Factoring Agreement Form In Phoenix

Description

Form popularity

FAQ

Phoenix Capital Group is headquartered in Denver, Colorado with satellite offices in Irvine, California; Casper, Wyoming; Dallas, Texas; and Fort Lauderdale, Florida. Our rapidly growing client list of mineral owners and investors stretches across all 50 states.

Contact eCapital Today at 855.790. 0906 | eCapital.

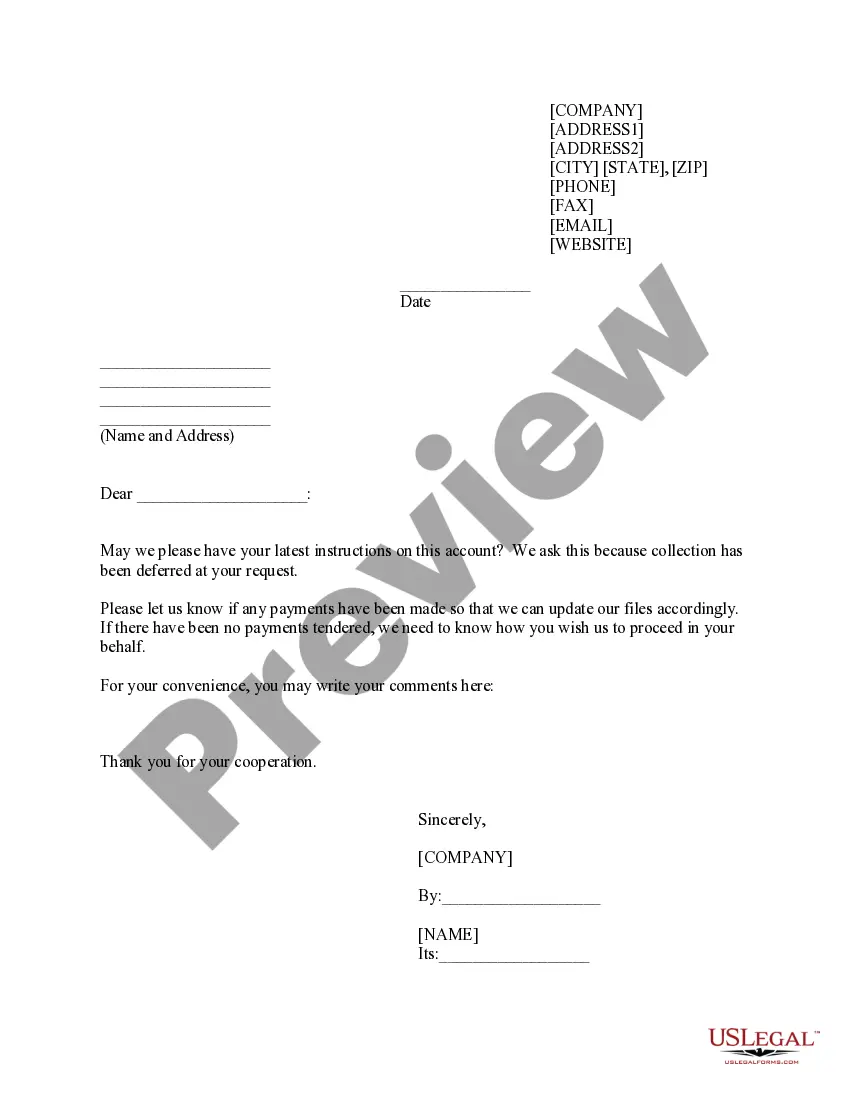

The Most Common Invoice Factoring Requirements A factoring application. An accounts receivable aging report. A copy of your Articles of Incorporation. Invoices to factor. Credit-worthy clients. A business bank account. A tax ID number. A form of personal identification.

Call (800) 860-7926 to speak with a customer service representative.

(800) 421-4225.

Remember, freight factoring is an excellent way to balance slow payers with ongoing daily expenses, which can otherwise prevent you from delivering product on schedule, paying your creditors, and taking on new loads.

The accuracy of any calculations or rates are not guaranteed, for accurate calculations, rates and advice please call Phoenix Capital Group, 623-298-3450.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

Invoice factoring eligibility depends on what type of business you have, where you're located, the type of industry you work in, and whether or not you have any outstanding liens or tax balance. You'll also need to work with creditworthy customers, who aren't at risk of not paying their outstanding receivables.

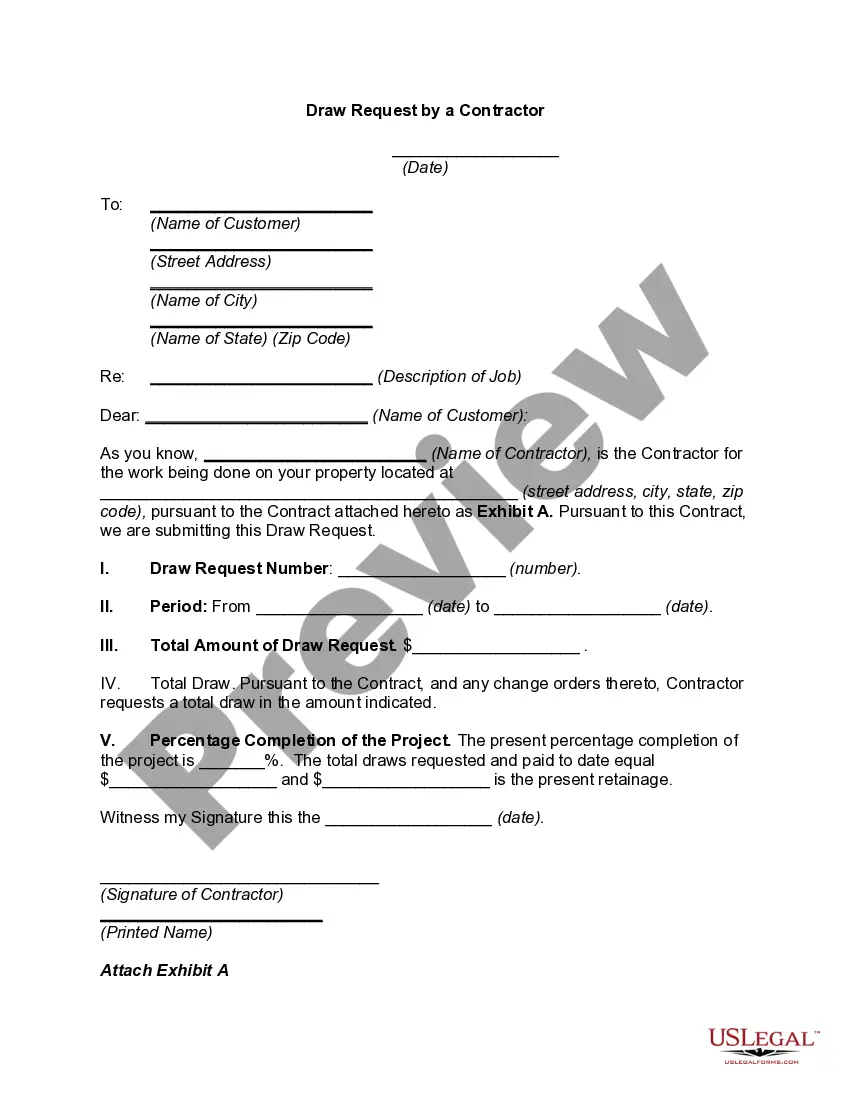

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)