Loan Modification Agreement Example In Contra Costa

State:

Multi-State

County:

Contra Costa

Control #:

US-00183

Format:

Word;

Rich Text

Instant download

Description

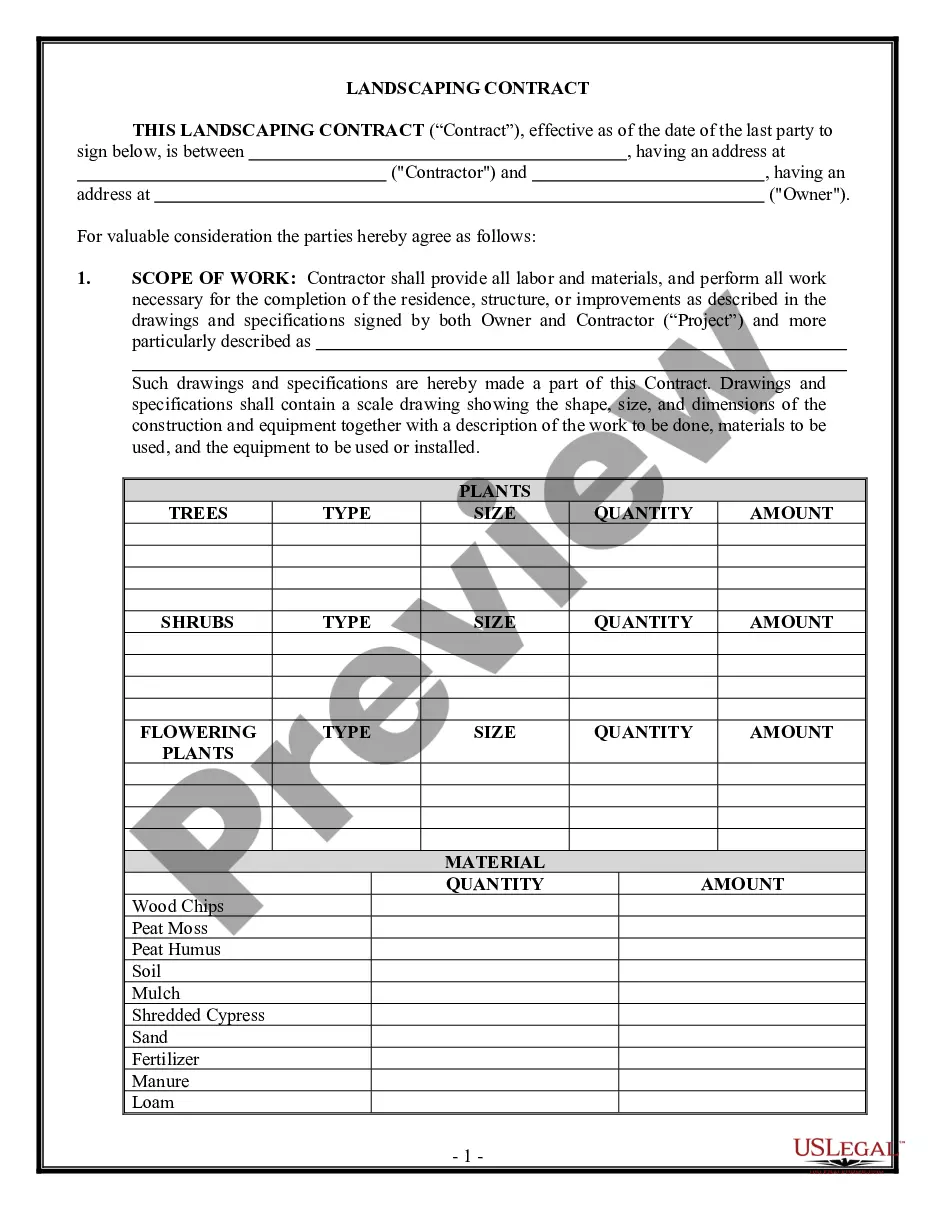

The Loan Modification Agreement example in Contra Costa is a legal document designed to modify existing mortgage or deed of trust terms between the borrower, co-grantor, and lender. This agreement emphasizes the renewal and extension of the lien associated with the original debt, ensuring that the modified terms remain enforceable until the outstanding amount is fully settled. Key features include defined payment terms, interest rates, and stipulations around borrower rights, such as the ability to prepay without penalties. Users must carefully fill in required information, including names, addresses, loan amounts, and payment schedules while ensuring compliance with applicable laws. This form is particularly useful for attorneys, partners, and paralegals, as it provides a structured template that simplifies negotiations and modifications related to existing loans. Legal assistants and associates can benefit from templates like this one to support clients in navigating the complexities of loan modification processes efficiently. Overall, it offers a clear framework for all parties involved to understand their rights and obligations.

Free preview

Form popularity

FAQ

Yes you can, and changing your term won't affect your monthly payments. However, the term can be changed to coincide with the maturity of your repayment plan.