One Time Showing Form With Two Points In Bexar

Description

Form popularity

FAQ

In ance to the Tax Code, a Disabled Veteran who has a 100% service-connected rating from the United States Department of Veteran Affairs, or is unemployable, is exempt from taxation on the veteran´s residential homestead.

One time showing agreements offer an opportunity for your agent to show a home not currently listed with the board members MLS, and contractually may compensate the agent for his or her efforts. We think outside the box.

The three types of real estate listing agreements are open listing, exclusive agency listing, and exclusive right-to-sell listing.

time showing agreement is a contract between a real estate seller and an agent who does not represent the seller but has a potential buyer interested in viewing the property. This document grants the agent the right to show the property to the interested buyer for a single occasion.

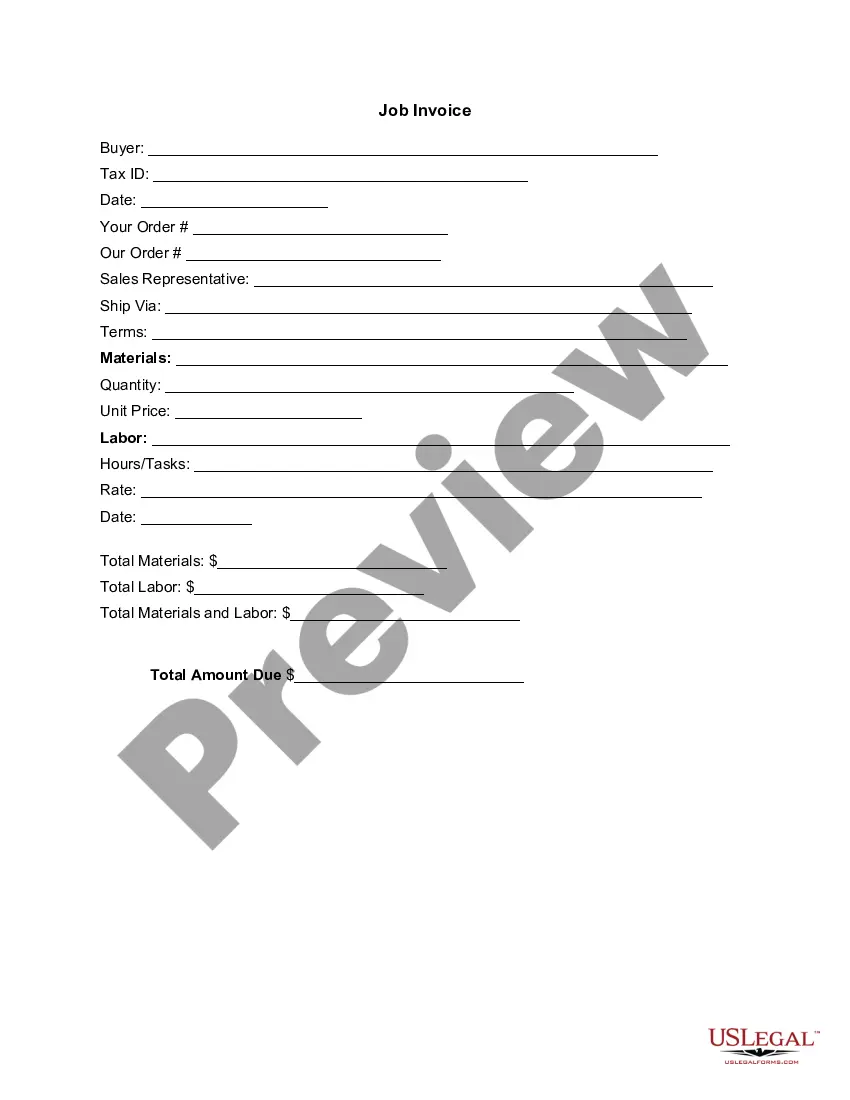

Off contract lasts “until completion of the obligations of the parties”. A deadline (i.e. a given date, not a month) will be clearly stipulated for the delivery of each deliverable.

Procedures: Please e-file all appropriate documents for your case with the Bexar County Probate Clerk's office, including Proposed Orders, Judgments, Affidavits of Heirship, and Proof of Death for review.

Taxes are calculated by subtracting the value of any exemptions and, if applicable, the cap value from the homestead value of the property, and then adding any productivity or non-qualifying value. This result, the taxable value, is then multiplied by the tax rate per $100.

Texas levies property taxes as a percentage of each home's appraised value. So, for example, if your total tax rate is 1.5%, and your home value is $100,000, you will owe $1,500 in annual property taxes.

If property owners need more information or want the forms needed to protest their value, they may visit the Bexar Appraisal District website at .bcad or call them at (210) 242-2432. They can also email the appraisal district at cs@bcad.

Taxes are calculated by subtracting the value of any exemptions and, if applicable, the cap value from the homestead value of the property, and then adding any productivity or non-qualifying value. This result, the taxable value, is then multiplied by the tax rate per $100.