Business Equity Agreement For Indy In Queens

Description

Form popularity

FAQ

A common way to own equity in a company is to invest in a publicly traded company listed on a stock exchange. For public companies, information about the company is transparent.

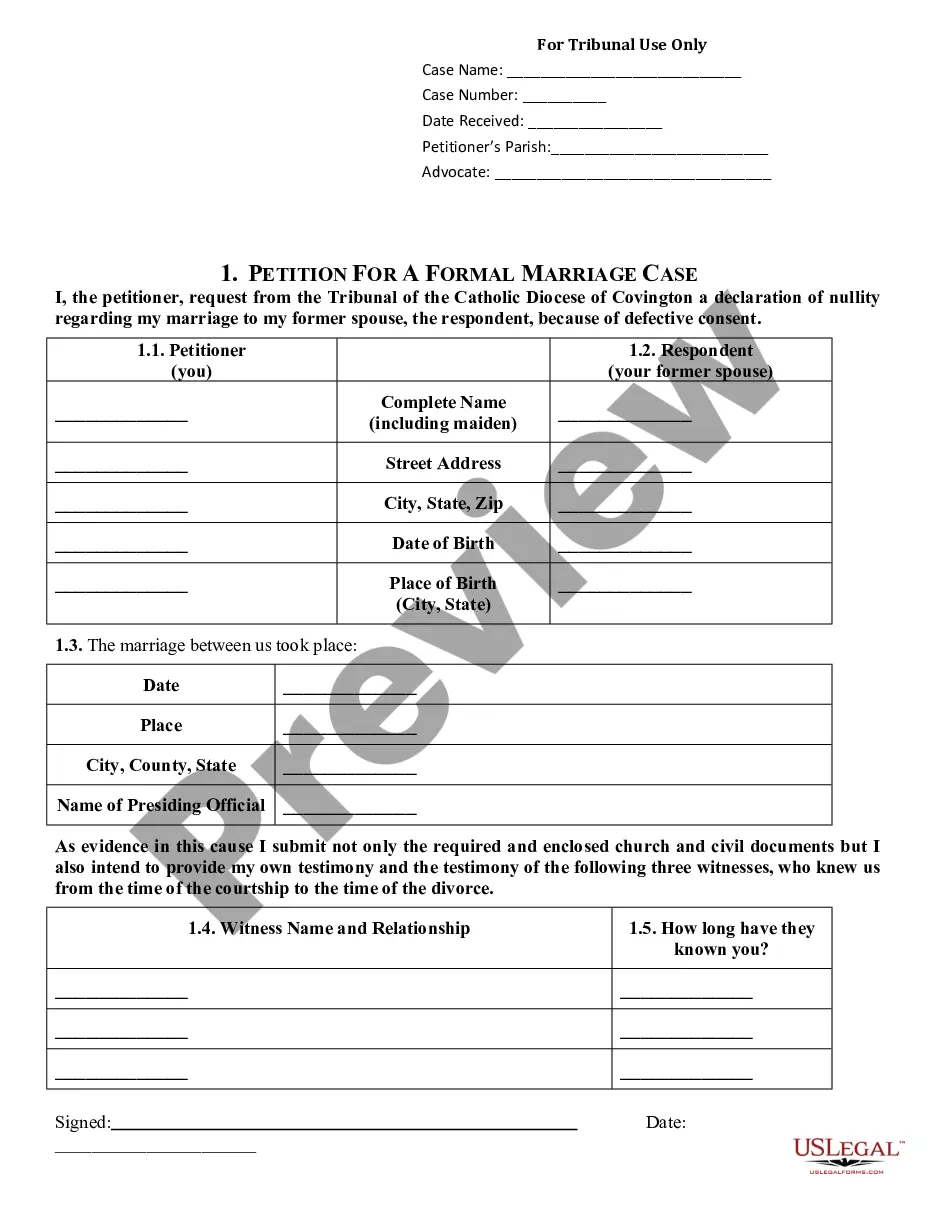

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).

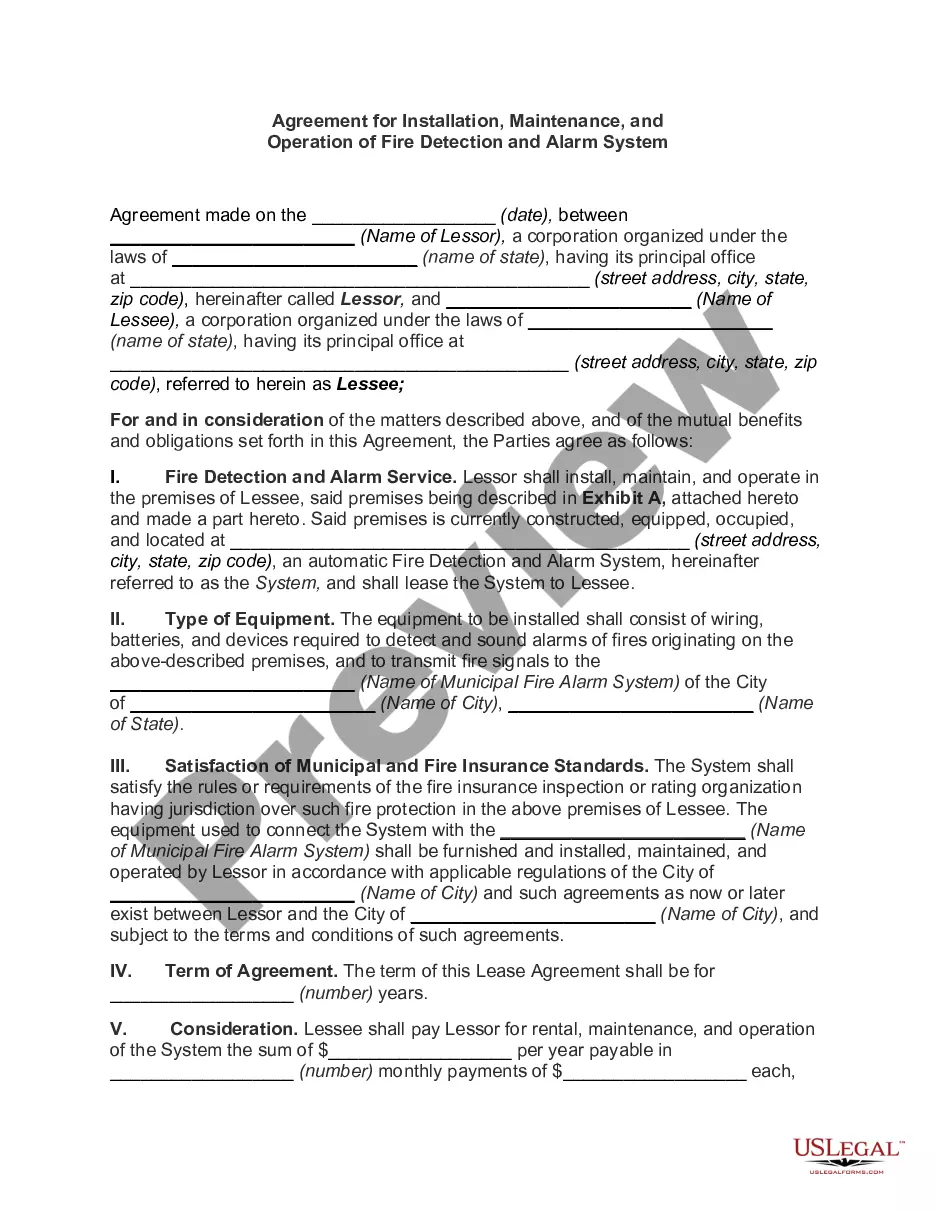

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

An equity agreement is like a partnership agreement between at least two people to run a venture jointly. An equity agreement binds each partner to each other and makes them personally liable for business debts.

An equity grant agreement is a legal document that breaks down the details of the equity such as the type of equity on offer, how many the person will be offered, the total value of the equity, any vesting periods or performance milestones attached to the offer, the fair market value of each equity unit, and other ...