Loan Agreement Modification For Employee

Description

How to fill out Loan Modification Agreement - Multistate?

Creating legal documents from the ground up can often be intimidating.

Certain circumstances may require extensive research and significant financial expenditure.

If you’re looking for a more straightforward and economical method to produce a Loan Agreement Modification For Employee or any other forms without unnecessary complications, US Legal Forms is readily available to assist you.

Our online repository of more than 85,000 current legal documents covers almost every facet of your financial, legal, and personal matters.

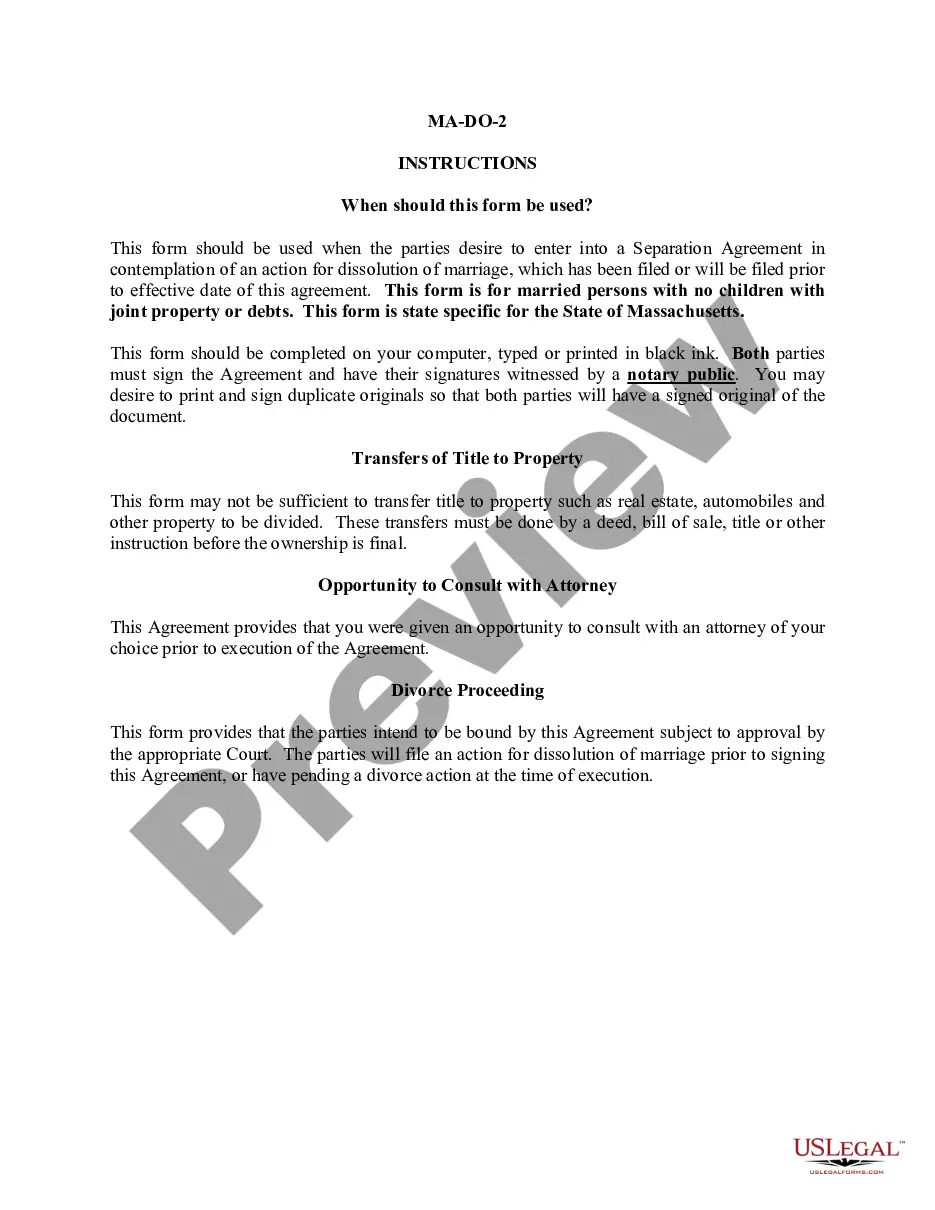

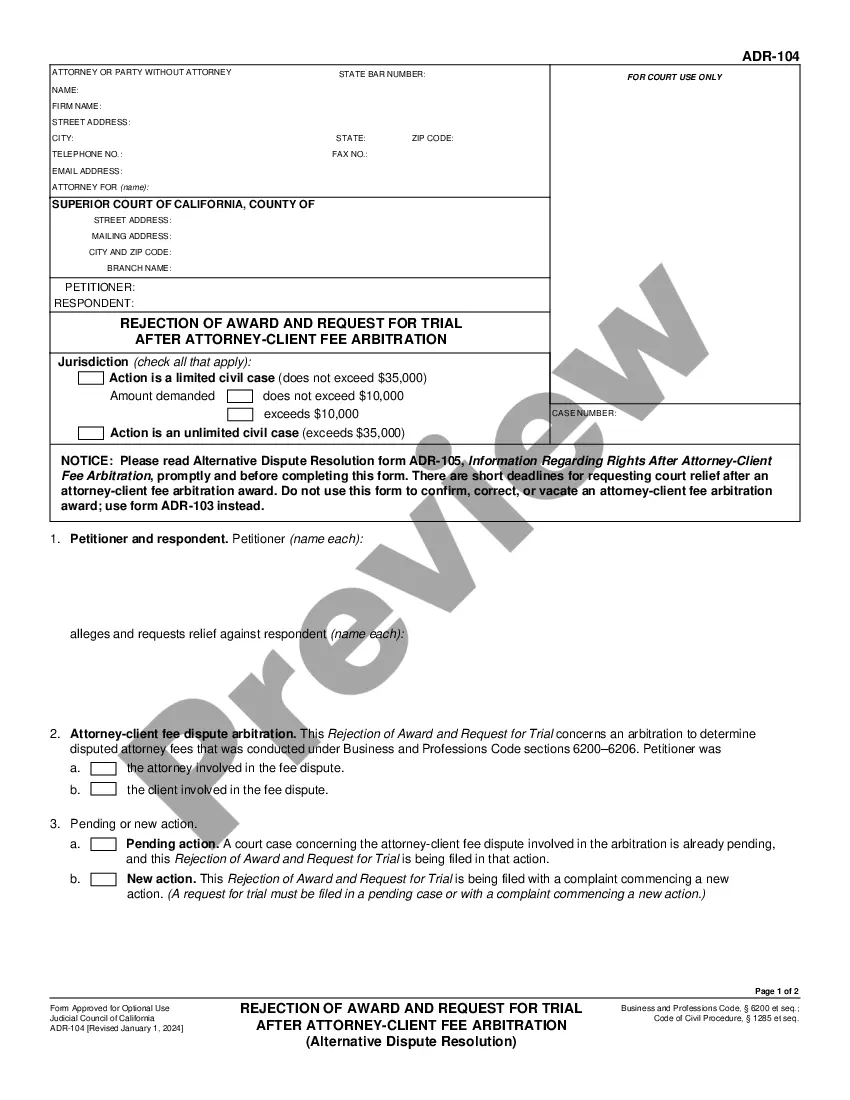

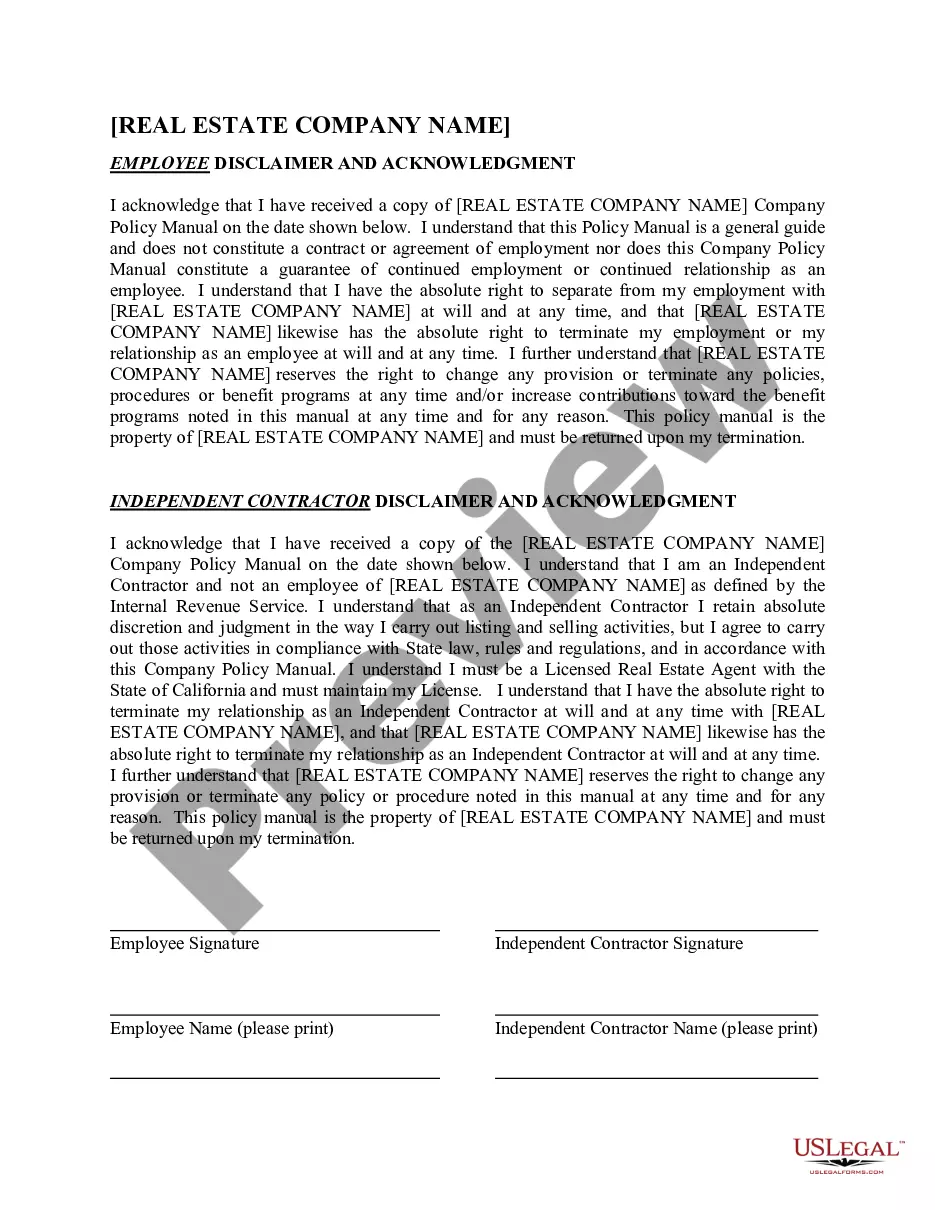

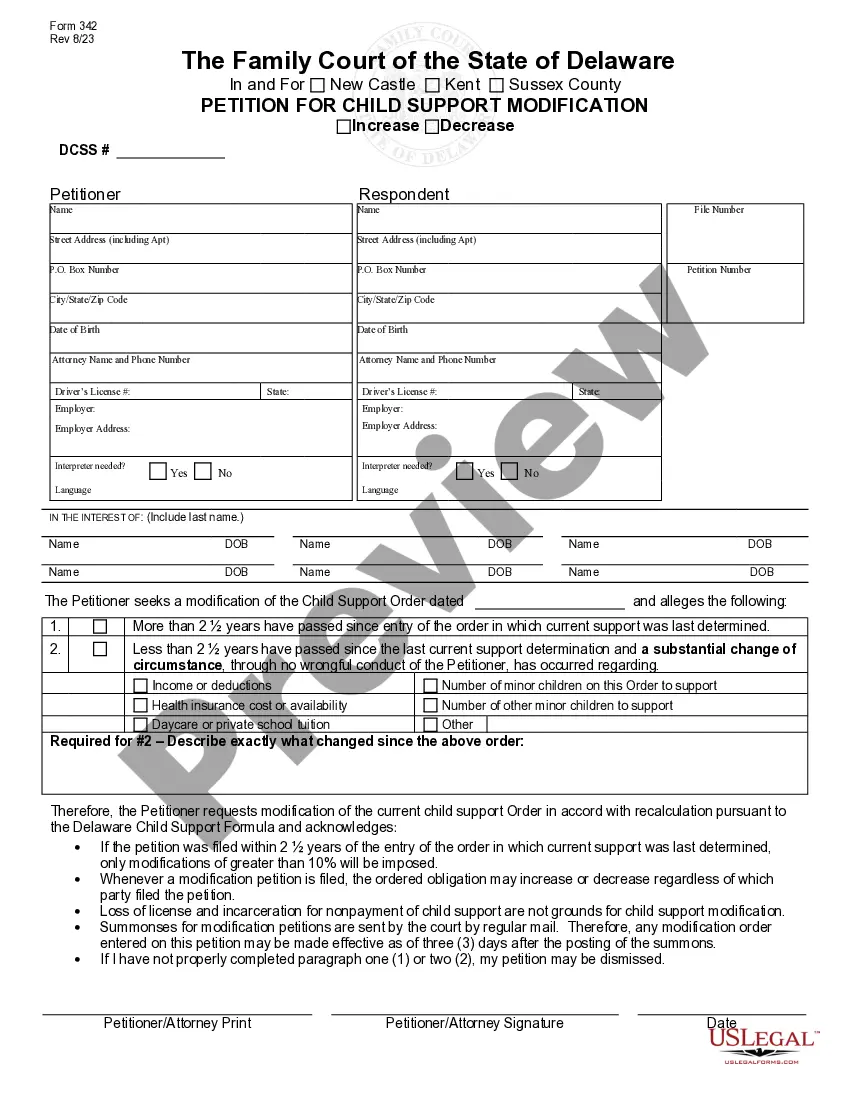

Before proceeding to download the Loan Agreement Modification For Employee, remember to: Check the form preview and descriptions to verify you have the correct document, ensure compliance with your state and county requirements, select the appropriate subscription plan to acquire the Loan Agreement Modification For Employee, and finally, download the form, complete it, certify it, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and make document processing simple and efficient!

- With just a few taps, you can swiftly obtain state- and county-specific documents meticulously prepared by our legal professionals.

- Utilize our platform whenever you require a dependable and trustworthy service to locate and download the Loan Agreement Modification For Employee swiftly.

- If you’re familiar with our offerings and have previously registered with us, simply Log In to your account, select the template, and download it or access it again later in the My documents section.

- Not signed up yet? No worries. It only takes a few minutes to register and explore the library.

Form popularity

FAQ

Yes, you can amend a contract after it is signed if both parties agree to the changes. It is important to document this loan agreement modification for employee formally, as verbal agreements may not hold up legally. Both parties should sign the amendment to signal their consent. Using a platform like US Legal Forms can help streamline this process and ensure all legal requirements are met.

To write an amendment to an agreement, begin by clearly stating the title of the original document. Next, specify the sections you intend to modify and outline the new terms using precise language. Make sure to include effective dates and signatures from both parties to ensure its validity. This loan agreement modification for employee should adhere to any existing legal frameworks to prevent misunderstandings.

Several factors can disqualify you from a loan agreement modification for employee, including having a non-qualifying loan type or failing to meet lender criteria. A lack of valid financial hardship may also be a basis for denial. Moreover, if you have recently filed for bankruptcy, it might affect your eligibility. Seeking guidance from US Legal Forms can clarify your options.

You can change a loan agreement through a loan modification process if both parties agree. It's crucial to document any changes to the agreement in writing. Be aware that alterations need to comply with existing laws and lender requirements. Using US Legal Forms can provide clarity and official documentation for the changes.

Engaging in a loan agreement modification for employee can be beneficial under certain circumstances. It may lead to lower monthly payments or a more manageable repayment schedule. Before making a decision, evaluate your financial situation thoroughly. Consulting with professionals or using resources from US Legal Forms can provide you with guidance.

Loan modification rules generally require that all parties consent to the changes. It's important to review the existing loan terms and the lender’s policies. You may need to demonstrate a valid reason for modification, such as financial hardship. To navigate this process effectively, consider utilizing US Legal Forms for tailored documents.

Yes, a loan agreement can be amended. This process often involves all parties involved agreeing to the changes. It's essential to document any modifications in writing to ensure clarity and prevent disputes. Using a service like US Legal Forms can simplify this process and provide the necessary legal documents.

Typically, a loan agreement modification for employee must be signed by all parties involved in the original loan. This usually includes the borrower and any co-borrowers listed on the loan. It is also advisable for the lender to sign the agreement to make it enforceable. Properly executed modifications ensure that all parties are aware of and agree to the updated terms.

To qualify for a loan agreement modification for employee, you'll generally need to demonstrate a change in your financial situation that justifies the modification. Requirements often include proof of income, an explanation of your hardship, and documentation of your current employment status. Each lender may have specific criteria; therefore, review your lender’s requirements closely. Utilizing resources like USLegalForms can help you gather and submit the necessary documentation effectively.

The process of a loan agreement modification for employee typically begins with submitting a modification request to your lender. You'll need to provide relevant financial documents, including income statements and any changes in your employment status. After this, the lender assesses your situation and evaluates your eligibility for a modification. Clear communication throughout the process can significantly enhance your chances of approval.