Buy Sell Agreement Online With English Subtitles In Middlesex

Description

Form popularity

FAQ

The buy-sell agreement can ensure that the ownership of the company continues on in a manner that is in the best interests of the company and fair to the owners by spelling out what happens under different triggering events.

Buy-sell agreements are commonly used by sole proprietors, closed corporations and partnerships. Most buy-sells require that the business shares be sold back to the company or the remaining members of the business. In the case of the death of a partner, the estate must agree to sell.

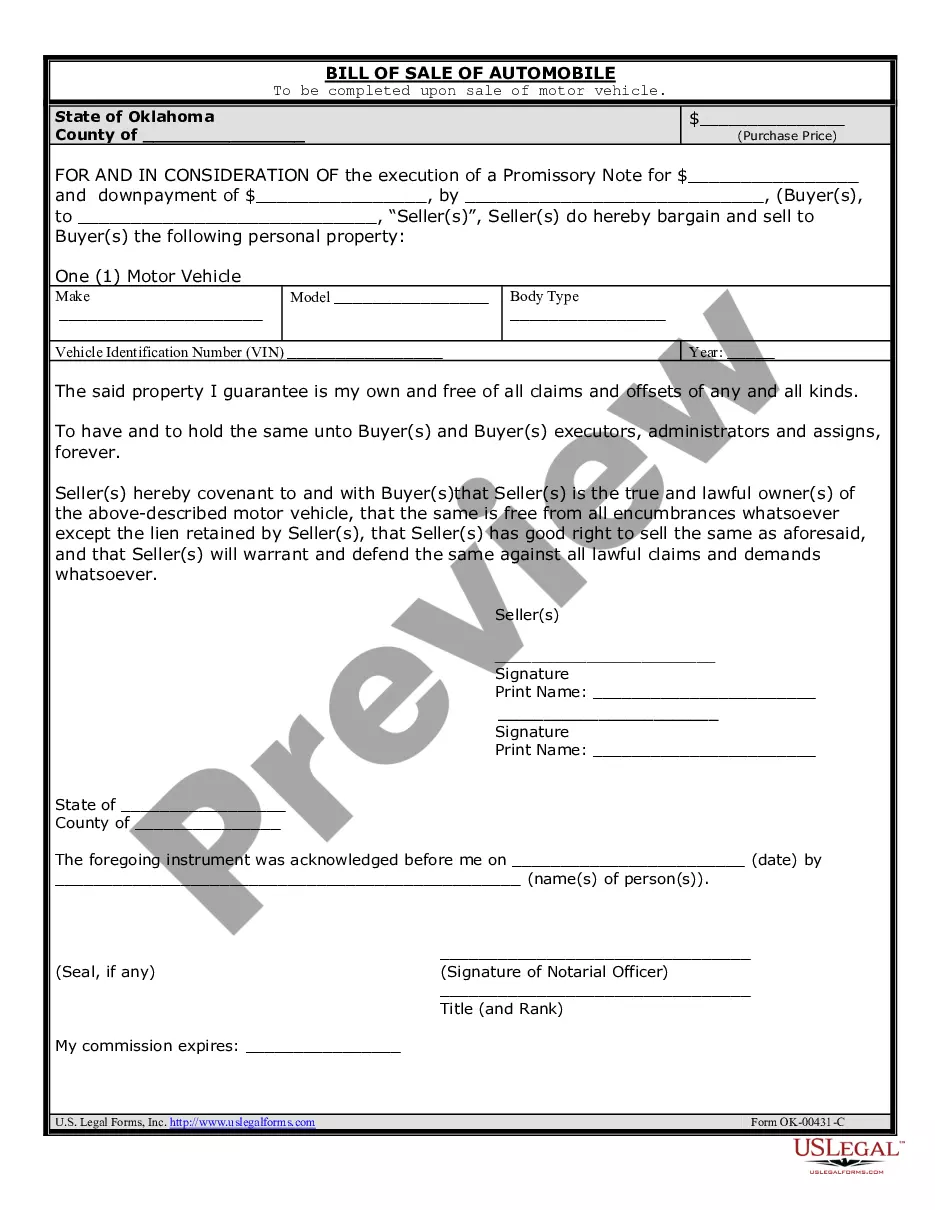

How to draft a contract in 13 simple steps Start with a contract template. Understand the purpose and requirements. Identify all parties involved. Outline key terms and conditions. Define deliverables and milestones. Establish payment terms. Add termination conditions. Incorporate dispute resolution.

What should be included in a buy-sell agreement? To avoid disagreements, a buy-sell agreement describes how an interest will be sold but also for how much. Elements of a buy-sell agreement include: Any stakeholders, including partners or owners, and their current stake in the business' equity.

To write a simple contract, title it clearly, identify all parties and specify terms (services or payments). Include an offer, acceptance, consideration, and intent. Add a signature and date for enforceability. Written contracts reduce disputes and offer better legal security than verbal ones.

Generally, they should include the following information: A list of the partners or owners involved and their current equity stakes. A recent business valuation, which is used to place a value on each partner's interest. Events that trigger a buyout, such as death, disability, bankruptcy, or retirement.