Agreement Consulting Service With Stock Options

Description

How to fill out Agreement To Provide Consulting Service For Health Care Projects - Self-Employed Marketing Consultant?

There's no longer a requirement to squander hours searching for legal documents to meet your local state obligations.

US Legal Forms has collected all of them in one location and enhanced their availability.

Our site offers over 85k templates for various business and individual legal matters categorized by state and area of application.

Utilize the search bar above to look for another template if the current one does not suit you.

- All forms are properly drafted and verified for authenticity, allowing you to feel assured in obtaining an updated Agreement Consulting Service With Stock Options.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You may also revisit all obtained documents whenever necessary by accessing the My documents section in your profile.

- If you have never interacted with our platform previously, the procedure will involve additional steps to finalize.

- Here's how new users can discover the Agreement Consulting Service With Stock Options in our library.

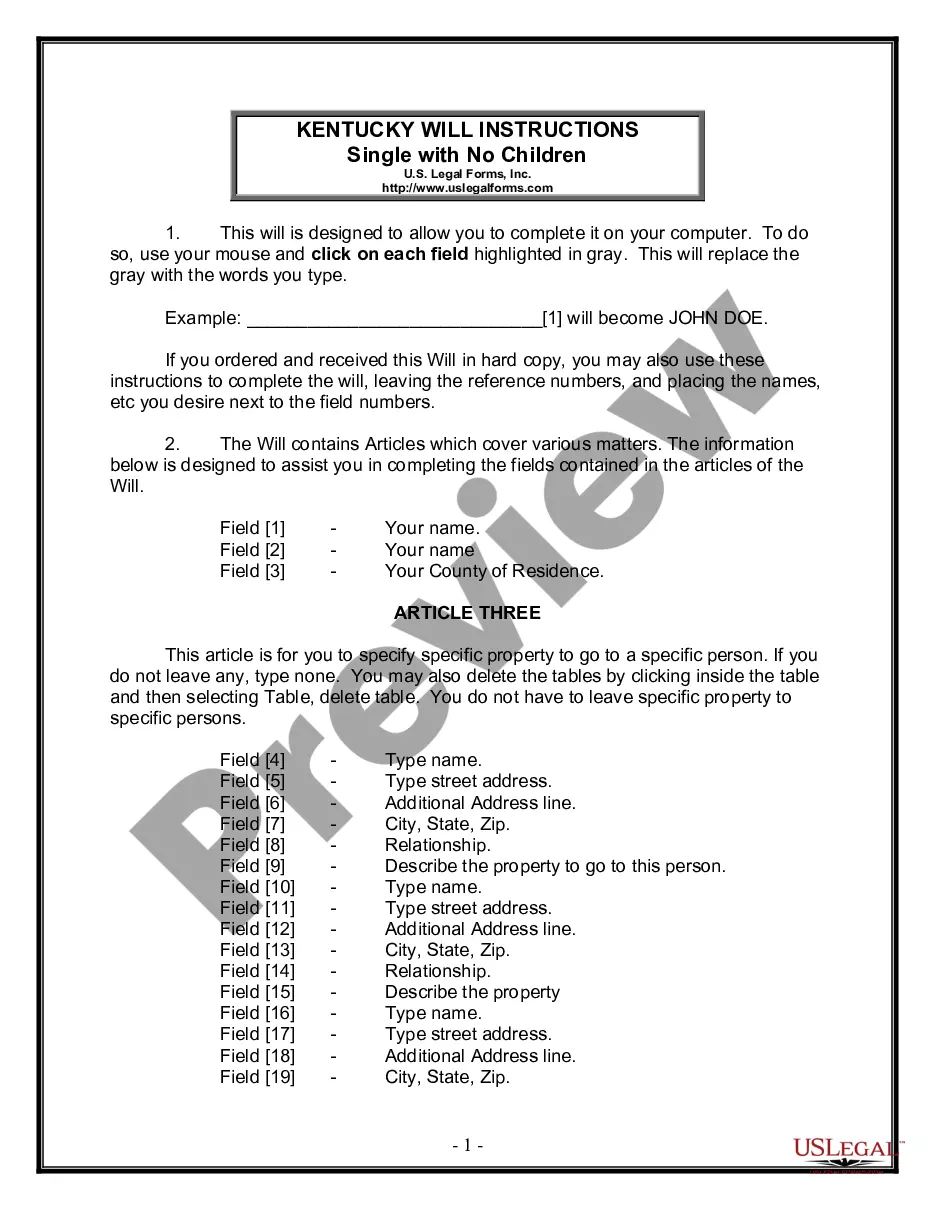

- Review the page content thoroughly to confirm it contains the sample you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

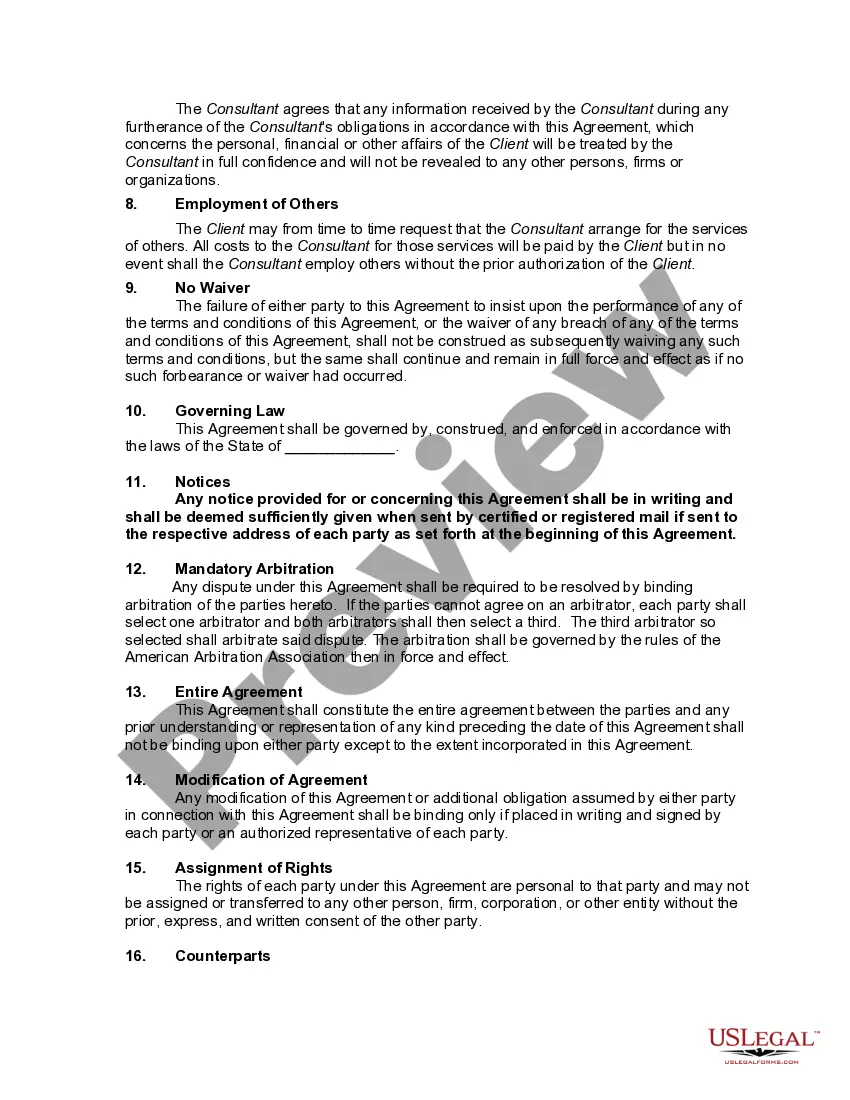

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

Incentive stock options can only be issued to employees of a company. Contractors, consultants, and board members are not eligible for ISOs, but are eligible for non-qualified stock options and other types of employee stock purchase plans.

In some situations companies choose to pay independent contractors with company stock in the form of stock options, restricted stock or outright stock grants. This is particularly common among startups that do not have access to a lot of cash or private companies that intend to be publicly traded in the future.

Yes, companies can absolutely offer stock options to their contractors, but contractors need to consider how the vesting, taxation, financial planning, and investment management related to the stock options fit into their personal financial plan.

About Stock Option Agreements Such an option, once granted to the employee, gives the employee the opportunity to benefit from increases in the company's share value by granting the right to buy shares at a future point in time at a price equal to the fair market value of such shares at the time of the grant.