Safe Deposit Access With Chase

Description

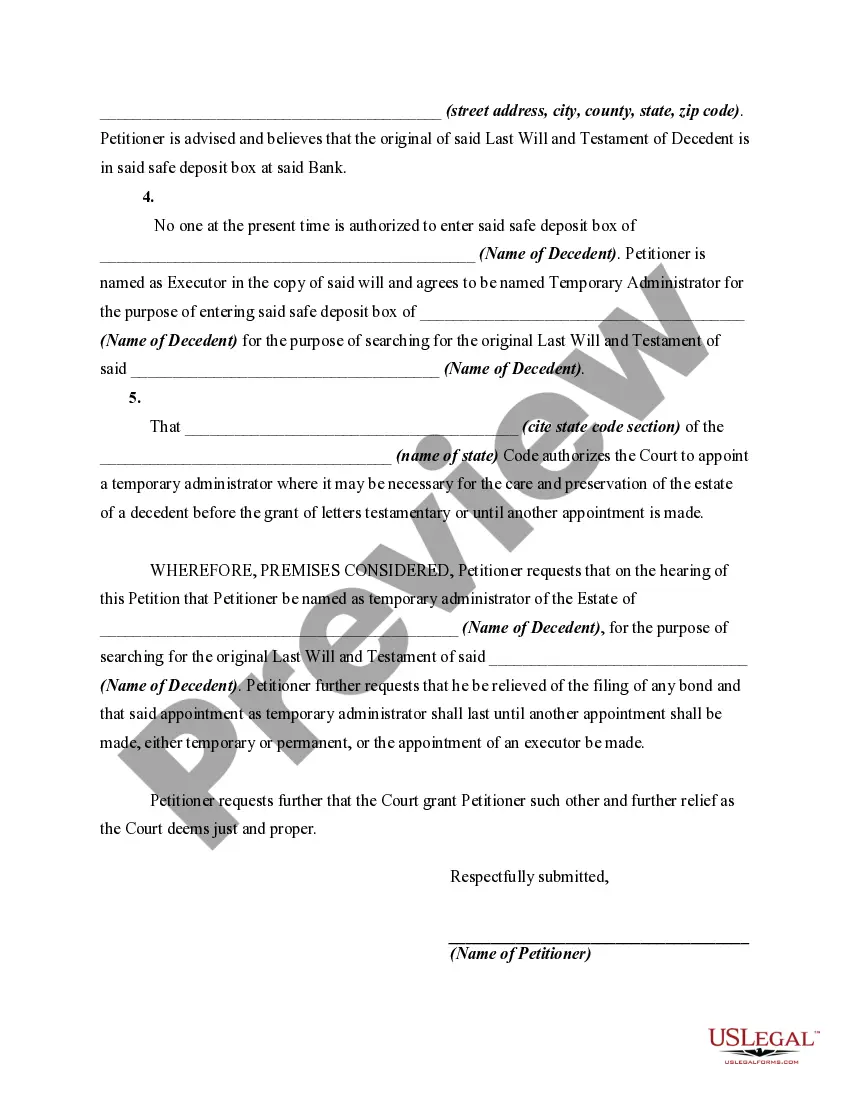

How to fill out Petition For Appointment Of Temporary Administrator In Order To Gain Access To Safe Deposit Box?

Getting a go-to place to access the most recent and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal files requirements accuracy and attention to detail, which is why it is crucial to take samples of Safe Deposit Access With Chase only from reputable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and see all the information about the document’s use and relevance for the situation and in your state or region.

Consider the following steps to complete your Safe Deposit Access With Chase:

- Utilize the catalog navigation or search field to locate your sample.

- View the form’s description to ascertain if it suits the requirements of your state and region.

- View the form preview, if there is one, to ensure the form is definitely the one you are looking for.

- Get back to the search and locate the appropriate document if the Safe Deposit Access With Chase does not fit your needs.

- When you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Choose the pricing plan that fits your preferences.

- Go on to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (bank card or PayPal).

- Choose the file format for downloading Safe Deposit Access With Chase.

- Once you have the form on your gadget, you can alter it with the editor or print it and finish it manually.

Get rid of the inconvenience that comes with your legal documentation. Explore the extensive US Legal Forms library where you can find legal samples, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Chase's check deposit limit is $2,000+ per day. The exact amount depends on the kind of account you own and the way you choose to deposit the money, which can include direct deposit, in person at a branch, through an ATM, or via the company's mobile app.

It's best to limit your endorsement to the dedicated box at the top. You'll typically need your signature, your mobile app may provide you with instructions such as adding ?For mobile deposit only.? Following these specific instructions carefully can help to process your check correctly.

How does online check deposit work? Sign into your selected banking mobile app. Tap "Deposit checks" and choose the account where you want your deposit to go. Enter the deposit amount. Tap "Front" and take a photo of the front of the check. Endorse your check, then tap "Next" Take a photo of the back of the check.

Chase was losing money on this service in a drastic fashion yet still charging clients an arm and a leg for the privilege. It was a no-win situation, so the difficult decision was made to discontinue safe deposit boxes entirely.

The safe deposit box shall be opened in the presence of an officer of the lessor. The contents shall be sealed in a package by the officer who shall write on the outside the name of the lessee and the date of the opening.