Corporation Resolution Form Withdrawal In Massachusetts

Description

Form popularity

FAQ

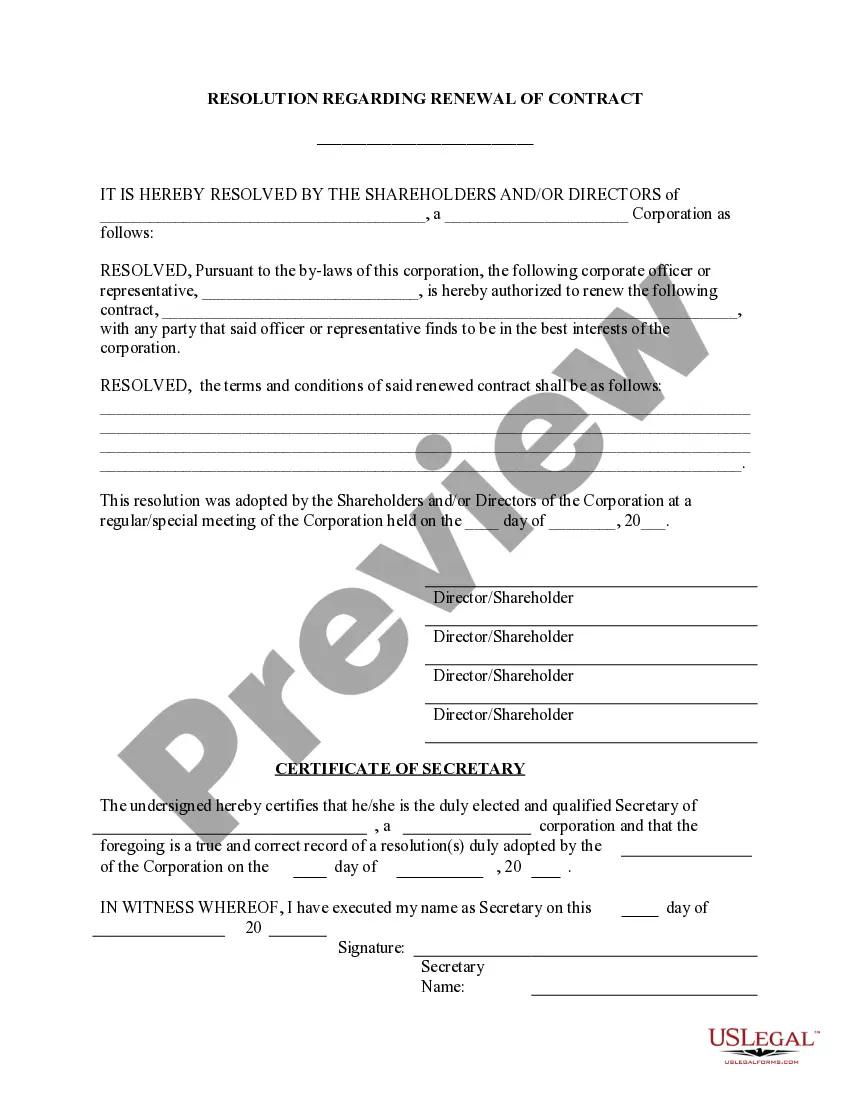

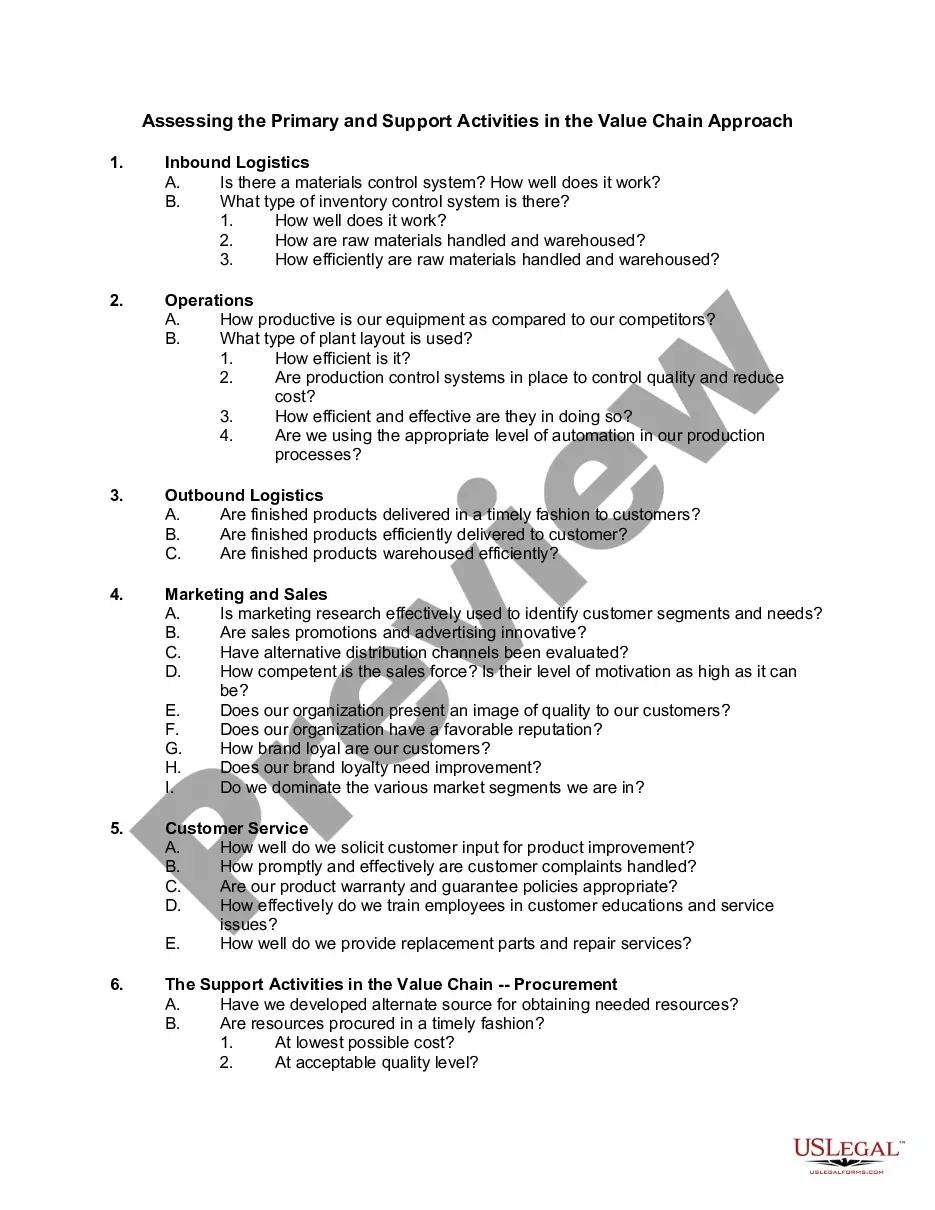

Massachusetts Corporate Resolution Template If you need to put major company decisions in writing then use a corporate resolution. A company's board of directors uses a corporate resolution to put decisions in writing. It shows that the business had the authority to make a specific choice or action.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

A California LLC that is less than one year old, hasn't conducted any business since registering, has no debts, and meets a few other requirements is eligible to file the Short Form Cancellation Certificate (Form LLC 4/8). The California LLC dissolution forms are available on the Secretary of State's website.

The steps to dissolve your Massachusetts LLC should be followed to legally terminate the business. Step 1: Vote to Dissolve the LLC. Step 2: Notify Creditors About Your LLC's Dissolution. Step 3: File Final Tax Returns and Obtain Tax Clearance. Step 4: File Articles or Certificate of Dissolution. Step 5: Distribute Assets.

Provide written notification to the LLC of your intent to remove yourself. Receive what interest in the company you are due. (The other members are required to buy you out in line with the Articles of Organization and your share of ownership in the business.)

Your board of directors assumes a resolution recorded in corporate minutes under the umbrella of any restrictions for adding or removing officers in the corporation. Changing officers of a corporation involves filing the articles of incorporation while adhering to Massachusetts state codes.