Personal Property Statement Withdrawal In Collin

Description

Form popularity

FAQ

Fill out the Release of Interest Document List the parties involved in the Release of Interest and record their contact information. Enter the property address and legal description. Identify the deed of release that is being given up. Indicate the consideration for the release, if applicable. Sign and date the document.

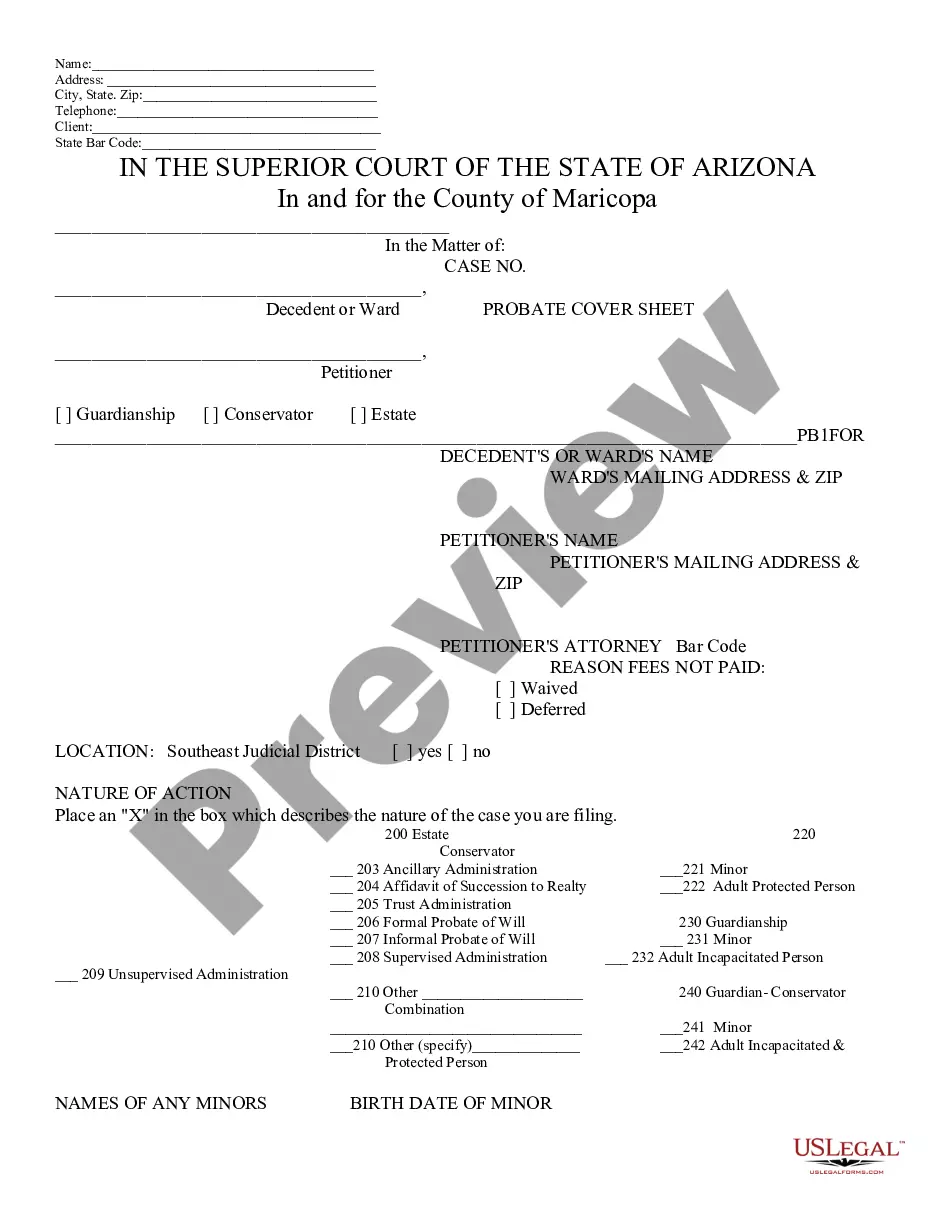

File a Notice of Protest Form (Form 50-132) There are three ways to file the Notice of Protest: 1) Online Appeals website, 2) by mail, or 3) in person. Collin Central Appraisal District (Collin CAD) encourages homeowners who have a pin on their Notice of Appraised Value to efile on the Online Appeals website.

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

A property release is a legal agreement between you and the property owner — or a corporate representative if the property is owned by a company. By signing a property release, that person gives you permission to use the image for commercial purposes.

Personal property is a class of property that can include any asset other than real estate. The distinguishing factor between personal property and real estate, or real property, is that personal property is movable, meaning it isn't fixed permanently to one particular location.

Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property. Just as some loans—mortgages, for example—are secured by real property like a house, some loans are secured by personal property.

What is a Release Form? A release form, or general release form, is a legal document that serves as consent in writing to release the legal liability of a releasee by a releasor. The document is a formal acknowledgment that, once signed, is a legal release of all a releasee obligations within an agreement.

To protest your property taxes in Collin County, follow these steps: Start by completing a Notice of Protest Form (Form 50-132), which will explain your reasons for protesting. Prepare evidence for your hearing. If possible, resolve with an informal review. If necessary, resolve with an ARB hearing.

Ing to the Comptroller, there is no provision for the cessation of property taxes at any stage. However, there is a Texas property tax exemption for people over the age of 65, which offers temporary tax relief for seniors. At the age of 65, seniors can apply for an exemption from Texas property taxes.

Most questions about property appraisal or property tax should be addressed to your county's appraisal district or tax assessor-collector.