Unsecured Loan Form With Two Points

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

Whether for commercial objectives or personal matters, everyone must handle legal circumstances at some stage in their life.

Completing legal paperwork demands meticulous care, beginning with selecting the right form template.

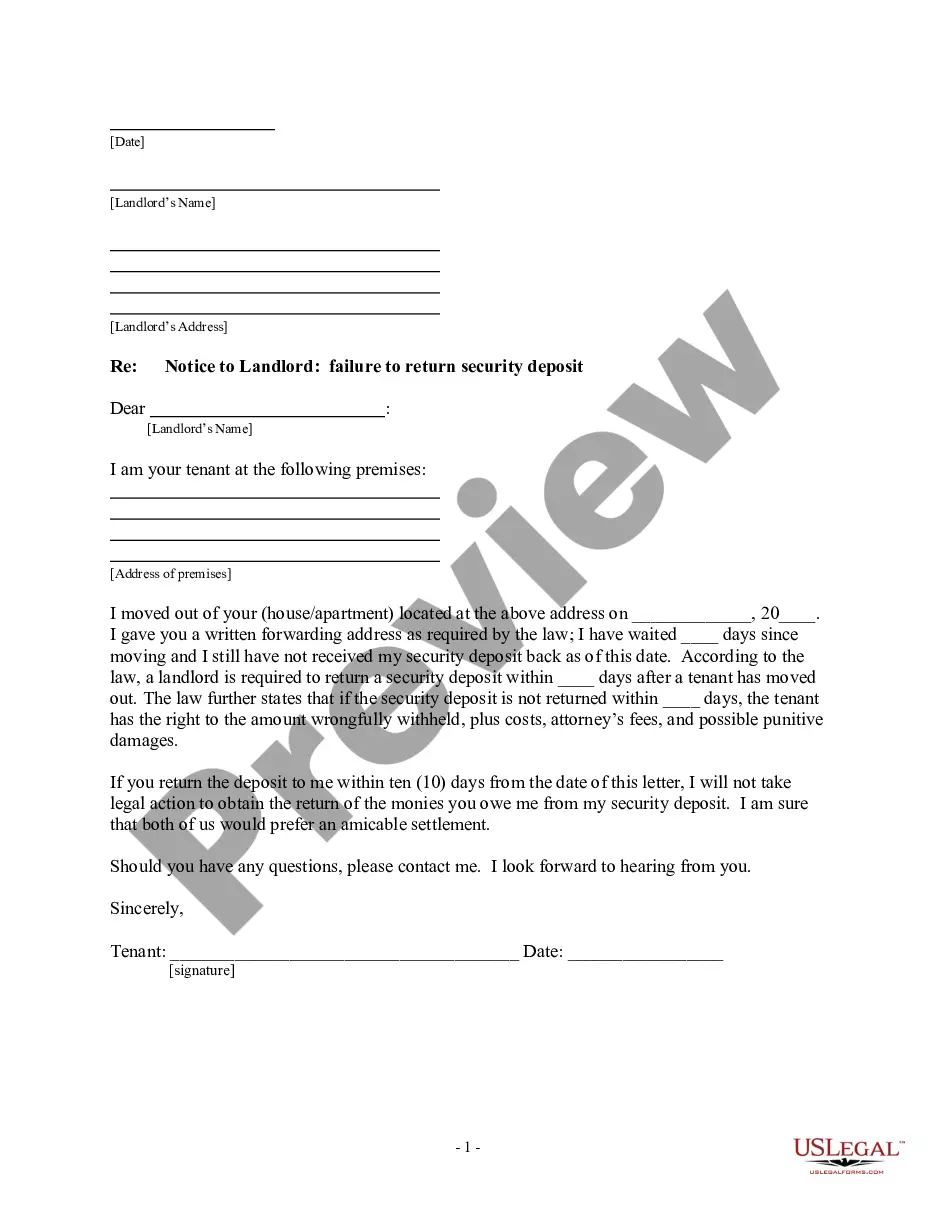

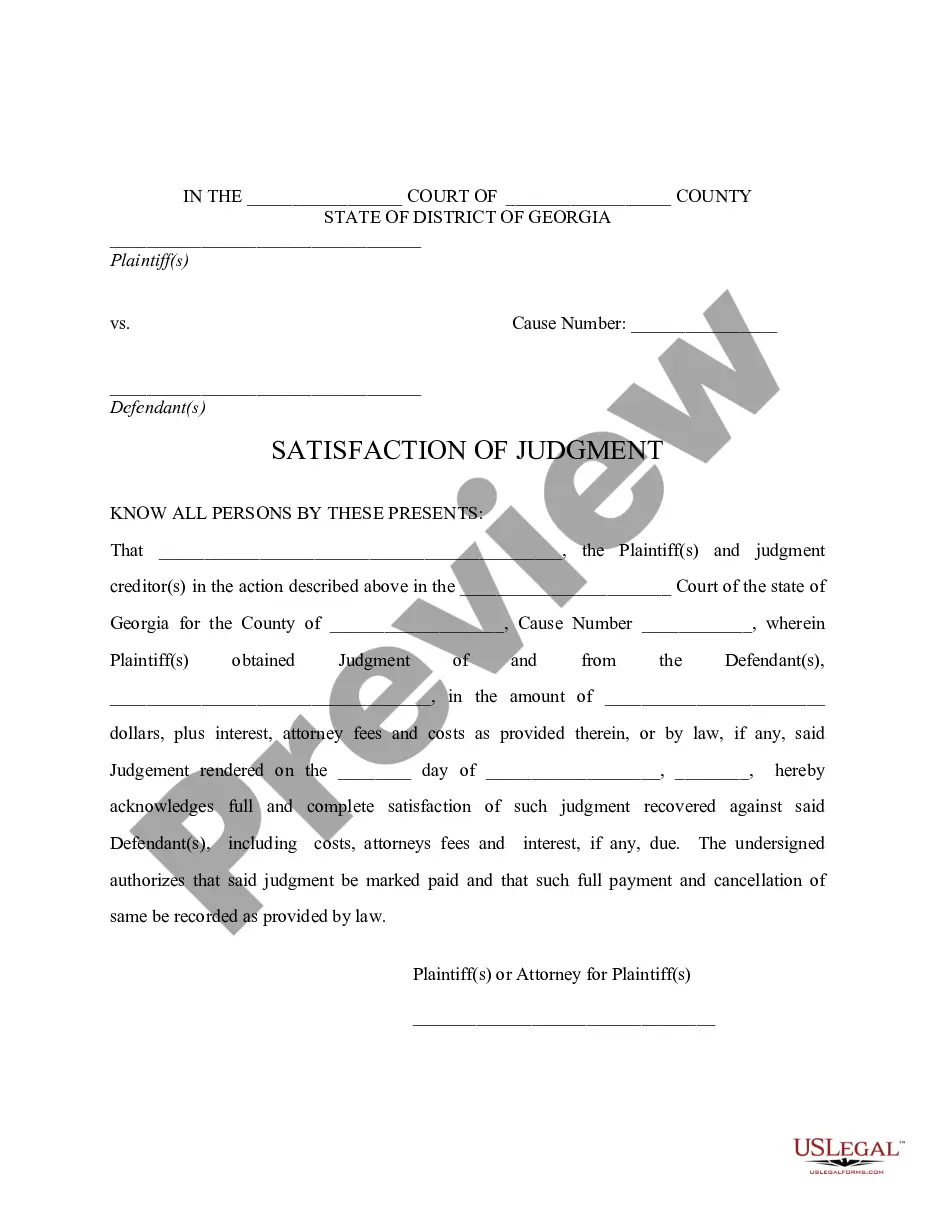

Once it is downloaded, you can fill out the form with the assistance of editing software or print it and complete it by hand. With a vast US Legal Forms catalog available, you don’t need to waste time searching for the right sample across the web. Utilize the library’s user-friendly navigation to find the appropriate template for any situation.

- For instance, if you choose an incorrect version of an Unsecured Loan Form With Two Points, it will be denied upon submission.

- Thus, it is crucial to find a reliable source for legal documents like US Legal Forms.

- If you need to acquire an Unsecured Loan Form With Two Points template, follow these straightforward steps.

- Locate the sample you require by utilizing the search bar or browsing the catalog.

- Review the form’s details to confirm it fits your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search feature to find the Unsecured Loan Form With Two Points template you need.

- Download the document if it meets your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you prefer and download the Unsecured Loan Form With Two Points.

Form popularity

FAQ

Your income and employment history are good indicators of your ability to repay outstanding debt. Income amount, stability, and type of income may all be considered. The ratio of your current and any new debt as compared to your before-tax income, known as debt-to-income ratio (DTI), may be evaluated.

Impact on credit score ? the more loans you apply for, the more your credit score will be checked. Lenders will be able to see your applications and approvals for other loans, so they may consider you a higher risk. Debt accumulation ? the more loans you have, the more debt you accumulate.

You need at least $10,500 in annual income to get a personal loan, in most cases. Minimum income requirements vary by lender, ranging from $10,500 to $100,000+, and a lender will request documents such as W-2 forms, bank statements, or pay stubs to verify that you have enough income or assets to afford the loan.

A traditional personal loan is unsecured, meaning it's not backed by collateral. Instead, the lender decides whether to approve you for a loan based on your income and creditworthiness.

Visit the branch of the financial lender. Procure the personal loan application form and enter all the required details. Submit relevant documents that prove one's income, age, address and identity. The lender will then verify the documents and check the eligibility of the applicant.