Equity Agreement Contract With Consultant In Kings

Description

Form popularity

FAQ

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Use these steps to help you get your first consulting contract: Consider your areas of expertise. In order to book a contract, you need to know what areas you can train in. Target companies in your area. Meet with the owner. Prove your knowledge. Get the contract. Ask for a referral and testimonial.

Many consultants choose to join an Operations Team at the Private equity level because it allows them to leverage their consulting toolkit to assess and drive operational improvement opportunities within a firm's portfolio.

Contracts Define Your Independent Status This could be helpful if you need to prove consultant status for tax or other financial purposes. This also protects your client. If a company misclassifies an employee as an independent contractor, it can be held liable for fines, penalties, and even class-action lawsuits.

To become a contract management consultant, start by acquiring a relevant degree and consider certifications. Gain experience in roles involving contract management and negotiation. Develop key skills, including analytical, communication, and legal knowledge.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).

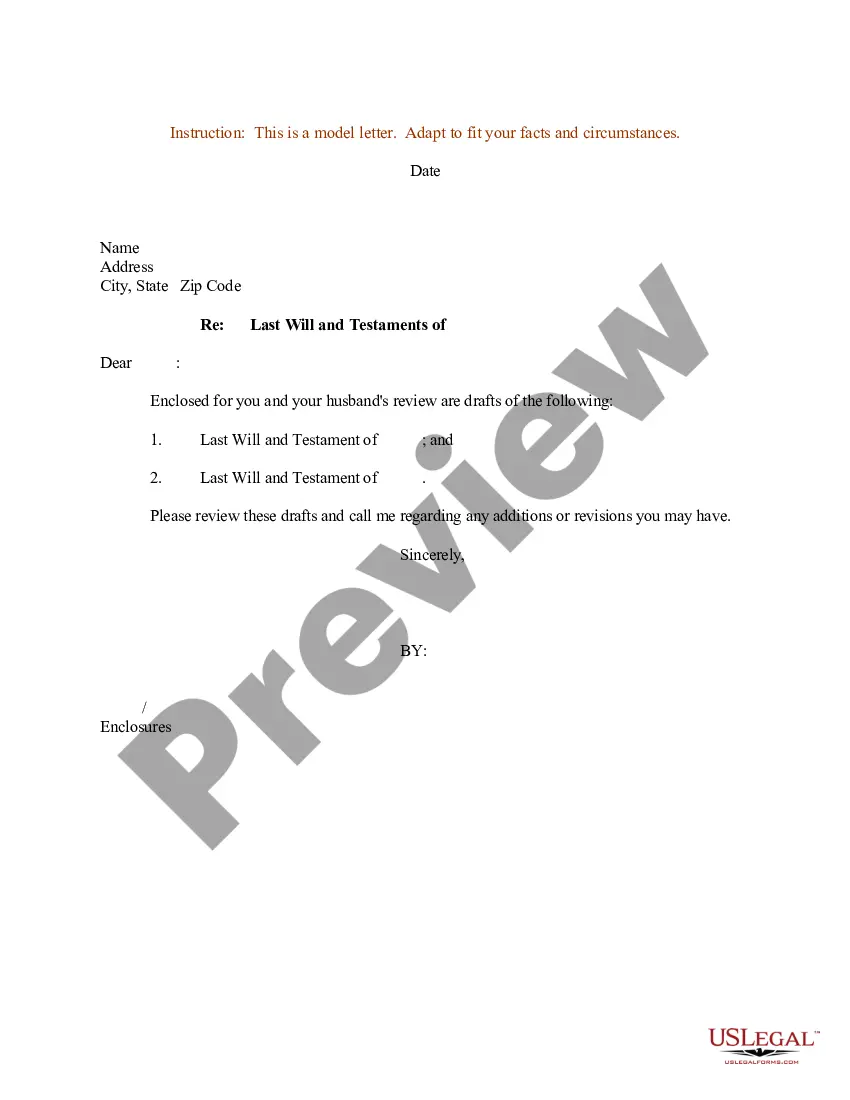

A consulting agreement is a contractual document that describes a working relationship between a business and a consultant providing that company with their services. Other terms that are used to refer to a consulting agreement include: Business consulting agreement. Independent contractor agreement. Freelance contract.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.