Equity Agreement Statement Within In North Carolina

Description

Form popularity

FAQ

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

SAFE Example The SAFE investor would receive 6,250 shares under the 20% discount rate term in their agreement, or 15,000 shares if they had a valuation cap of $4 million. If an Investor had both features included in their SAFE agreement, the investor would likely choose the valuation cap and receive 15,000 shares.

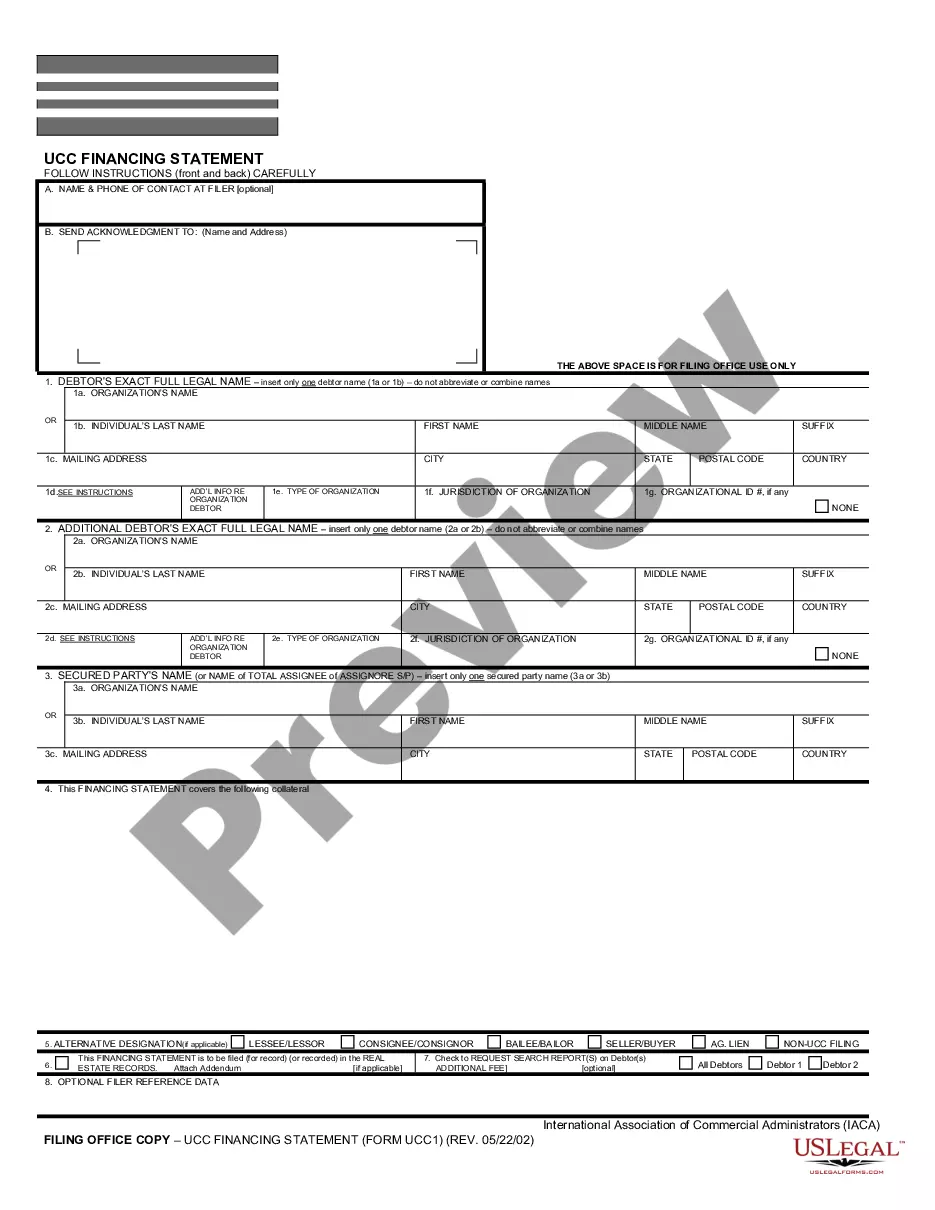

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Qualifying for a HEA is relatively easy, too. The main requirement is to have built up some equity in your property. You don't need a super high credit score, and the income criteria are flexible.

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Qualifying for a HEA is relatively easy, too. The main requirement is to have built up some equity in your property. You don't need a super high credit score, and the income criteria are flexible.

What are the steps for changing an LLC name in North Carolina? Check if your new LLC name is available. File the North Carolina LLC Amendment form (and wait for approval) Update the IRS. Update the NC Department of Revenue. Update financial institutions (credit card companies, banks) Update business licenses.

You must file Articles of Amendment to notify your state of your intent to change the legal name of your LLC. The Articles will also demonstrate the consent of other members, if required. Once the Articles of Amendment is approved the name change is considered official.

How to change your business name Check your name availability and get internal buy-in. The first step is simple— check that your desired new name is available. File your articles of amendment. Notify the IRS of your business name change. Update business documents.

What are the steps for changing an LLC name in North Carolina? Check if your new LLC name is available. File the North Carolina LLC Amendment form (and wait for approval) Update the IRS. Update the NC Department of Revenue. Update financial institutions (credit card companies, banks) Update business licenses.