Write-off Crédito

Description

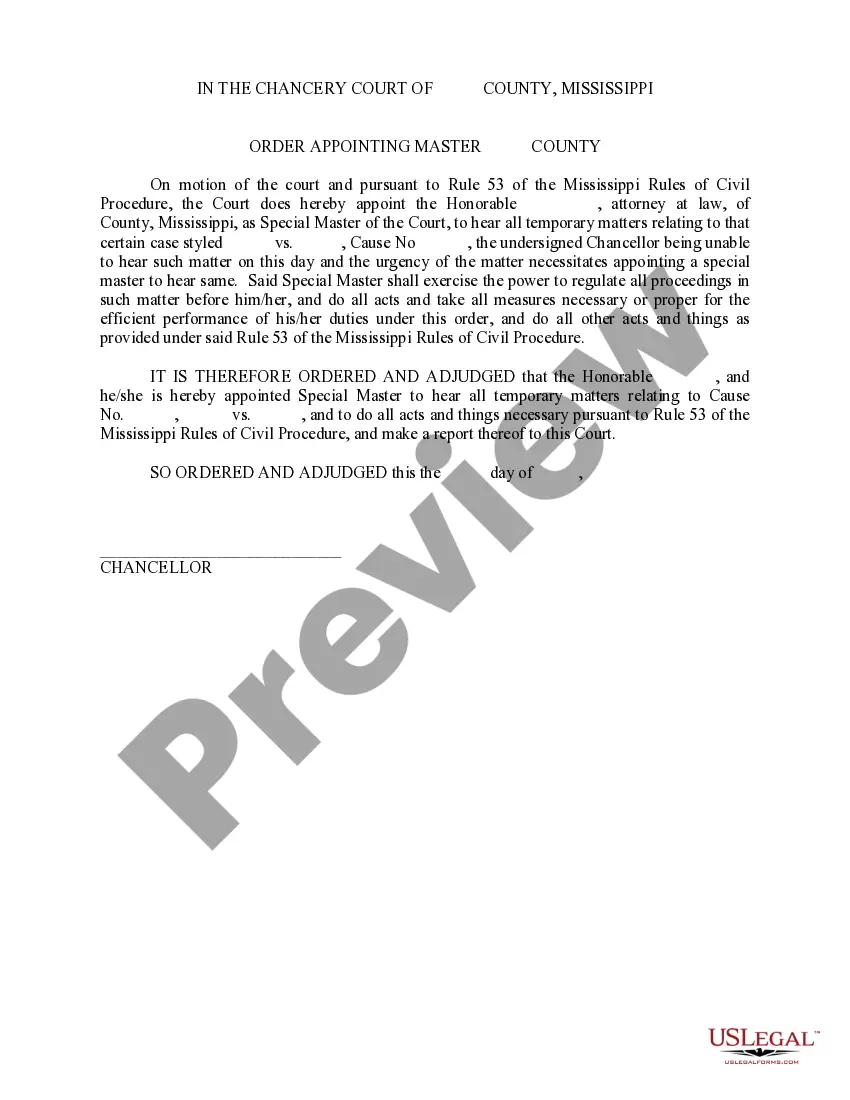

How to fill out Sample Letter For Insufficient Funds?

- If you are a returning user, log in to your account and locate the form template you need. Ensure your subscription is active; renew it if necessary.

- For new users, begin by browsing the Preview mode and descriptions of the forms. Confirm that the selected document aligns with your specific needs and complies with your local jurisdiction.

- If you cannot find the perfect template, utilize the Search feature to explore alternative options.

- Once you've chosen the correct document, click 'Buy Now' and select your preferred subscription plan. You will need to create an account to access the library's resources.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Download the form to your device. You can also access it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms serves as a valuable resource for both individuals and legal professionals, streamlining the process of acquiring necessary legal documents. With a vast library at your fingertips and expert assistance available, you can ensure that your forms are accurate and compliant.

Start simplifying your legal document needs today; explore US Legal Forms for your next write-off crédito!

Form popularity

FAQ

The best way to write-off a bad debt involves a systematic approach. First, confirm that the debt is uncollectible, then make the necessary accounting entries. Lastly, document the entire process thoroughly for future reference and compliance. Using platforms like USLegalForms can assist you in understanding the proper forms and procedures required for writing off crédito effectively.

Yes, bad debt is considered an allowable deduction under IRS guidelines, provided it meets specific criteria. Writing off crédito allows businesses to reflect a more accurate income statement. However, it is crucial to ensure that the debt was genuinely uncollectible to qualify for the deduction. Staying informed about tax regulations helps ensure compliance and maximizes tax benefits.

Generally, you need documentation that supports the claim of bad debt, such as invoices, communication records, and any relevant contract terms. This proof is crucial for justifying your write-off crédito during audits or inspections. Properly documenting your write-offs safeguards your business from potential issues with tax authorities. Consider maintaining organized records to facilitate this process.

For an LLC, the amount you can write off depends on the actual bad debts incurred. It is essential to keep detailed records to ensure accuracy during tax time. Writing off crédito can significantly impact your overall tax liability and financial health. Consulting with a tax professional can provide personalized advice tailored to your LLC needs.

To write off bad credit, first ensure you clearly identify debts that are uncollectible. Next, follow the steps to make the appropriate accounting entries, documenting the process for future reference. By understanding how to write-off crédito properly, you can enhance your financial management and maintain accurate records. It may also be wise to consult financial professionals for guidance.

The entry for writing off bad debt typically involves debiting a bad debt expense account and crediting accounts receivable. This process reduces your receivables balance and acknowledges the loss. By properly recording the write-off crédito, you maintain clear and transparent financial statements. Utilizing accounting software can streamline this process for your business.

Yes, you can write-off bad debt expenses. Writing off crédito can help improve your financial statements by removing uncollectible debts. This process reflects your company's true financial condition, enabling better decision-making for future investments. Understanding how to record these write-offs is essential for maintaining accurate accounting records.

The 6000 pound vehicle loophole enables significant tax write-offs for eligible vehicles weighing over 6,000 pounds. This tax strategy can lead to a substantial write-off crédito, benefiting business owners looking to reduce their tax liabilities. Understanding how this loophole works will empower you to make informed decisions about your vehicle purchases. Utilize platforms like uslegalforms to streamline your tax documentation and maximize your savings.

You may write off 100% of a 6000 lb vehicle if it qualifies for the Section 179 deduction and is used exclusively for business. This full deduction lets you maximize your write-off crédito, leading to substantial tax benefits. However, accurate record-keeping and ensuring compliance with IRS regulations are crucial to avoid potential issues. Reviewing your options with a tax expert can provide clarity and guidance.

Yes, you can write off a personal vehicle in an LLC, but specific conditions must be met. The vehicle must be used for business purposes, and you should track your mileage and expenses diligently. This approach can help you take advantage of write-off crédito opportunities. Consider using reputable platforms like uslegalforms to manage your vehicle-related documentation effectively.