Sell Of Partnership In Suffolk

Description

Form popularity

FAQ

A transfer of partnership interest involves transferring ownership, profits, losses, and management responsibilities from one partner to another or to a new entity. Partnership agreements typically dictate the terms of transfer, often including restrictions like the right of first refusal for existing partners.

Essentially, partners share in the profits and the debts of the daily workings of the business. Because of that, when one partner wants to sell, they cannot sell the entire business. They can only sell their assets – i.e., their share of the partnership.

The Partnership Buyout Agreement Your path to an ownership sale will be simpler if you created a clear and thorough partnership buyout agreement when you started your company. The agreement should discuss what might lead to one of the partners wanting to sell her share and state the terms and timing that would apply.

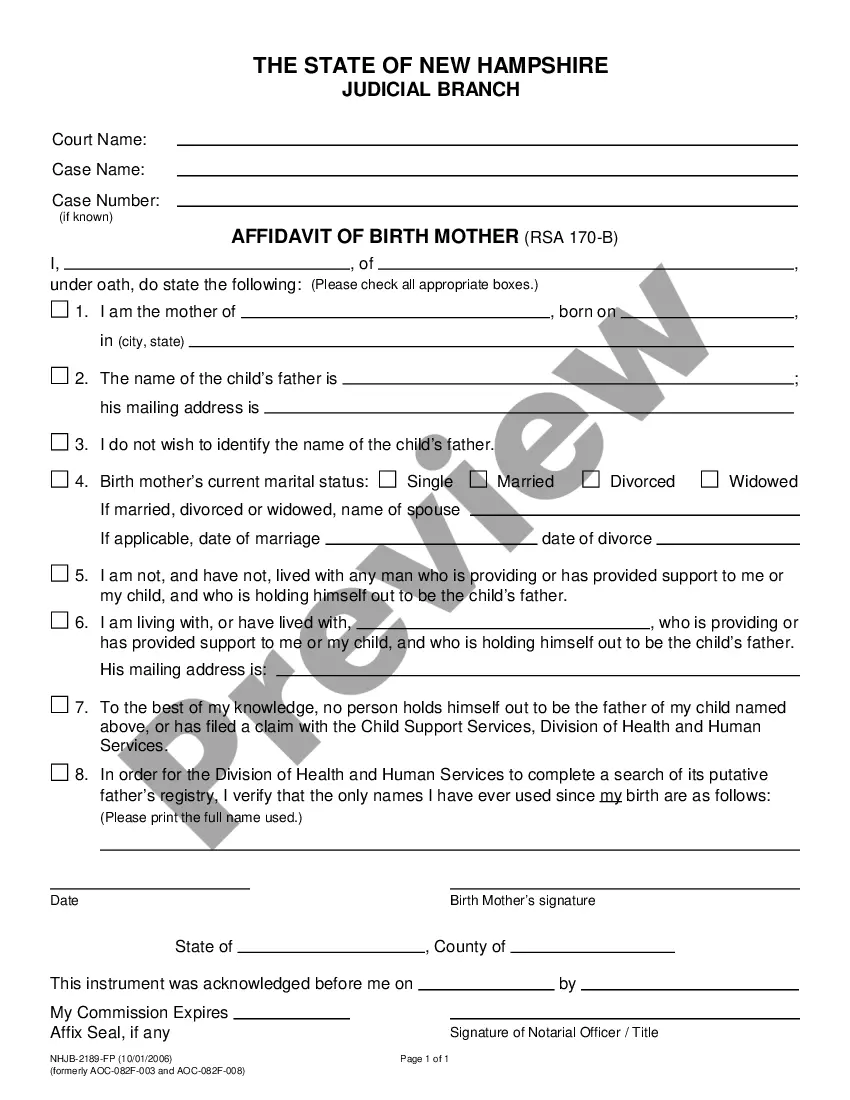

In order to register, persons shall execute an affidavit of domestic partnership and submit it to the County Clerk, who shall maintain a registry of domestic partnerships. Both parties to the partnership shall be present when the affidavit is submitted.

Conclusion: Partner sales involve leveraging external organizations to enhance a company's sales efforts. By utilizing partners' established customer bases, market knowledge, and resources, companies can expand their market reach, reduce costs, improve customer access, scale operations, and ensure accountability.

Kickstart your new business in minutes There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

A business registration certificate is an official document issued by a government authority that confirms a company's legal existence and compliance with local regulations, allowing it to operate and engage in business activities.