Factoring Agreement Meaning For Students In San Diego

Description

Form popularity

FAQ

In Mathematics, factorisation or factoring is defined as the breaking or decomposition of an entity (for example a number, a matrix, or a polynomial) into a product of another entity, or factors, which when multiplied together give the original number or a matrix, etc.

Factor expressions, also known as factoring, mean rewriting the expression as the product of factors. For example, 3x + 12y can be factored into a simple expression of 3 (x + 4y).

/ˌfæktərəˈzeɪʃən/ In math, factorization is when you break a number down into smaller numbers that, multiplied together, give you that original number. When you split a number into its factors or divisors, that's factorization. For example, factorization of the number 12 might look like 3 times 4.

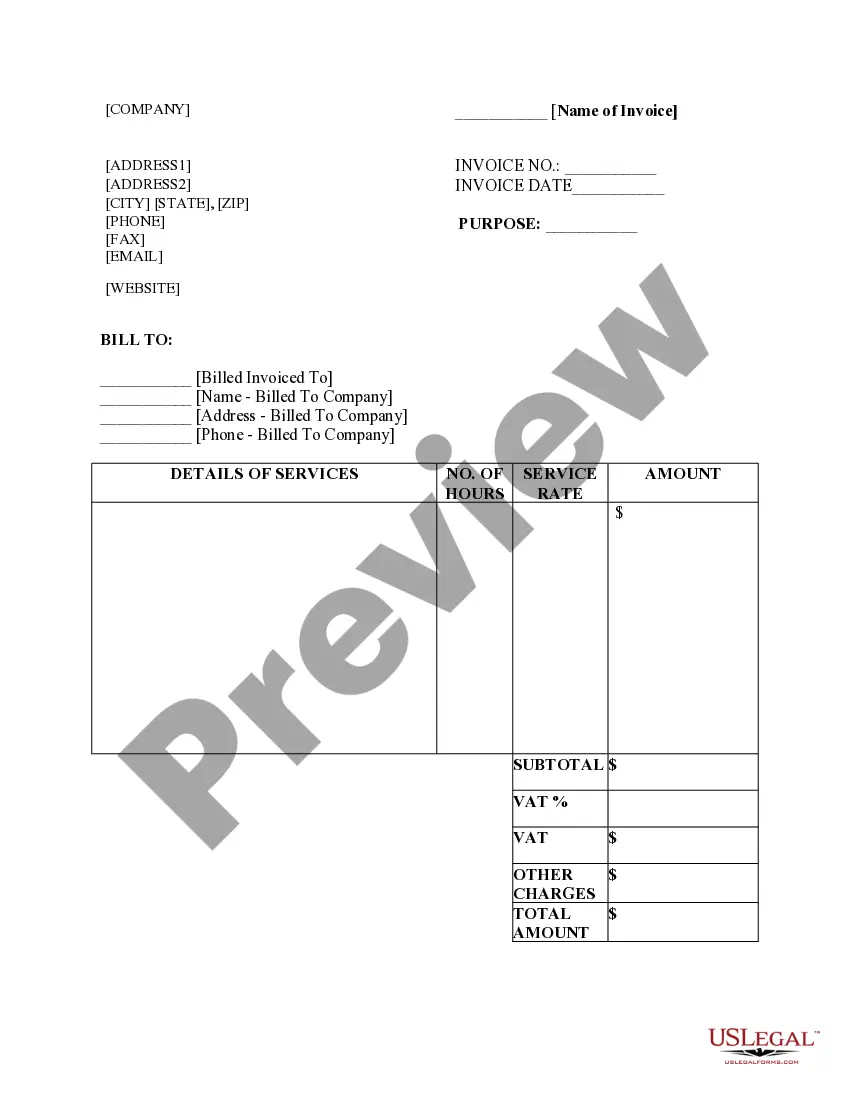

Another document required for factoring is an accounts receivable aging report. This report lists out unpaid invoices, credit memos, and notes by date. Accounts receivable aging reports may also be referred to as a schedule of accounts receivable or just a schedule.

In order to qualify for factoring, your company will need to have the following items: Invoices to factor. Creditworthy clients. A completed factoring application – apply now. An accounts receivable aging report. A business bank account. A tax ID number. A form of personal identification.

Leaving Your Current Factor You need to consider the fees associated with switching before committing to the change. Once you've decided to leave your current factor, you will need to give notice. All factoring companies require written notice to terminate the contract.

Here are the common steps for switching factoring companies. Find a new factor. Create a game plan. Submit termination notice & confirm buyout eligibility date. Begin Buyout Process. Begin Invoice Audit & Budget for 3-5 Days of Holding Invoices. Sign Buyout Agreement & Upload New Invoices.

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

Get a Release Letter: Once all obligations are fulfilled, ask for a release letter from the factoring company. This document should state that you have fulfilled all contractual obligations and that the factoring company has no further claim on your invoices or receivables.