Escrow Release Form For Mortgage In Suffolk

Description

Form popularity

FAQ

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.

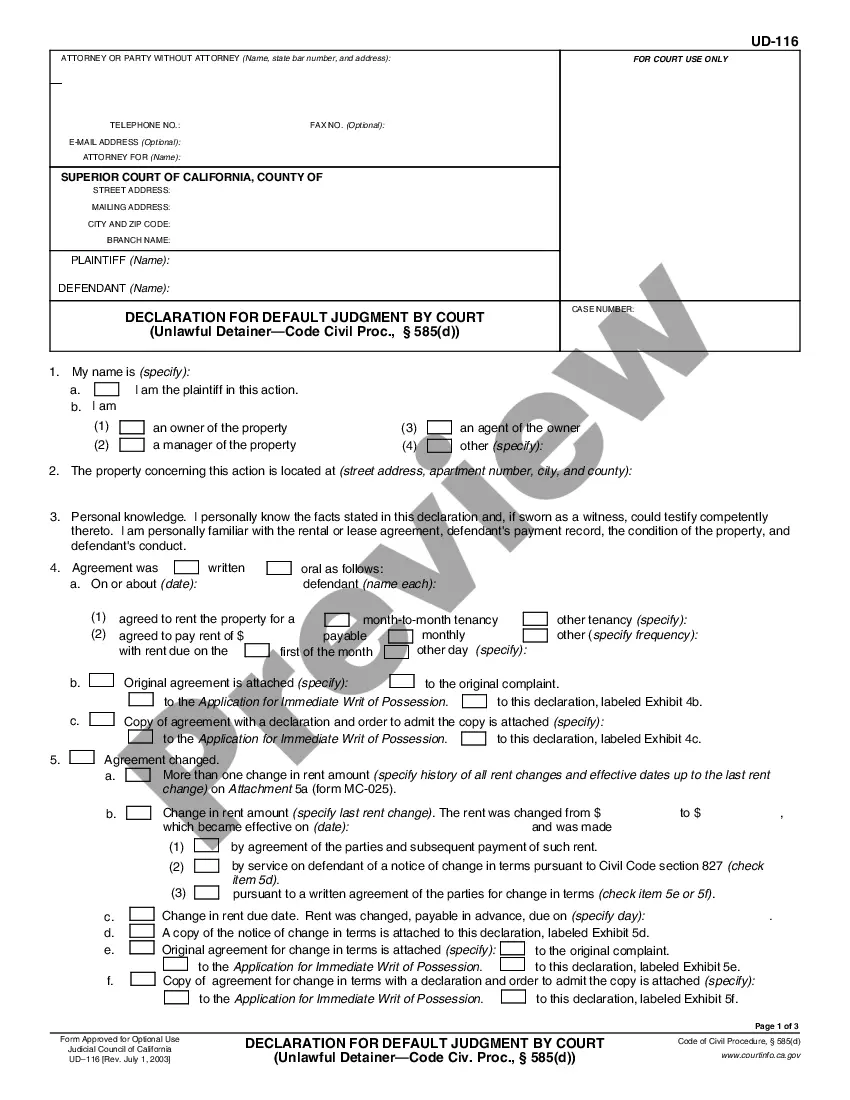

A release of mortgage, commonly known as a discharge of mortgage, is a legal document issued by the lender acknowledging that the mortgage debt is settled.

The grantor must sign the deed form and that signature must be properly acknowledged by a notary public. All signatures must be original; we cannot accept photocopies. A complete description of the property including the village, town, county and state where the property is located must also be included on the form.

How do I obtain a copy of my property deed? Property deeds are recorded in the Suffolk County Clerk's Office in Riverhead, NY. The direct phone number is (631) 852-2000.

Whatever the reason, you will need to retain an attorney, experienced in real estate, to draft a new deed conveying (i.e., transferring) your home to yourself and the person you wish to add to your title. In addition to the deed, your attorney will also need to prepare transfer tax returns.

In addition the following information should be included: The Payee Name. The Owner(s) of the mortgage holder. Total amount of mortgage. Mortgage date of execution. Full and legal description of the property to include tax parcel number. Acknowledgement that all payments have been made in full.

Mortgage Tax is computed by a formula based on 1.05% of the amount of the mortgage. If mortgage amount is less than $10,000.00, mortgage tax is figured at three-quarters percent.