Trust Requisição

Description

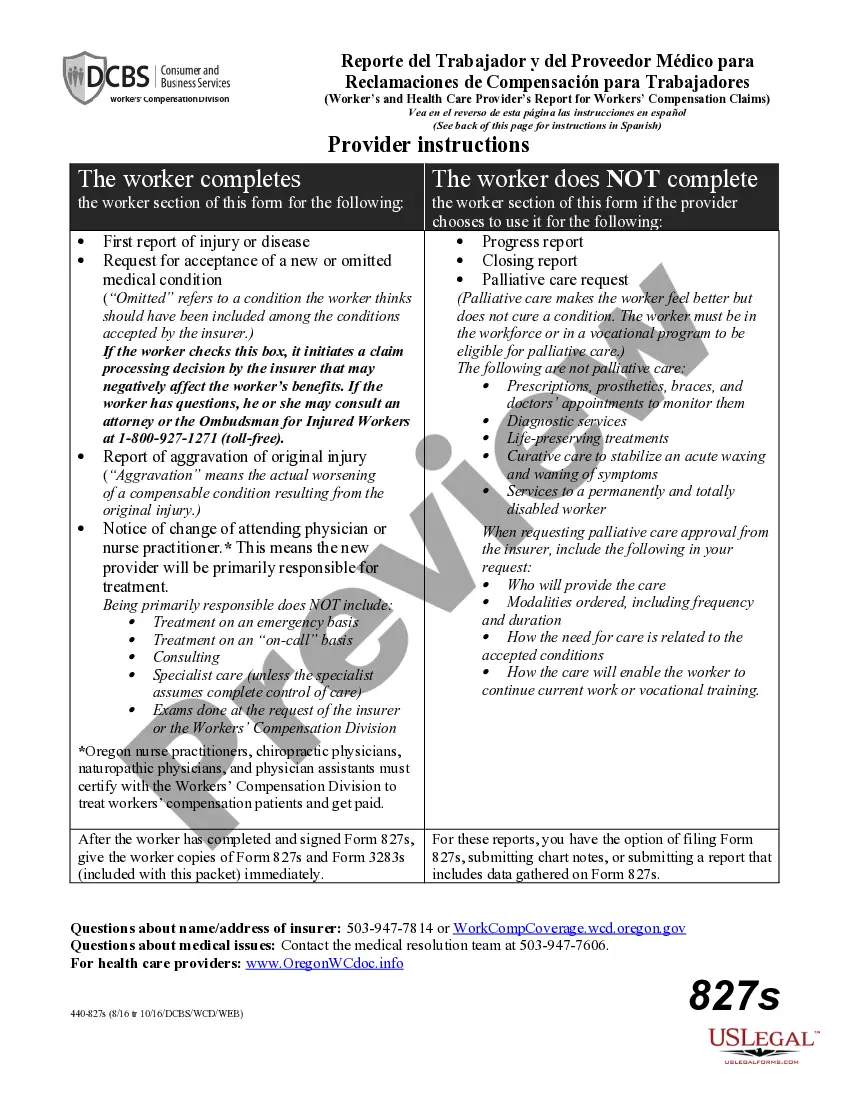

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

- If you are an existing user, simply log in to your account and download the required form template by clicking the Download button, ensuring your subscription is current.

- For new users, start by checking the Preview mode and form description to ensure you've selected the appropriate form that meets local jurisdiction requirements.

- If the current template doesn’t fit your needs, use the Search tab above to find the right one. Once you locate an appropriate form, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting the subscription plan that works for you. Registration is necessary to access the library's offerings.

- Complete your purchase by entering your credit card details or utilizing your PayPal account for the subscription payment.

- Finally, download the form and save it for completion. You can access it anytime via the My Forms section of your profile.

In conclusion, US Legal Forms equips individuals and attorneys with a robust collection of over 85,000 legal forms, enabling quick and reliable document creation. By following these steps, you can ensure that your legal needs are met with precision.

Ready to simplify your legal process? Join US Legal Forms today and take the first step towards hassle-free document management.

Form popularity

FAQ

The new IRS rule for irrevocable trusts requires increased transparency regarding trust reporting and income distributions. This change emphasizes the importance of maintaining accurate records and timely filings. Familiarizing yourself with these rules can help you manage your Trust requisição effectively.

To file an irrevocable trust with the IRS, you need to complete Form 1041 and submit it by the deadline. You will also need to gather documentation regarding the trust's income and expenses. Following these steps carefully ensures your Trust requisição is handled accurately.

Yes, you can file your own irrevocable trust, but it is essential to understand the requirements and forms involved. Many individuals choose to seek assistance to ensure compliance with tax laws and regulations. Resources like uslegalforms can provide the tools you need for a successful Trust requisição.

You should report irrevocable trust income on Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. This form allows you to detail the income generated by the trust and any distributions made to beneficiaries. Ensuring accurate reporting is crucial for your Trust requisição.

Yes, an irrevocable trust often requires registration with the court, depending on your state’s laws. This process ensures that the trust is valid and protected under the legal framework. Understanding how to navigate this requirement can simplify your Trust requisição.

Filing ITR 7 for a trust involves filling out the necessary sections accurately. You need to provide comprehensive details about the trust's income, deductions, and the beneficiaries. Using platforms like uslegalforms can guide you through the process, ensuring your Trust requisição is correctly submitted.

To file a return for a trust, you typically need TurboTax Business. This version is specifically tailored for business and trust returns, ensuring that you meet all necessary requirements. When using TurboTax, you can efficiently handle the complexities associated with the Trust requisição.

Filling out a trust fund generally requires you to provide details about the trust's creators, beneficiaries, and the assets involved. Clearly stating the purpose and terms of the trust is crucial as well. With USLegalForms, you can access user-friendly templates that simplify the process of completing your trust fund documents related to your trust requisição.

Documenting trust income involves keeping accurate records of any earnings generated by the trust's assets, such as interest and dividends. It's essential to maintain clear documentation of all financial transactions. USLegalForms provides templates and resources to help you efficiently track and report income for your trust requisição, ensuring compliance and accuracy.

To file a trust, you'll typically need to complete IRS Form 1041 if the trust is generating income. Additionally, you might require the trust document itself, which outlines the trust's terms and structure. Using a reliable platform like USLegalForms can guide you through the process of obtaining and filling out the necessary forms related to your trust requisição.