How Do You Respond To A Debt Lawsuit

Description

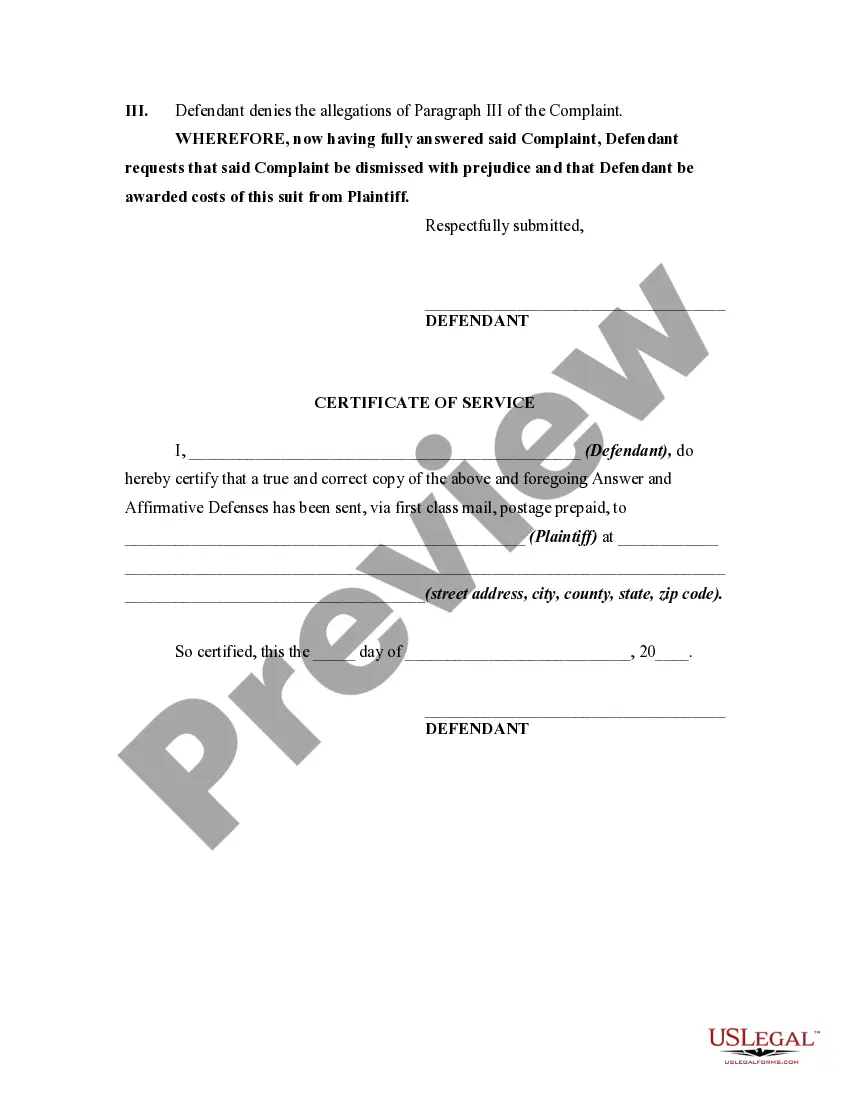

How to fill out General Form Of An Answer By Defendant In A Civil Lawsuit?

- Log in to your US Legal Forms account if you're an existing user. Ensure your subscription is current; renew it according to your payment plan if necessary.

- Review the form previews and descriptions to confirm you've selected the accurate document for your situation according to local jurisdiction.

- If you need a different template, use the Search tab to find one that fits your requirements.

- Once you've found the right document, click on the Buy Now button and select your preferred subscription plan. Create an account to access the full library.

- Complete your purchase with your credit card information or PayPal account.

- Download the form to your device and save it for completion. You can also access it anytime in the My Forms section of your profile.

US Legal Forms stands out with its extensive collection of over 85,000 fillable and editable legal forms, making it a superior option compared to competitors. Furthermore, premium assistance is available to ensure that your documents are completed accurately and comply with legal standards.

Take the first step toward addressing your debt lawsuit confidently. Visit US Legal Forms now and equip yourself with the right resources to effectively respond.

Form popularity

FAQ

Ignoring a debt lawsuit can lead to serious consequences, including a default judgment against you. This judgment can result in wage garnishment or bank account levies. It’s crucial to respond within the designated time frame to protect your rights. Learning how do you respond to a debt lawsuit is vital to prevent such outcomes.

When you face a debt collector lawsuit, respond promptly to avoid a default judgment. Prepare a written answer addressing each claim, and consider including any defenses you may have. Consulting a legal professional or utilizing platforms like USLegalForms can provide valuable resources and templates to assist you. Knowing how do you respond to a debt lawsuit helps ensure you take the right steps.

Defending yourself in a debt lawsuit requires understanding the claims made against you. Gather evidence, such as payment records and communications, to support your case. You might also need to file a response to the lawsuit with the court. Familiarizing yourself with how do you respond to a debt lawsuit can significantly strengthen your defense.

To settle a debt collection lawsuit, first review the allegations against you. Then, consider negotiating with the creditor to reach a settlement that works for both parties, often for less than the original amount. It’s essential to get any agreement in writing. Knowing how do you respond to a debt lawsuit will aid you in negotiating more effectively.

When you dispute a collection, clearly state your position and ask for validation of the debt. Request written documentation to support the collection agency's claim. Remember, being calm and firm is key; you have the right to know the details of the debt. Understanding how do you respond to a debt lawsuit empowers you during these discussions.

Yes, you should always answer a debt collection lawsuit. Responding ensures that you protect your rights and have a chance to present your side of the case. If you’re unsure about how to respond to a debt lawsuit, consider seeking help from professionals or using platforms like uslegalforms that provide templates and guidance.

When writing a response to a debt lawsuit, start by addressing the court and including the case number. Clearly state your position regarding the debt, whether you admit, deny, or lack sufficient knowledge of the claims. Be sure to follow the local court rules for formatting and filing, as this can affect how you effectively respond to a debt lawsuit.

Ignoring a debt lawsuit can lead to severe consequences, such as a default judgment against you. This judgment allows the creditor to garnish your wages or put liens on your property. If you're uncertain about how to respond to a debt lawsuit, it’s crucial to take action and seek legal advice.

Debts generally become uncollectible after a certain period, often around six to seven years, depending on state laws. After this time, creditors cannot take legal action to recover the debt. However, you should still check the specifics for your state. Understanding this timeframe can significantly influence how do you respond to a debt lawsuit.

The 777 rule is a guideline that assists consumers in their dealings with debt collectors. It states that a debt collector must cease contact after seven days if they don’t receive a written response from you. If you ask them to stop contacting you, they must comply. When considering how do you respond to a debt lawsuit, it's important to understand your rights under this rule.