Deed Of Trust Example In Palm Beach

Description

Form popularity

FAQ

Recording a Deed Must present a photocopy of a government issued photo identification for each grantor(s) and grantee(s) listed on the deed. "Prepared by" statement (name and address of the "natural" person preparing the Deed) Grantor(s) (Sellers-Party Giving Title) names legibly printed in the body of the deed.

Fees customers inquire about most frequently are: Recording - $10 for the first page and $8.50 for each additional page.

In response to a change in Florida law, the following is required when recording deeds: Government-issued photo identification of grantees and grantors. Mailing addresses noted below each witness name or signature on the document.

Same Day Recording Main Courthouse. Recording Department. 205 N. Dixie Highway, Room 4.2500. West Palm Beach, FL 33401. South County Courthouse. 200 W. Atlantic Ave. Delray Beach. North County Courthouse. 3188 PGA Blvd. Palm Beach Gardens. West County Courthouse. 2950 State Road 15, Room S-100. Belle Glade.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

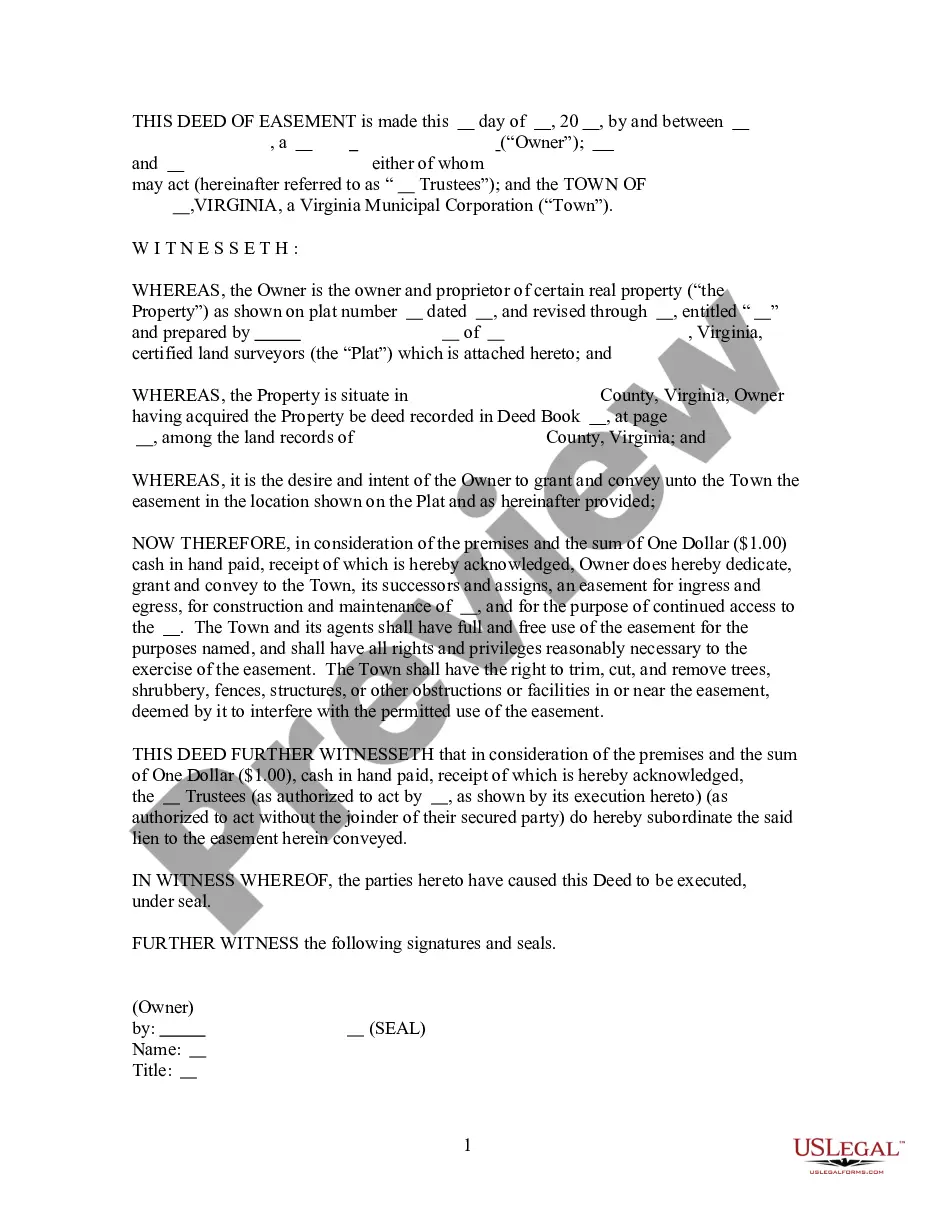

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

Is Florida a Mortgage State or a Deed of Trust State? Florida is a Mortgage state.

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.