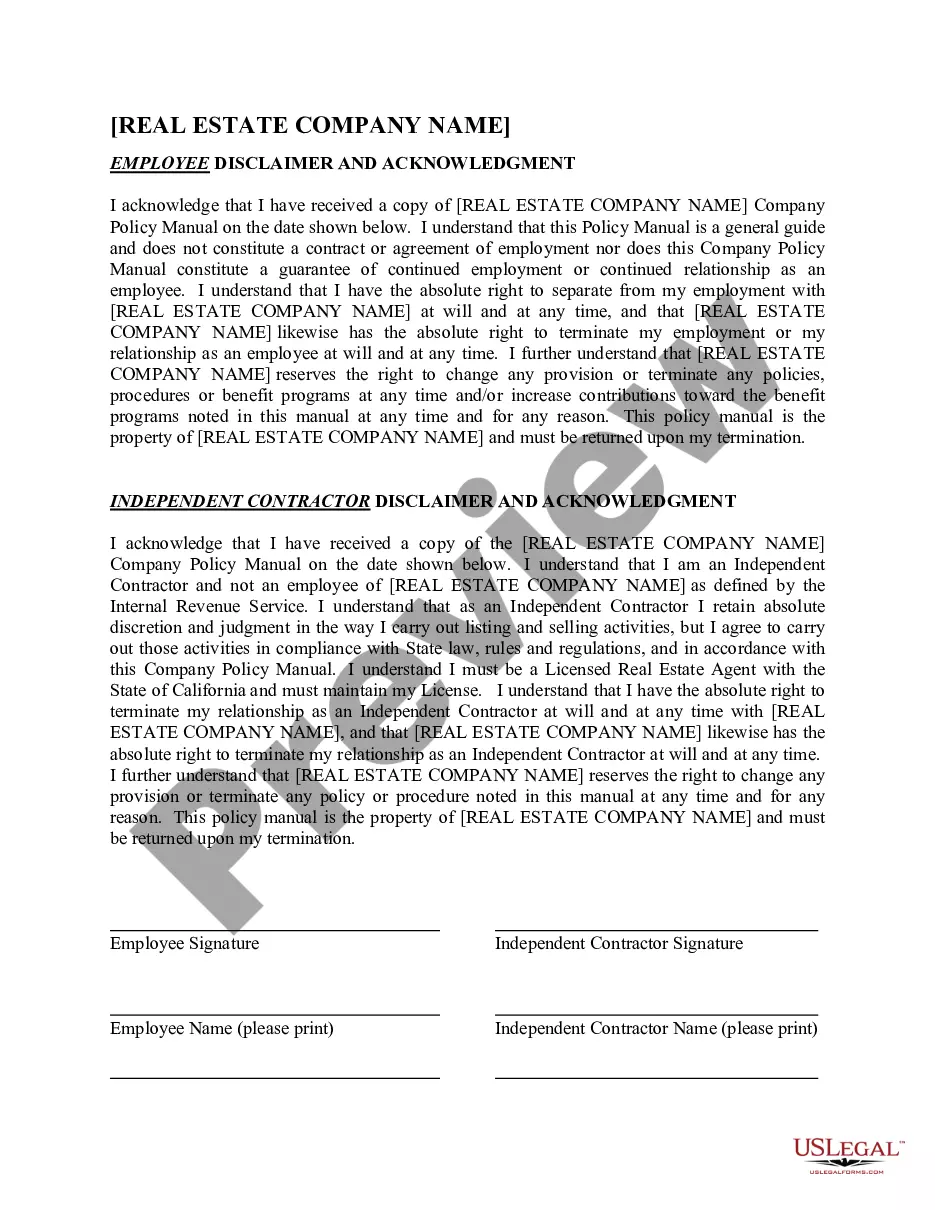

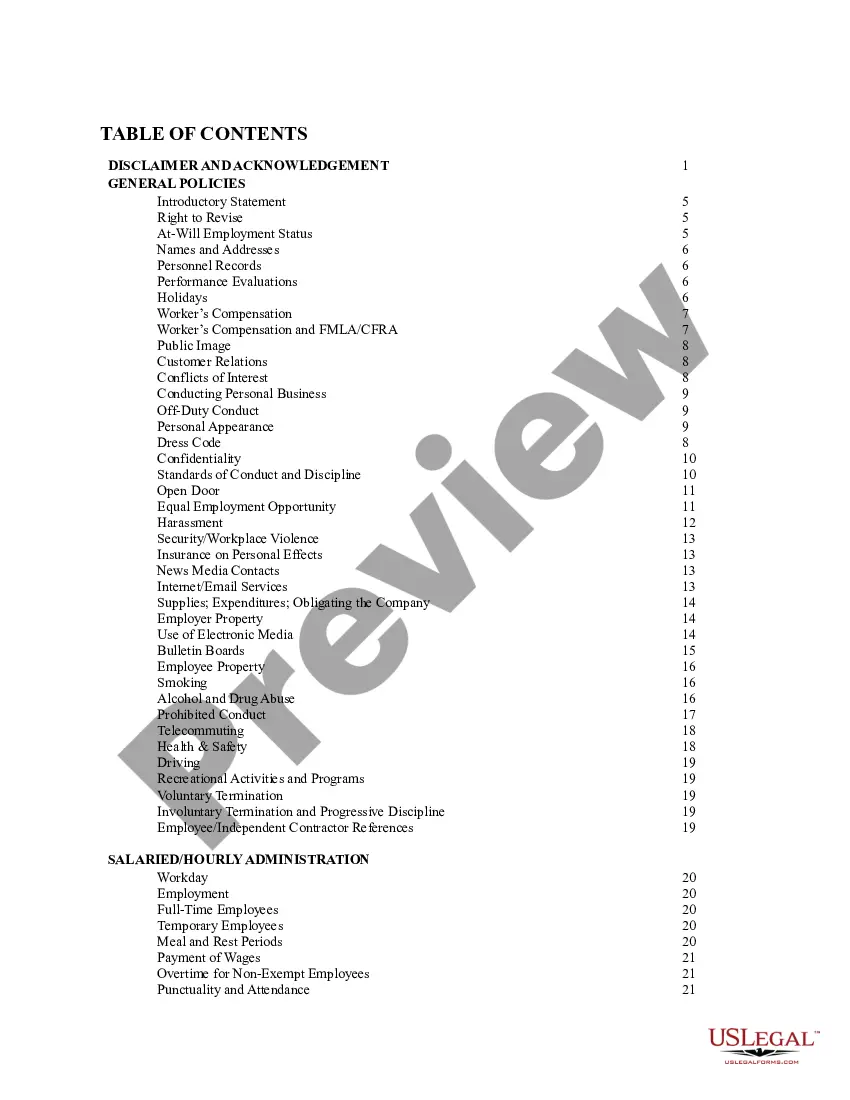

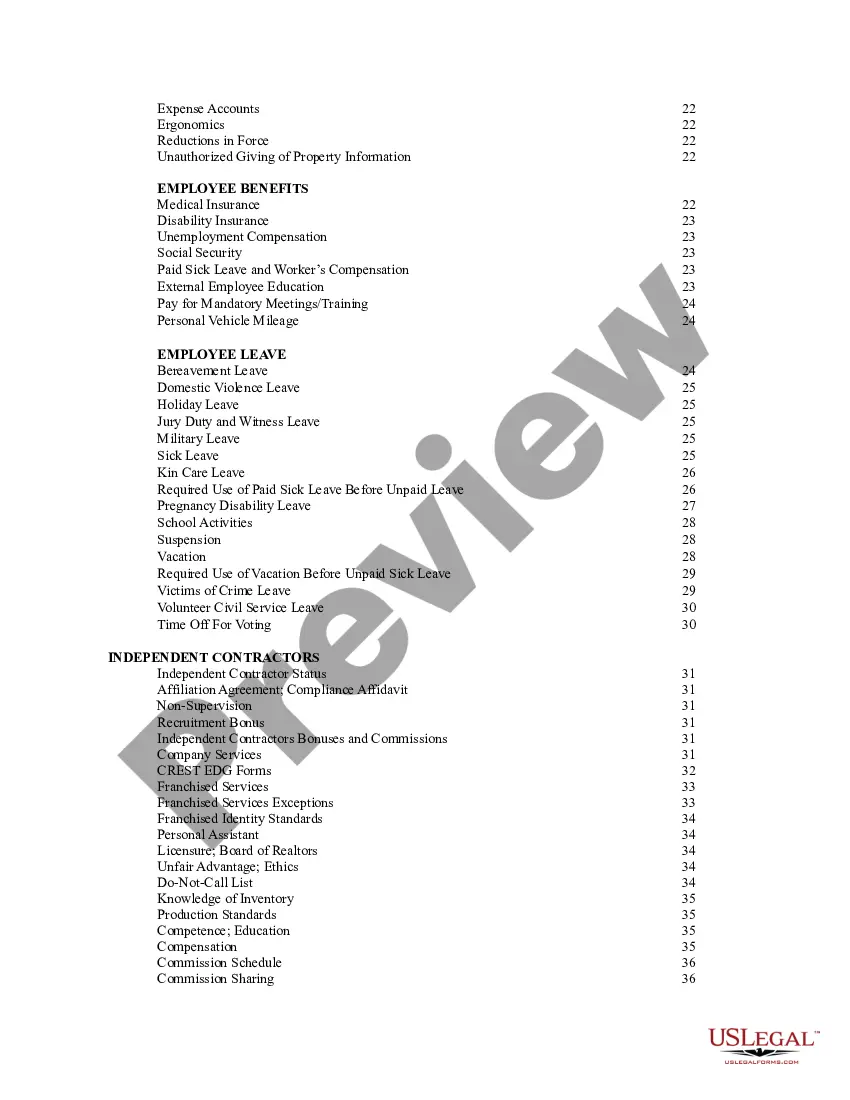

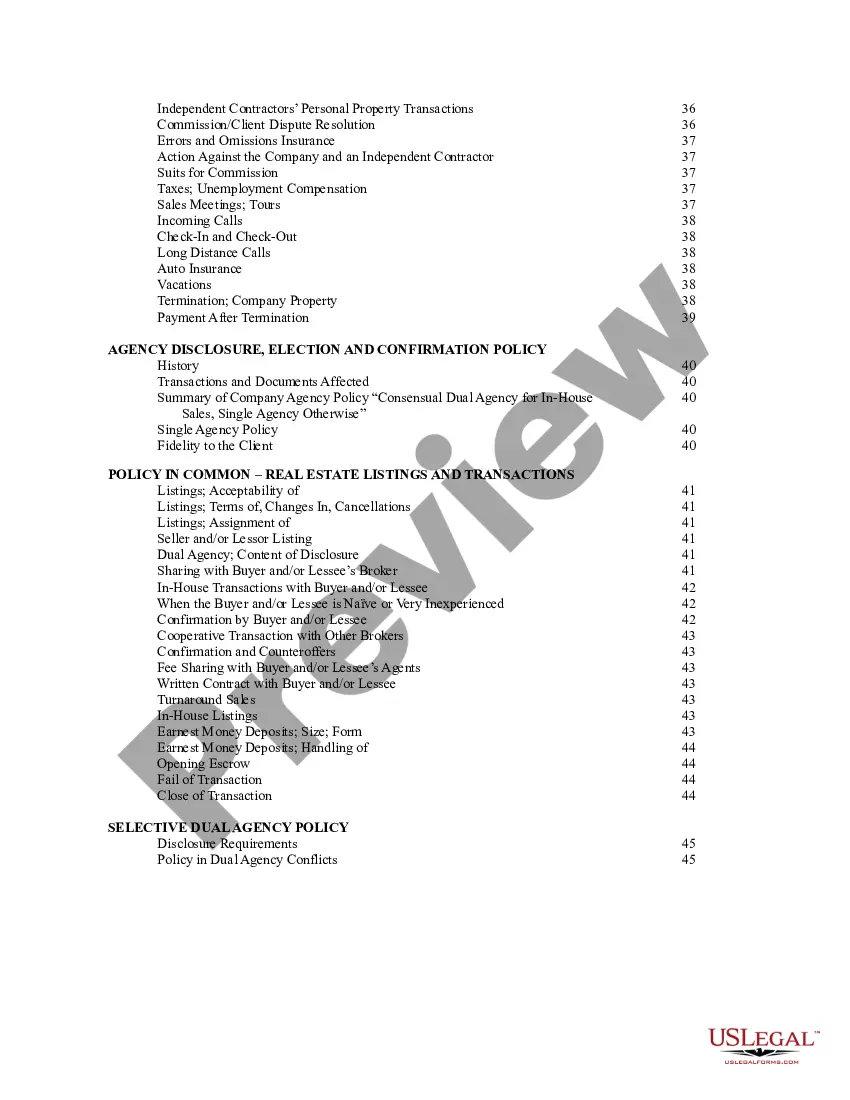

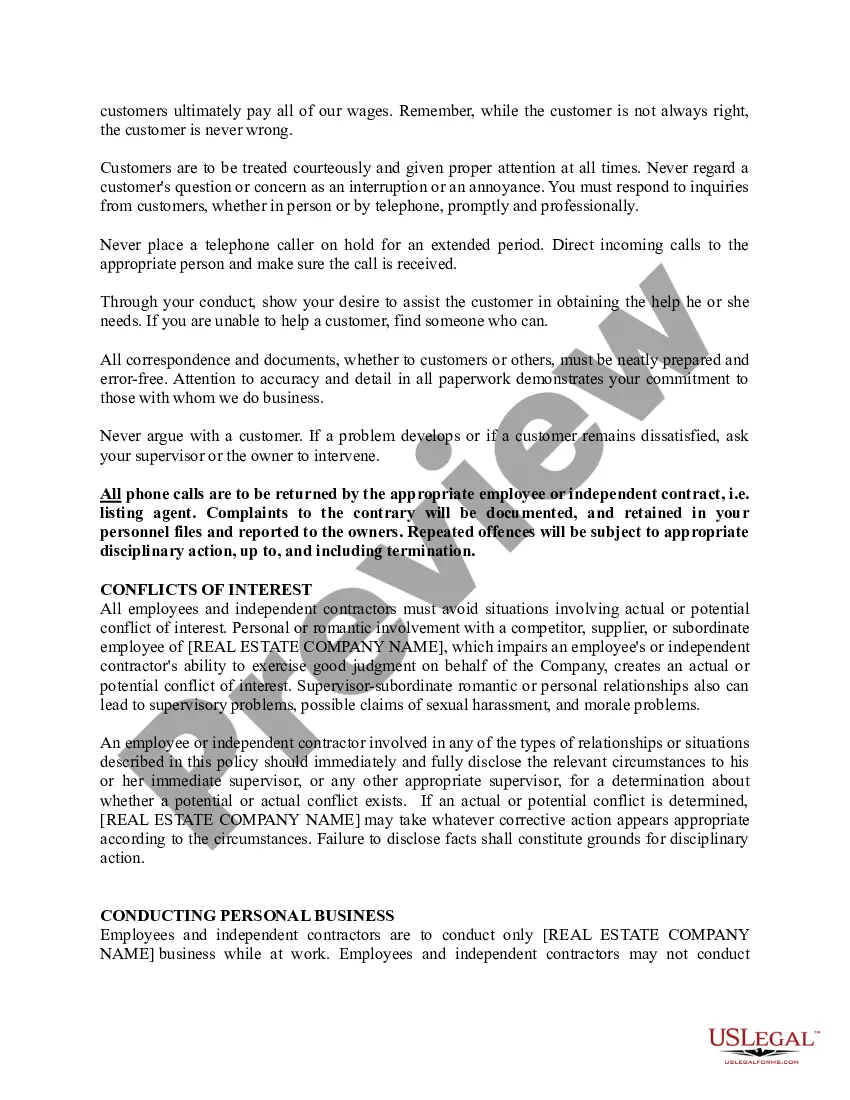

California Disclaimer and Acknowledgment Forms are documents used by employers and independent contractors in the state of California. They serve as a means to protect both parties from potential legal liabilities or disputes. Employee Disclaimer and Acknowledgment Form: This form is used by employers to inform an employee of the terms of their employment. It includes a disclaimer of any implied warranties or promises, a disclosure of any potential liabilities, and an acknowledgment of the employee's rights and responsibilities. It also typically includes a clause that any dispute must be resolved in accordance with the laws of the State of California. Independent Contractor Disclaimer and Acknowledgment Form: This form is used by independent contractors to acknowledge the terms of the contract they have agreed to. It includes a disclaimer of any implied warranties or promises, a disclosure of any potential liabilities, and an acknowledgment of the contractor's rights and responsibilities. It also typically includes a clause that any dispute must be resolved in accordance with the laws of the State of California. California Labor Law Disclaimer and Acknowledgment Form: This form is used by employers and independent contractors to acknowledge and agree to California labor laws. It includes a disclaimer of any implied warranties or promises, a disclosure of any potential liabilities, and an acknowledgment of the employee's or contractor's rights and responsibilities under the law. It also typically includes a clause that any dispute must be resolved in accordance with the laws of the State of California.

California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Disclaimer And Acknowledgment Form For Both Employee And Independent Contractor?

Handling official documentation demands focus, accuracy, and the use of appropriately drafted forms. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor template from our service, you can be confident it complies with federal and state laws.

Engaging with our service is straightforward and quick. To obtain the necessary documentation, all you'll require is an account with an active subscription. Here’s a brief guideline for you to locate your California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor in just minutes.

All documents are prepared for multiple uses, such as the California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor that you observe on this page. If you require them again, you can complete them without additional payment - simply access the My documents tab in your profile and finalize your document whenever needed. Try US Legal Forms and complete your business and personal documentation swiftly and in full legal compliance!

- Ensure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternative official template if the previously opened one does not suit your circumstances or state regulations (the option for that is located on the top page corner).

- Log In to your account and download the California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor in the format you prefer. If it’s your first time using our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Select the format in which you want to save your form and click Download. Print the blank form or add it to a professional PDF editor to complete it digitally.

Form popularity

FAQ

An independent contractor needs to fill out several forms including the W-9 for tax purposes, and they may also complete a 1099-NEC if payments exceed a certain amount. Additionally, any contracts or agreements related to their services should be documented. Proper documentation is essential for compliance, especially concerning the California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor.

Independent contractors typically receive a 1099 form, while employees receive a W-2 form. This distinction is vital for tax purposes, as it determines how income is reported and taxed. Awareness of these differences is crucial when you are preparing your California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor.

The two types of acknowledgment in California are the individual acknowledgment and the representative acknowledgment. An individual acknowledgment is for a person signing on their own behalf, while a representative acknowledgment is for someone signing on behalf of another person or entity. Knowing these types can streamline the process of completing your California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor.

Independent contractors primarily need to fill out a W-9 form to provide their taxpayer information. They may also need to complete additional forms like 1099-NEC when they receive payments above a certain amount. Keeping these forms organized is essential for accurate reporting and compliance, particularly when dealing with the California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor.

In California, a jurat requires the signer to swear or affirm the content of the document, while an acknowledgment verifies that the signer willingly signed the document. Both forms play significant roles in legal transactions. It's crucial to understand these differences when preparing documentation like the California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor.

As of the 2020 tax year, independent contractors generally receive a 1099-NEC form instead of the 1099-MISC form for reporting nonemployee compensation. The 1099-NEC specifically captures payments made to independent contractors, making tax filing easier. Being aware of which form pertains to you is vital when managing your finances and ensuring compliance with your California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor.

Independent contractors typically fill out a W-9 form, which provides their taxpayer identification number to the hiring entity. This information is crucial for reporting income accurately. If contractors earn over a certain threshold, they will receive a Form 1099, which summarizes their income. This process is essential for properly preparing your California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor.

The main difference lies in their purposes. A jurat confirms that the signer swears the document's content is true, while an acknowledgment verifies that a signer willingly signed a document. Both are vital for valid transactions and legal compliance, such as with the California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor. Understanding these distinctions helps you choose the correct form.

In California, you should use a jurat when a signer needs to affirm the truthfulness of the contents of the document before a notary public. This is crucial for documents requiring sworn statements. Alternatively, an acknowledgment is appropriate when a person claims they signed a document voluntarily. Knowing when to use these forms is essential, particularly when preparing a California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor.

Determining whether an individual is an employee or an independent contractor in California involves evaluating several factors. Consider the level of control the employer has over the individual’s work, the degree of independence in task completion, and the nature of the working relationship. Utilizing a California Disclaimer and Acknowledgment Form for both Employee and Independent Contractor can help establish clarity regarding this classification.