Deed Of Donation Without Land Title In Suffolk

Description

Form popularity

FAQ

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.

Donor's Tax: One of the main costs in a Deed of Donation is the donor's tax. Under the current Philippine Tax Code, donations between parents and children are taxed at a flat rate of 6% of the fair market value (FMV) or zonal value of the property, whichever is higher.

It's the type of deed that offers the most buyer protection. When committing to a general warranty deed, the seller is promising there are no liens against the property, and if there were, the seller would compensate the buyer for those claims.

Donor's Tax: One of the main costs in a Deed of Donation is the donor's tax. Under the current Philippine Tax Code, donations between parents and children are taxed at a flat rate of 6% of the fair market value (FMV) or zonal value of the property, whichever is higher.

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.

Donor's Tax: One of the main costs in a Deed of Donation is the donor's tax. Under the current Philippine Tax Code, donations between parents and children are taxed at a flat rate of 6% of the fair market value (FMV) or zonal value of the property, whichever is higher.

– Quitclaim Deed: This deed transfers the grantor's interest in the property without any warranties or guarantees. It is often used for transfers between family members where the grantor may not want to warrant the current status of title.

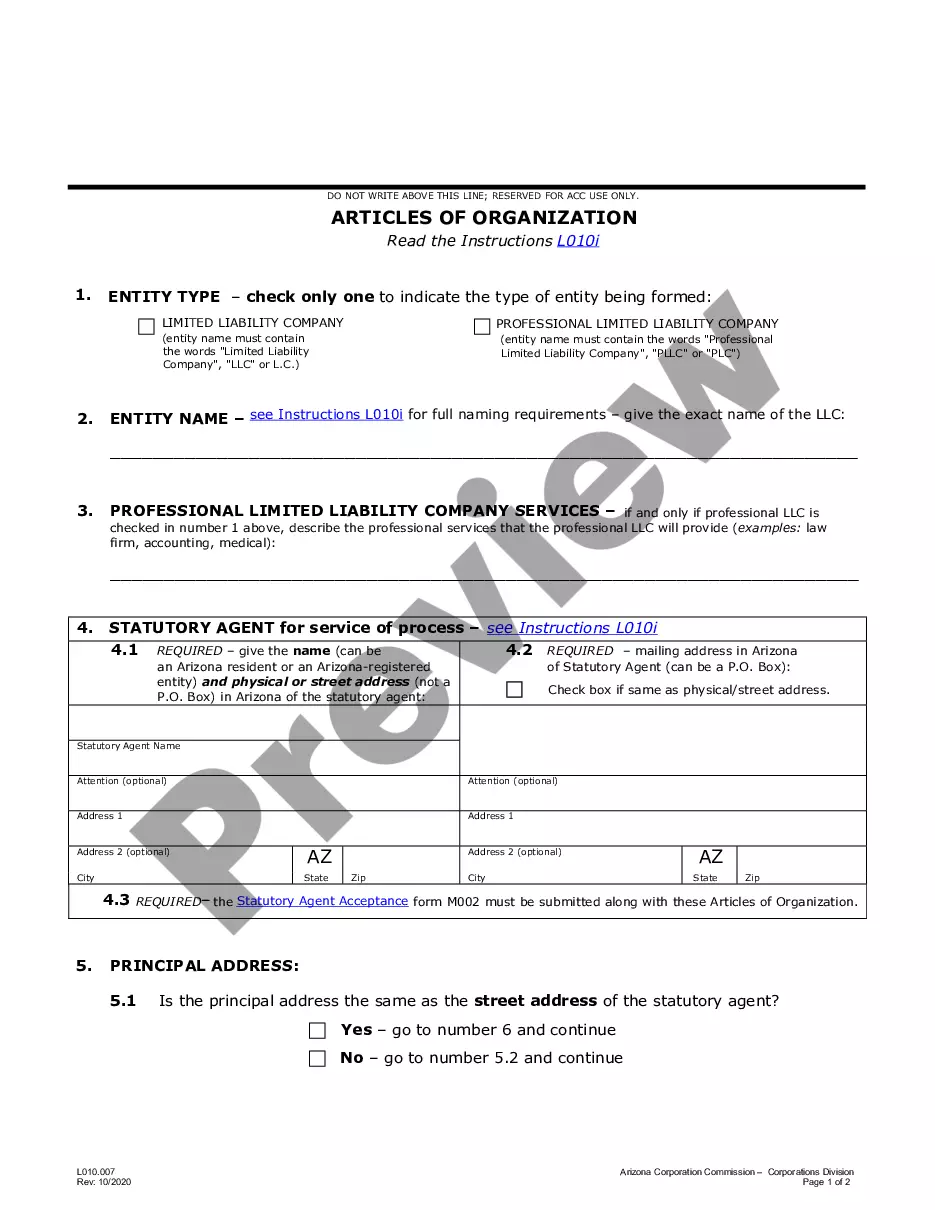

Deeds should be recorded in the Office of the County Clerk of the county in which the real property being transferred is located.