Quash Garnishment Meaning

Description

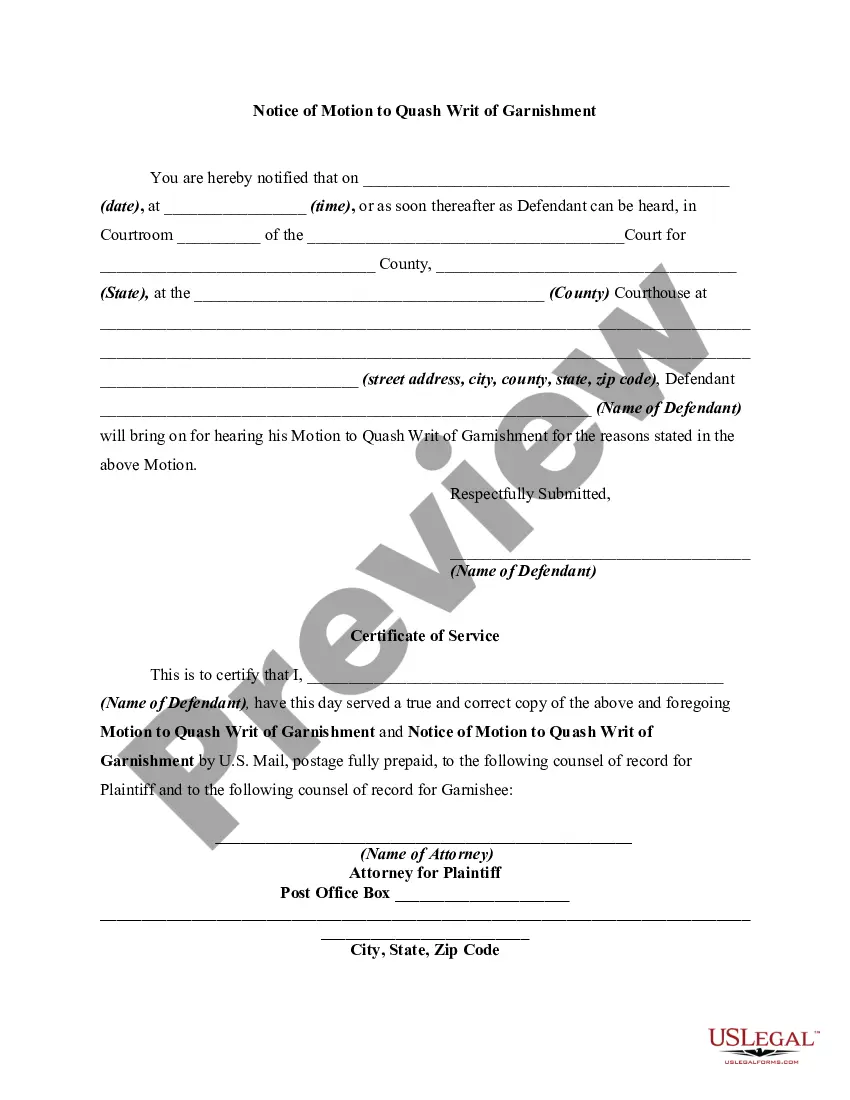

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment And Notice Of Motion?

Whether for commercial aims or personal matters, individuals must handle legal issues at some stage in their lives.

Filling out legal documents requires meticulous consideration, starting with selecting the appropriate form example.

With an extensive US Legal Forms catalog available, you no longer need to waste time searching for the right example online. Utilize the library’s user-friendly navigation to find the appropriate template for any situation.

- Acquire the example you require by using the search bar or catalog browsing.

- Review the form’s details to ensure it suits your circumstances, state, and locality.

- Click on the form’s preview to view it.

- If it is the incorrect document, return to the search tool to locate the Quash Garnishment Meaning example you need.

- Obtain the file once it meets your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can acquire the form by selecting Buy now.

- Choose the appropriate price option.

- Complete the profile registration form.

- Select your payment method: a credit card or PayPal account can be used.

- Choose the document format you desire and download the Quash Garnishment Meaning.

- Once it is saved, you can fill out the form using editing tools or print it and complete it by hand.

Form popularity

FAQ

Tip: Get faster service: Online at .irs.gov, Get Your Tax Record (Get Transcript) or by calling 1-800-908-9946 for specialized assistance. We have teams available to assist.

The Division has transitioned from the RI-7004 to the Form BUS-EXT. Details are contained in ADV 2022-38. For Tax Year 2022, if an extension is being filed for the RI- 1065, RI-1120S, RI-1120C, RI-PTE or RI-1120POL, the extension must be filed using the Form BUS-EXT.

Rhode Island requires that you use the same filing status as you used on your federal return, with the exception that married couples filing jointly for federal purposes may file their Rhode Island return(s) separately if one spouse is a RI resident and the other spouse is a nonresident.

These 2021 forms and more are available: Rhode Island Form 1040/1040NR ? Personal Income Tax Return for Residents, Nonresidents, and Part-Year. Rhode Island Form 1040H ? Property Tax Relief Claim. Rhode Island Form 1040MU ? Resident Credit for Taxes Paid to Another State.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

For those not subject to this electronic filing requirement: All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.

Local IRS Taxpayer Assistance Center (TAC) ? The most common tax forms and instructions are available at local TACs in IRS offices throughout the country. To find the nearest IRS TAC, use the TAC Office Locator on IRS.gov.