Amended Implementing Order, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama statutes and law.

Alabama Amended Implementing Order

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

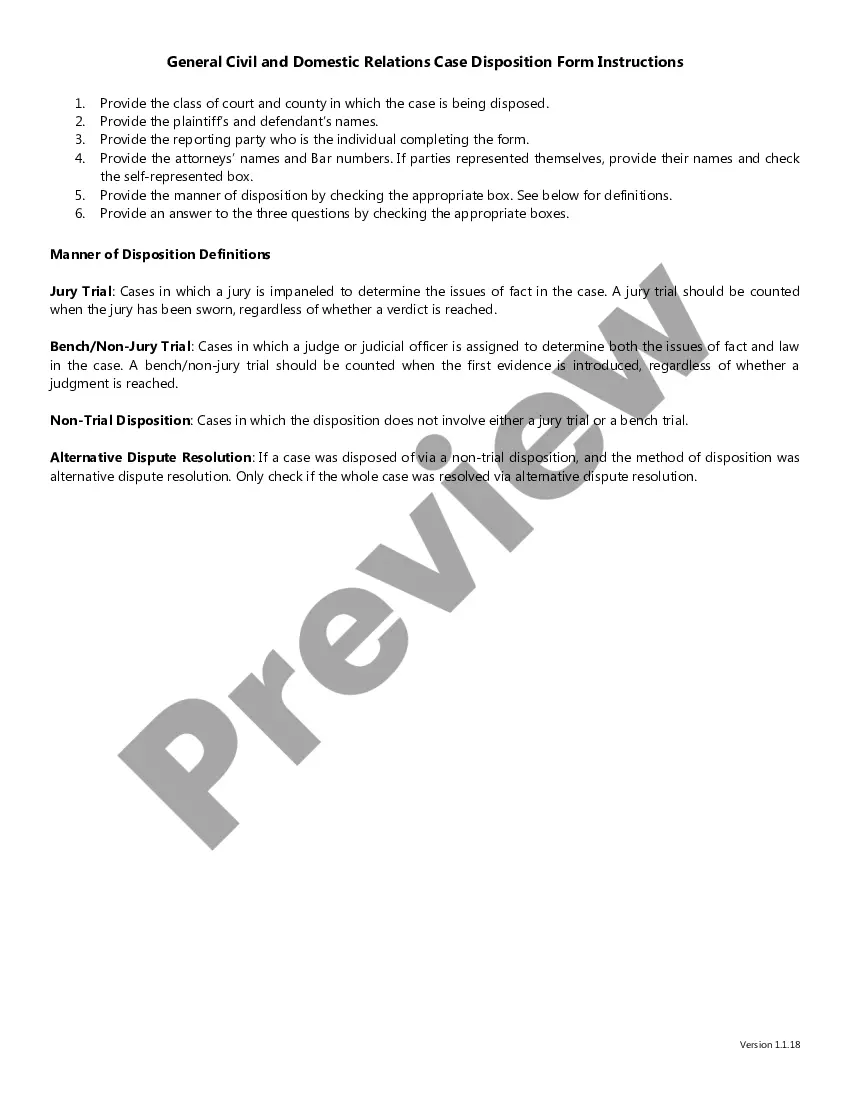

How to fill out Alabama Amended Implementing Order?

Employing examples of the Alabama Amended Implementing Order created by professional attorneys enables you to avert complications when filing paperwork.

Simply download the form from our site, complete it, and request a legal expert to review it.

By doing so, you can conserve significantly more time and expenses than if you were to ask a lawyer to draft a document from scratch to meet your specifications.

After completing all of the aforementioned steps, you'll be able to fill out, print, and sign the Alabama Amended Implementing Order template. Ensure to review all entered information for accuracy before submitting or sending it. Minimize the time spent on filling out documents with US Legal Forms!

- Verify that you are downloading the correct state-specific form.

- Use the Preview option and review the description (if available) to ascertain if you need this particular example; if so, click Buy Now.

- Search for another template using the Search bar if needed.

- Choose a subscription that fits your needs.

- Begin the signup process using your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

Filling out an amended return requires careful attention to detail. Start by obtaining the correct form as outlined in the Alabama Amended Implementing Order. Accurately include all relevant details from your original return, but make sure to highlight the changes you are making. If necessary, resources from platforms such as uslegalforms can guide you through the process, ensuring your amended return is correctly completed.

A PPT form in Alabama refers to the Property Tax Return that must be submitted by businesses to report property owned for tax assessments. This form is essential when aligning your reporting with the Alabama Amended Implementing Order if you require adjustments. Properly managing your property tax submissions can significantly impact your overall tax liability. For assistance in filing, services like uslegalforms can be invaluable.

Form 20C C in Alabama is used for specific reporting related to tax credits or adjustments needed for your tax returns. Understanding this form is important, especially when navigating through amendments as per the Alabama Amended Implementing Order. Make sure to complete this form thoroughly if it applies to your situation, as it can influence your overall tax obligations. If you are unsure about how to proceed, consulting with a professional can help.

You can file Alabama Form 40, including amendments, online or by mailing it to the appropriate address listed on the form. For electronic filing, you may find it beneficial to use platforms like uslegalforms which streamline the process. If you choose to mail your form, ensure it goes to the Alabama Department of Revenue specified address for timely processing. This is part of your adherence to the Alabama Amended Implementing Order.

Filing an Alabama amended return involves completing Form 40 and marking it as an amended return. Follow the Alabama Amended Implementing Order which outlines the process in detail. After filling it out, submit the form to the Alabama Department of Revenue, either online or via mail, depending on the instructions provided. Ensure that all previous tax return details are accurately referenced in your amendment.

To submit an amended return in Alabama, you will need to complete the appropriate form specifically designed for this purpose. You can access the Alabama Amended Implementing Order guidelines to ensure your submission is correct. After filling out the form, mail it to the designated address provided by the Alabama Department of Revenue. Always double-check your address to avoid delays.

Yes, you can file your amended return electronically if you choose to use approved tax software that accommodates this process. It's important to check that the software incorporates the Alabama Amended Implementing Order requirements. If you prefer traditional methods, you can still opt to mail in your amended return.

You should file Form 40 in accordance with the instructions provided in the Alabama Amended Implementing Order. Generally, the form can be sent to the Alabama Department of Revenue, whose address is specified on the form. Ensure you send it to the correct division to facilitate efficient processing.

Yes, you can amend only your state return without needing to change your federal return. This is particularly relevant if you discover a state-specific issue rather than a federal one. When you implement the changes, reference the Alabama Amended Implementing Order to ensure compliance with state laws.

Yes, filing an amended return can be worth it if you discover errors that could reduce your tax liability or increase your refund. The Alabama Amended Implementing Order may offer guidelines that help determine your eligibility for adjustments. Ultimately, correcting mistakes ensures that you remain compliant with state tax laws.