Homestead Exemption Forms With Miniatures In Maricopa

Description

Form popularity

FAQ

Property Tax Credit -You may claim this credit if you meet ALL of the following: You were age 65 or older in the current tax year, or if under age 65, you were receiving SSI title 16 income from the Social Security Association. You were a full year resident of Arizona for the tax year.

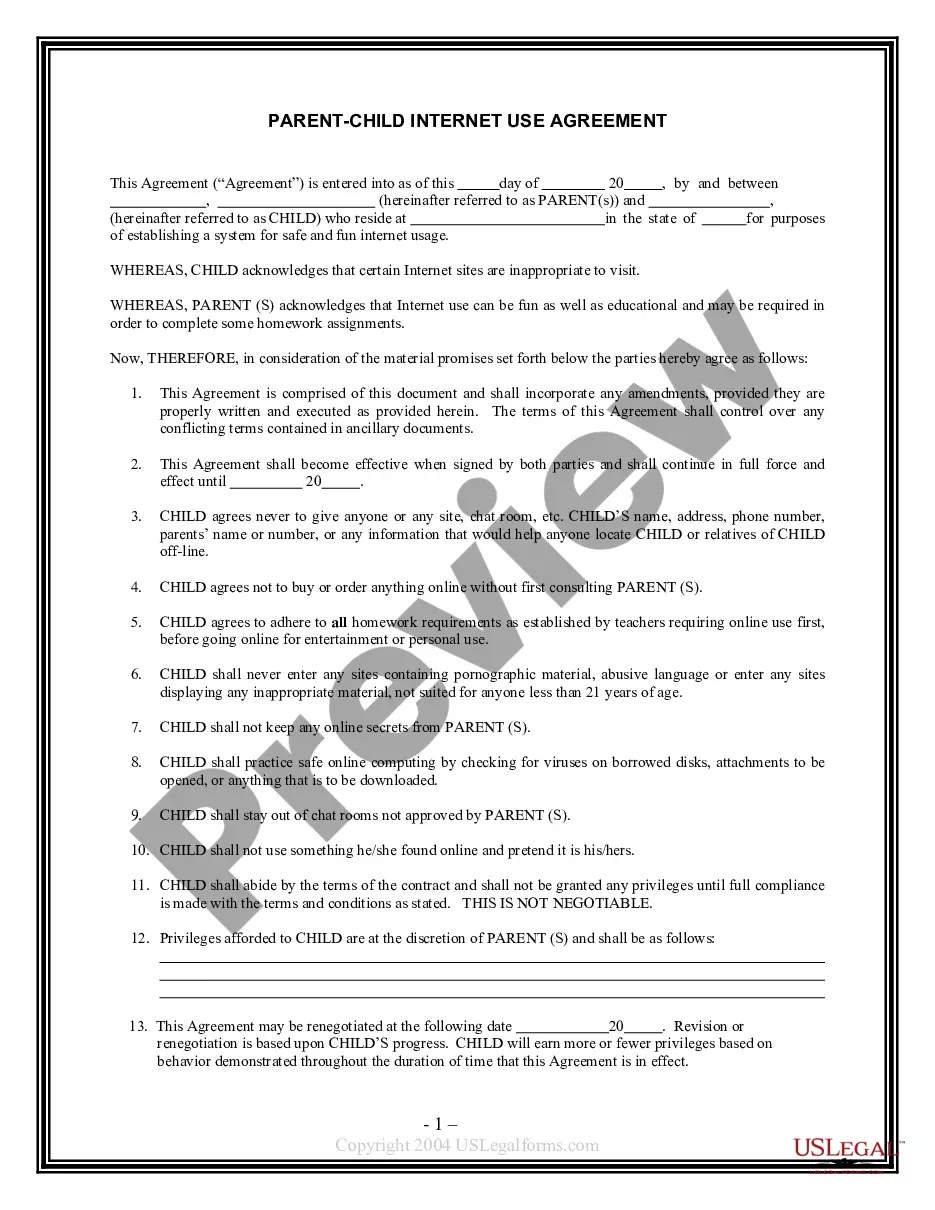

Who qualifies for a senior property tax exemption? he eligibility criteria for senior property tax exemptions vary by location. Generally, they are available to homeowners who are at least a certain age (often 65 or older) and meet specific income or property value requirements.

To claim the Arizona Property Tax Credit all the following must apply: You were a resident of Arizona for all of 2024. You (or your spouse) were either 65 or older or received Title 16 Supplemental Security Income (SSI) payments during 2024.

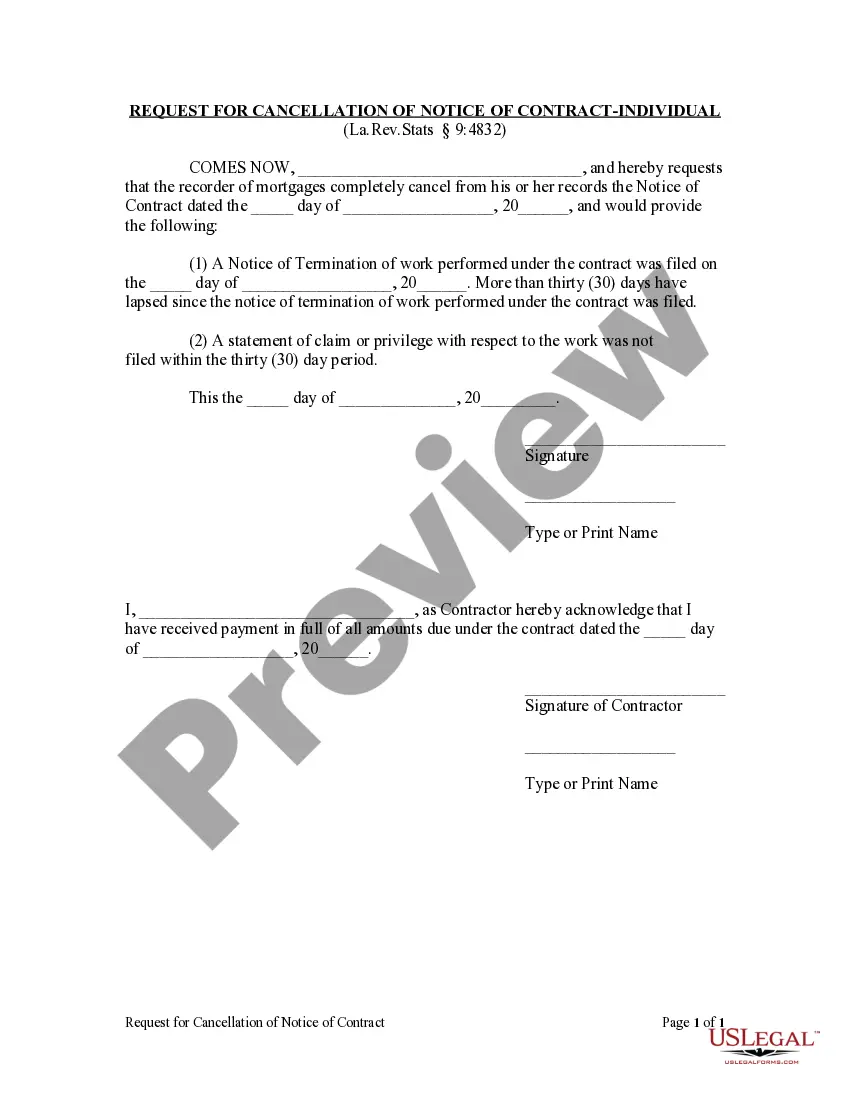

The exemption application process for individuals and organizations is described in A.R.S. 42-11152 . In almost every case, the taxpayer must file an application with the county assessor, which provides the information required by the assessor to make an exemption determination.

Claiming a Homestead Exemption The Arizona homestead exemption is automatic, meaning that no written claim is required. If a person desires to waive the exemption, the person must record the waiver in the office of the county recorder.

As a senior in Arizona, you may be eligible for a Tax Freeze on the taxable market value of your home. This includes Phoenix's active adult communities, as well as, homes outside of those communities. The intent is to help low-income seniors. Let's explore Arizona senior homeowner's tax relief in more detail below.

California exempts the first $7,000 of residential homestead from property taxes.

1. Property owner (applicant) must be 65 years of age or older. 2. The property must be the primary residence of the property owner and must have lived there for at least 2 years.