Equity Agreement Template With Vesting In Wake

Description

Form popularity

FAQ

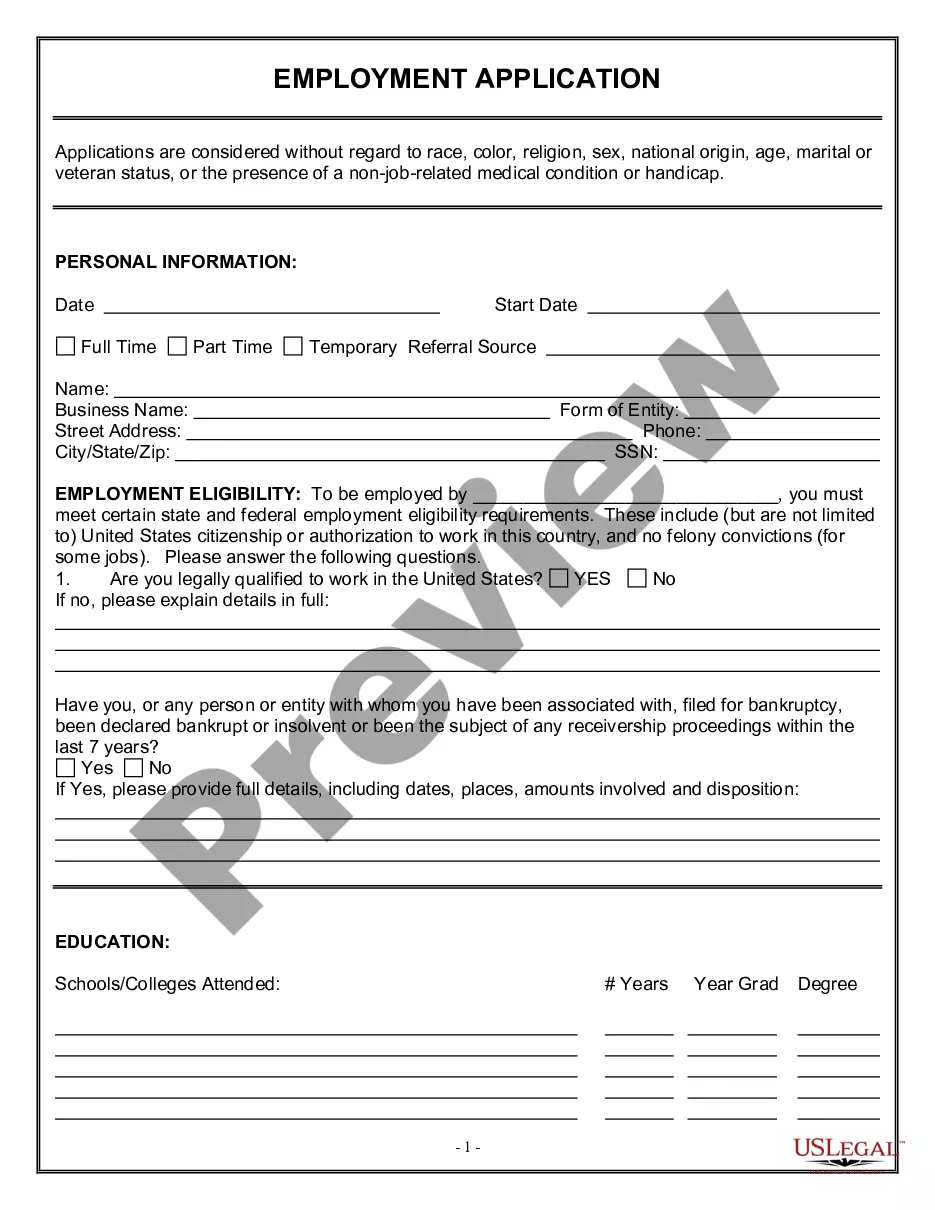

Vesting (or a vesting schedule) requires employees to fulfill a specified term of employment to gain access to benefits, such as retirement funds. Vesting is a way for employers to keep top-performing employees at the company.

Determine the Purpose of the Vesting Schedule. Decide on the Type of Equity. Define the Total Amount of Equity. Choose a Vesting Period. Determine a Cliff Period. Set the Vesting Frequency. Consider Accelerated Vesting Provisions. Draft the Vesting Agreement.

Usually, most common vesting schedules span over 4 years including a one-year cliff period, which is the time an employee has to work in the company before becoming eligible for shares. Then on, a certain percentage of shares 'vest' monthly in an incremental fashion. In some cases, shares may vest immediately.

What is a vesting schedule? A vesting schedule is a timeline that dictates when an employee or participant in a financial arrangement gains ownership of certain assets, typically stock options, retirement account contributions, or other forms of compensation provided by an employer or organization.

A vesting schedule is an incentive program for employees that gives them benefits when they have contractually fulfilled a specified term of employment with the company. Employers can choose from several types of vesting schedules.

1.18 "Vesting" means that Shares that have been issued to a Shareholder are subject to forfeiture unless certain events occur during the term of employment of the Shareholder.

A vesting schedule is an agreement laid out in advance that specifies how much of their equity allocation each co-founder actually owns at any point of time. For example, say the agreement is that shares of equity vest over a four-year period at 25% per year.

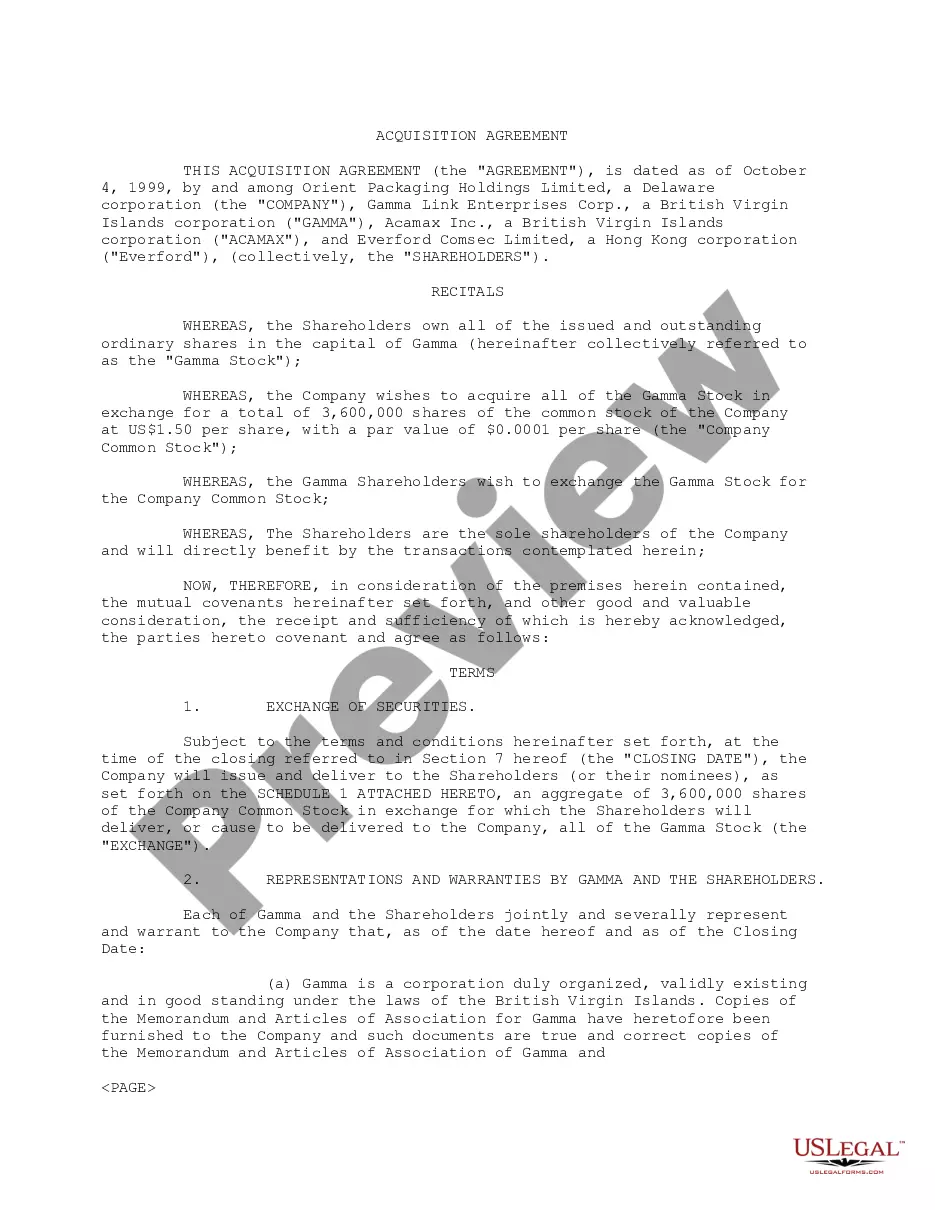

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.