Form Assignment Accounts Receivable With Balance Sheet In Massachusetts

Description

Form popularity

FAQ

Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables. This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.

With factoring, the factor takes control of bill collection and assumes the credit risk for customer non-payment. In contrast, with the assignment of receivables, the business retains control of its customer relationships and the collection process, bearing all of the credit risk.

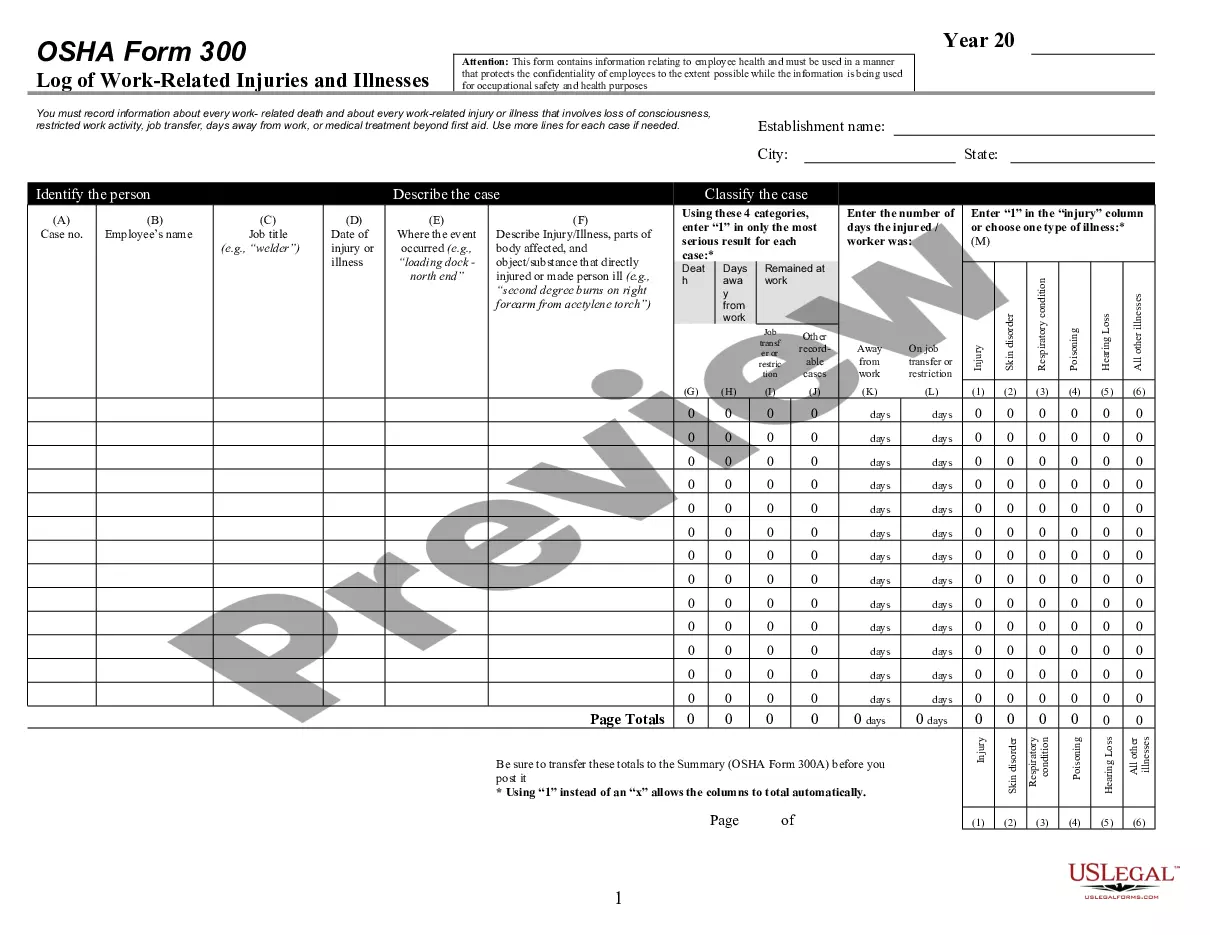

To report accounts receivable effectively on the balance sheet: Break down accounts receivable into categories, such as “trade accounts receivable” and “other receivables.” Clearly indicate the aging of accounts receivable to show how much is current, 30, 60, or 90+ days overdue.

You can find your accounts receivable balance under the 'current assets' section on your balance sheet or general ledger. Accounts receivable are classified as an asset because they provide value to your company.

Accounts receivable are listed under the current assets section of the balance sheet and typically fluctuate in value from month to month as the company makes new sales and collects payments from customers.

Accounts receivable are listed under the current assets section of the balance sheet and typically fluctuate in value from month to month as the company makes new sales and collects payments from customers.

What is the 10 rule for accounts receivable? The 10 Rule for accounts receivable suggests that businesses should aim to collect at least 10% of their outstanding receivables each month.

Net accounts receivable is recorded as a debit on the balance sheet. In accounting, debits increase asset accounts, while credits decrease them. Since net accounts receivable is an asset, it is listed as a debit to indicate the expected amount to be collected from customers.

Accounts Receivables are current assets on the balance sheet and are to be reported at net realizable value.

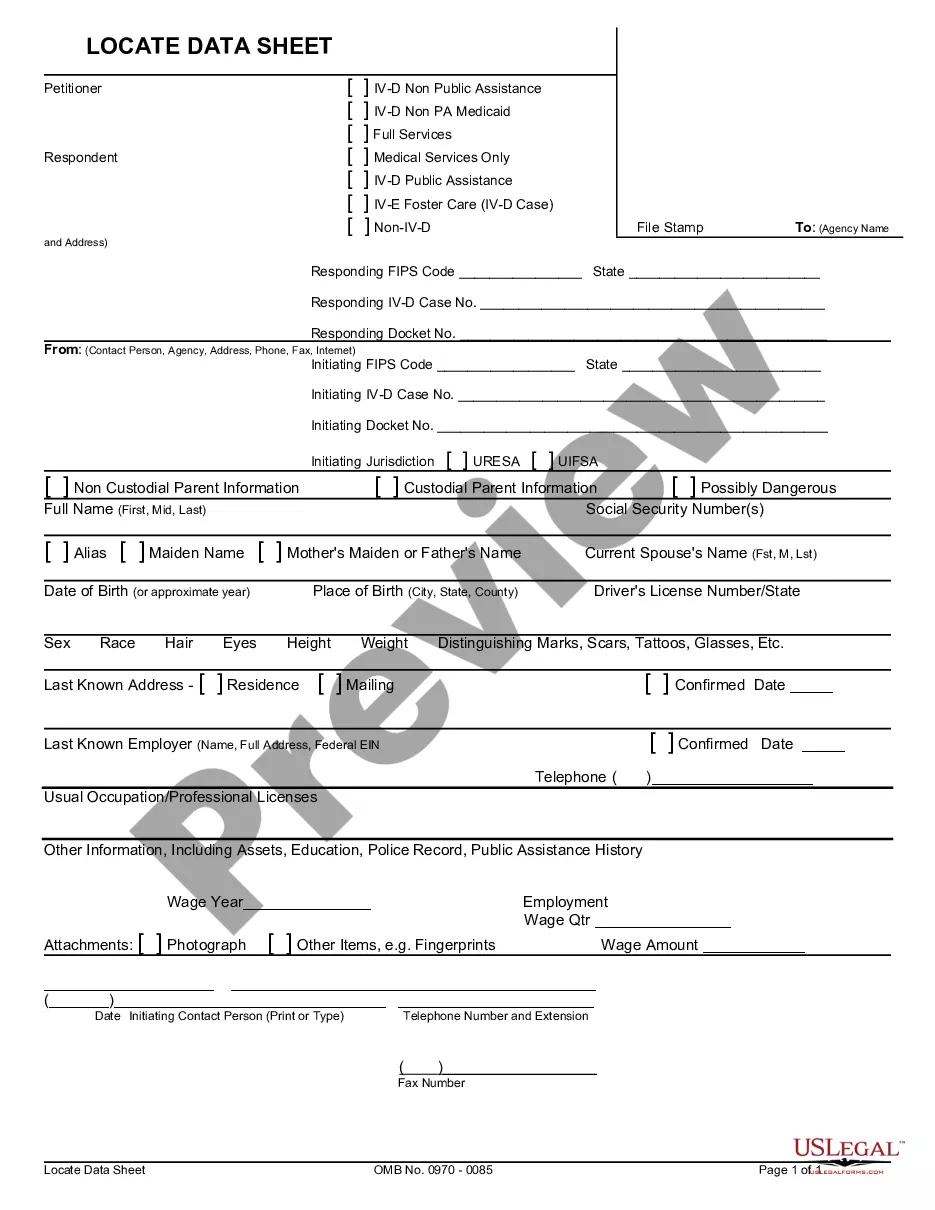

A financial declaration form is a form that is intended to provide information about a person's financial situation and assets. Categories. Information Request Forms. Financial Advisor Forms.