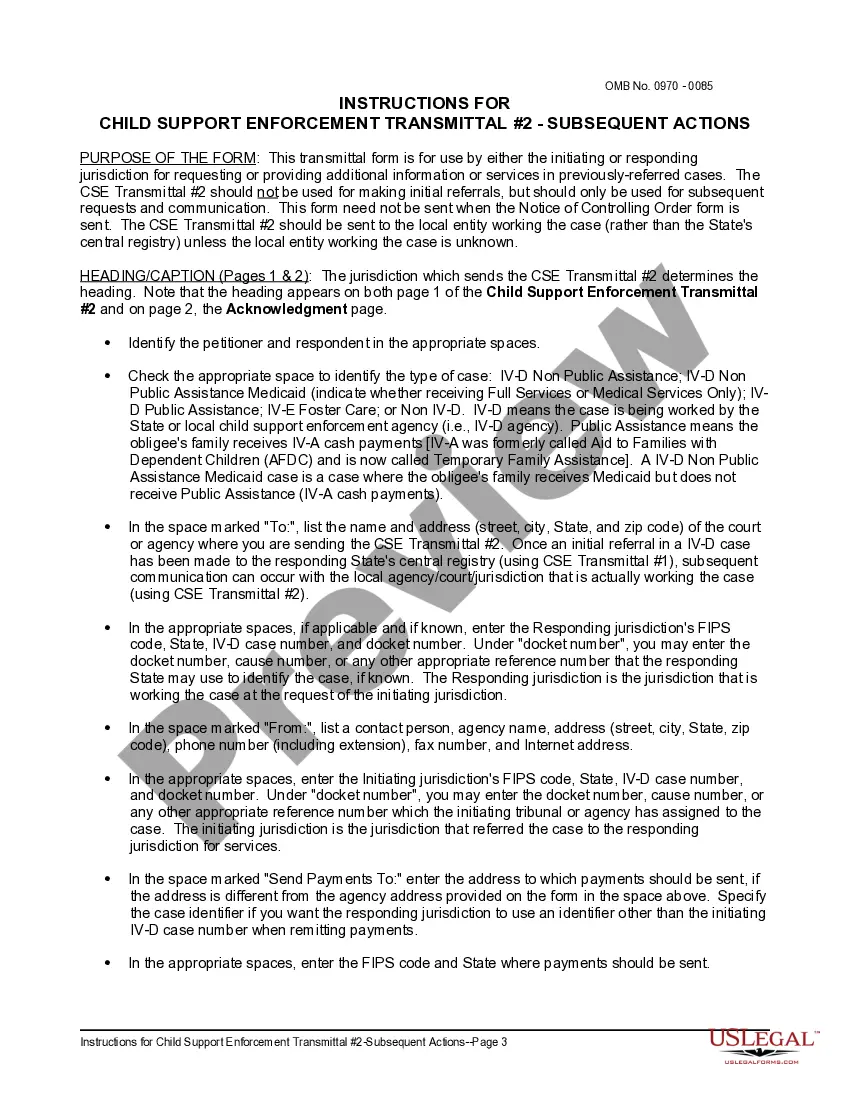

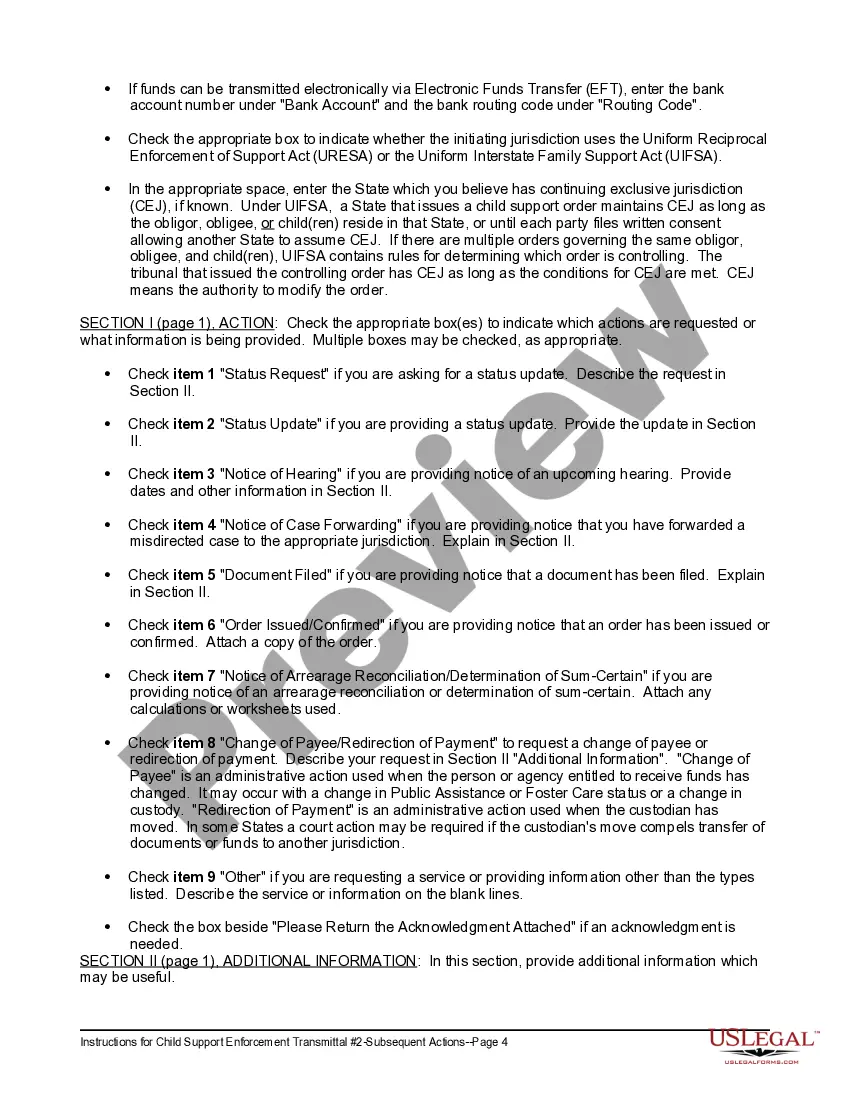

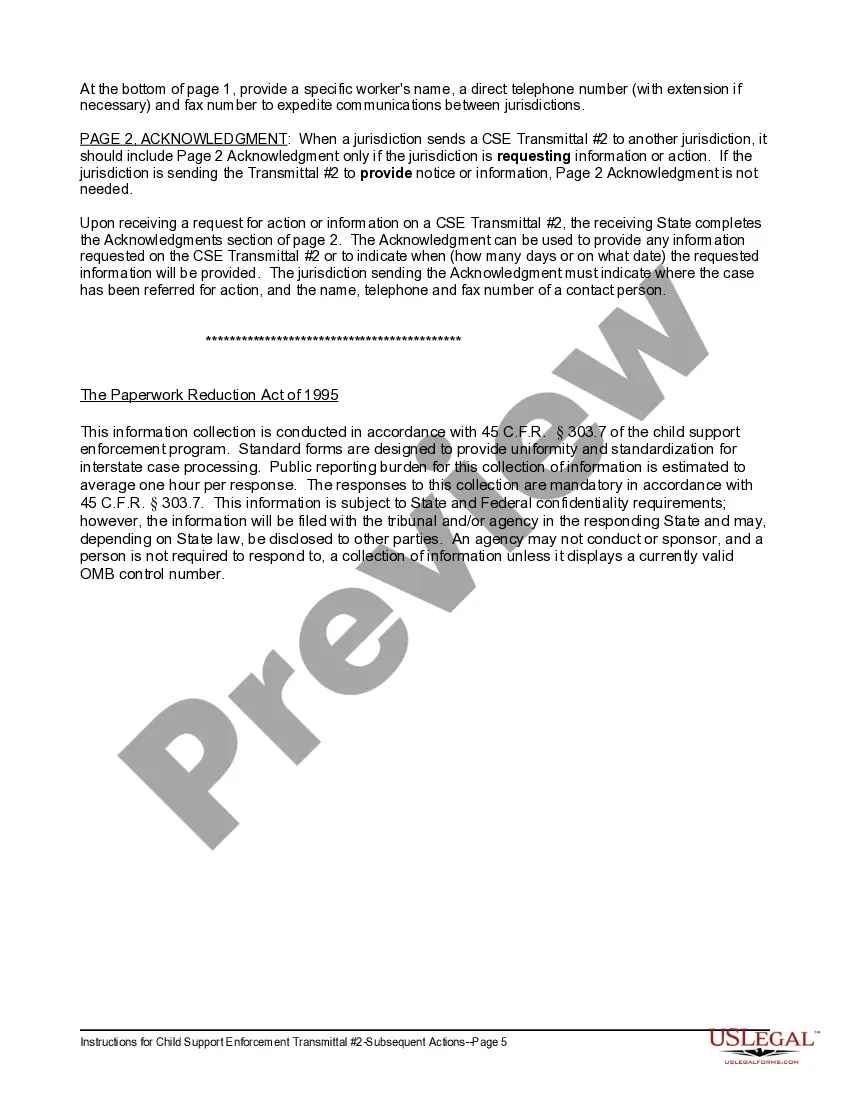

How to fill out Child Support Transmittal #2 - Subsequent Actions And Instructions?

Working with legal papers and operations could be a time-consuming addition to your entire day. Child Support Calculator For Florida and forms like it usually require that you search for them and understand how you can complete them effectively. Therefore, whether you are taking care of financial, legal, or individual matters, using a thorough and practical online catalogue of forms when you need it will significantly help.

US Legal Forms is the top online platform of legal templates, boasting more than 85,000 state-specific forms and numerous tools to assist you complete your papers easily. Discover the catalogue of appropriate papers accessible to you with just one click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Protect your document managing procedures with a high quality service that allows you to put together any form within minutes with no additional or hidden fees. Just log in to your account, locate Child Support Calculator For Florida and download it straight away in the My Forms tab. You can also access formerly downloaded forms.

Could it be the first time utilizing US Legal Forms? Register and set up up a free account in a few minutes and you’ll have access to the form catalogue and Child Support Calculator For Florida. Then, follow the steps listed below to complete your form:

- Make sure you have the correct form using the Preview feature and looking at the form information.

- Select Buy Now when ready, and select the subscription plan that suits you.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of experience helping consumers manage their legal papers. Get the form you require today and streamline any operation without breaking a sweat.

Form popularity

FAQ

Step 2: Select the number of children involved. Combined Monthly IncomeOneThree$1,000$235$397$1,050$246$443$1,100$258$489$1,150$269$52261 more rows

After you have added up all of the various deductions which you are entitled to be credited with under Florida law, you subtract that total from your gross income. This is your monthly net income for calculating child support.

Florida follows an ?Income Shares Model? for determining child support. This means that courts will attempt to estimate the amount of money the parents would have spent on their children if they remained together and were not divorcing. This amount is then divided between the two parents, based on their incomes.

A major factor in calculating child support is the number of nights each parent will have the children during the year. The Florida child support calculator does not estimate; it calculates accurate requirements as prescribed by law.

For instance, for income over $10,000, the guidelines stipulate the lowest amount based on the following percentages: One child ? 5%, two children ? 7.5%, 3 children -9.5%, four children ? 11%, five children -12% and 6 children up to 12.5%.