Collection Letter Examples For Business

Description

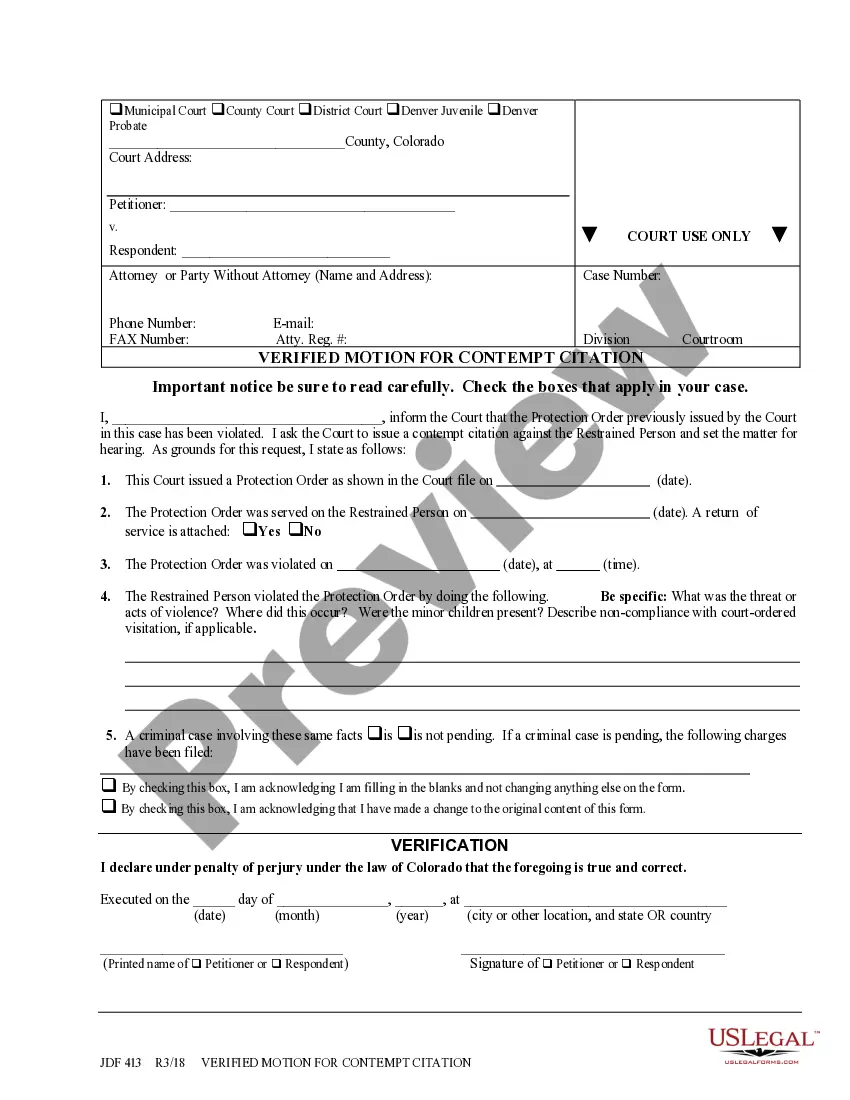

How to fill out Sample Letter For Collection?

Acquiring legal templates that adhere to federal and state laws is essential, and the internet provides numerous selections to choose from.

However, what's the advantage of spending time searching for suitable Collection Letter Examples For Business samples online when the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms is the premier online legal repository with over 85,000 fillable templates created by lawyers for various professional and personal situations. They are easy to navigate, with all documents categorized by state and intended use. Our experts stay updated with legal changes, ensuring your documents are always current and compliant when obtaining a Collection Letter Examples For Business from our site.

Once you’ve located the right form, click Buy Now and select a subscription plan. Create an account or Log In, and complete your payment using PayPal or a credit card. Choose the best format for your Collection Letter Examples For Business and download it. All templates found on US Legal Forms are reusable. To re-download and fill out forms previously acquired, navigate to the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal document service!

- Obtaining a Collection Letter Examples For Business is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, sign in and download the required document sample in the appropriate format.

- If you are a newcomer to our website, follow the steps below.

- Review the template using the Preview function or through the text description to confirm it meets your requirements.

- Utilize the search feature at the top of the page to find another sample if necessary.

Form popularity

FAQ

Contact Customer Service at 888-218-5050 or e-mail us at contact@ftc.net.

Contact Customer Service at 888-218-5050 or e-mail us at contact@ftc.net.

The FTC's Bureau of Consumer Protection stops unfair, deceptive and fraudulent business practices by collecting reports from consumers and conducting investigations, suing companies and people that break the law, developing rules to maintain a fair marketplace, and educating consumers and businesses about their rights ...

Telling the Federal Trade Commission helps us stop ripoffs, scams, and fraudsters. Your complaints matter here.

You will probably be sued If a debt collector is unable to find you, don't think you are in the clear. If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court.

Every year the FTC brings hundreds of cases against individuals and companies for violating consumer protection and competition laws that the agency enforces. These cases can involve fraud, scams, identity theft, false advertising, privacy violations, anti-competitive behavior and more.

For general information, or to submit a filing in an administrative litigation before an Administrative Law Judge or before the Commission, please contact electronicfilings@ftc.gov .

The Federal Trade Commission works to promote competition, and protect and educate consumers. You can learn more about consumer topics and file a fraud report online or by calling 1-877-FTC-HELP (382-4357).