Business Services Per For 2023

Description

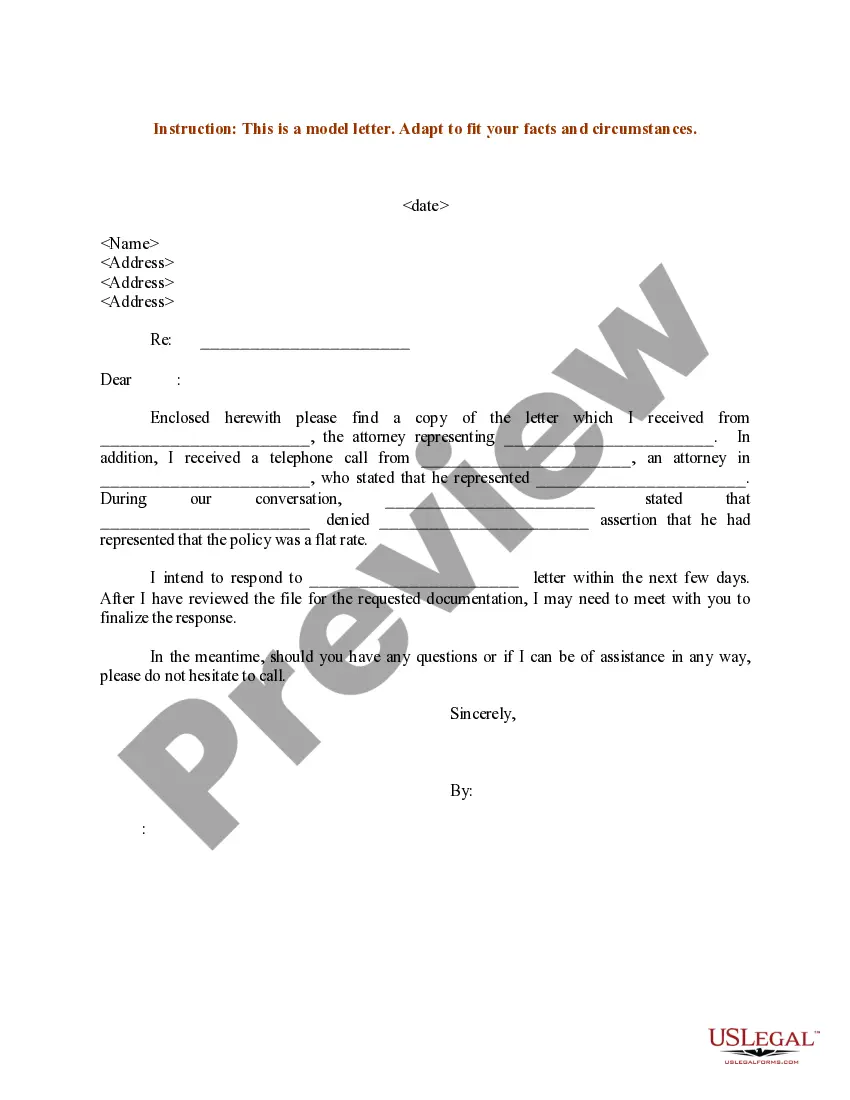

How to fill out Simple Consulting Agreement?

Managing legal documents and protocols can be a lengthy endeavor that adds to your day.

Business Services Per For 2023 and similar forms typically necessitate that you locate them and figure out how to fill them out properly.

Therefore, whether you are addressing financial, legal, or personal issues, having access to a comprehensive and useful online directory of forms will be very beneficial.

US Legal Forms is the premier online source for legal templates, featuring over 85,000 state-specific documents and many resources to help you complete your paperwork efficiently.

Is this your initial experience with US Legal Forms? Sign up and create a free account in a matter of minutes to gain access to the form directory and Business Services Per For 2023. Then, follow the listed steps to complete your document: Make sure to have identified the correct form using the Preview feature and reviewing the form details. Click Buy Now when ready, and select the subscription plan that fits your needs. Press Download and then fill out, sign, and print the document. US Legal Forms has a quarter-century of expertise assisting users with their legal documentation. Locate the form you need today and simplify any procedure effortlessly.

- Browse the collection of relevant documents with just a single click.

- US Legal Forms offers you forms specific to your state and county available for download at any time.

- Safeguard your document management processes with a premium service that enables you to prepare any document in minutes without any additional or hidden fees.

- Simply Log In to your account, find Business Services Per For 2023, and download it directly from the My documents section.

- You can also retrieve forms you have previously downloaded.

Form popularity

FAQ

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

To find an employee's PUCC value under the cents-per-mile rule, multiply their personal miles driven by the IRS standard mileage rate. For 2023 the standard mileage rate is 65.5 cents per business mile drive. The rate includes the costs of maintenance, insurance, and fuel.

The Form 941 for 2023 has a few minor changes. Line 12 of Form 8974 has been modified to reflect this. Credit against the employer portion of social security tax has replaced the previous quarter's "Credit" terminology. Moreover, the form now includes Lines 13?17 for the first quarter of 2023.

By Rachel Blakely-Gray. The new W-4 form for 2023 is now available. Unlike the big W-4 form shakeup of 2020, there aren't significant changes to the new form.

Box a?Employer's name, address, and ZIP code. Box b?Employer's Federal EIN. Box c?Tax year/Form corrected. Box d?Employee's correct SSN. Box e?Corrected SSN and/or name. Box f?Employee's previously reported SSN. Box g?Employee's previously reported name. Box h?Employee's first name and initial, Last name, Suff.