Repossession Form Statement For Insurance In Miami-Dade

Description

Form popularity

FAQ

Fax Number (850) 617-5216 The turnaround time is the same, whether you submit your documentation by mail or fax.

Once your debtor is in default, you can repossess the car at any time without prior notice and you can even go onto the debtor's property to seize the car. That being said, you are not allowed to seize a vehicle by using physical violence or threats of force.

Failure to surrender a valid license plate when your insurance is cancelled or expires will result in suspension of your driver license. When you dispose of a plate by turning it into a tax collector's office you will receive a receipt showing that the plate was surrendered.

Failure to surrender your license plate when you sell your vehicle and are not transferring the plate to a replacement vehicle within 30 days will also result in a driver license suspension. When you surrender your plate, a new vehicle registration will be printed indicating the license plate is canceled.

You should dispose of Florida license plates via one of the following methods: In person at a motor vehicle service center. Via mail to a motor vehicle service center along with a request to cancel and recycle the license plate.

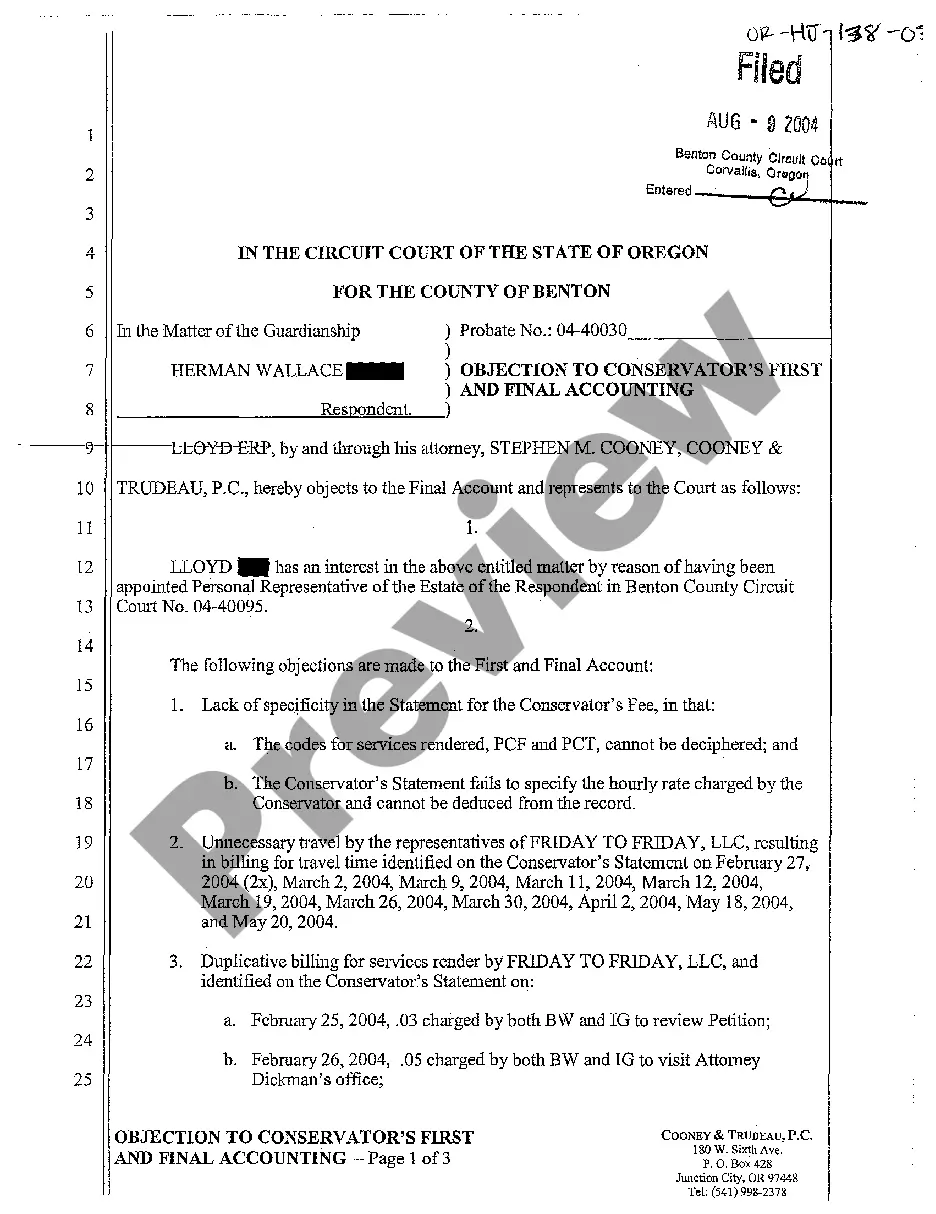

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

Complete title transfer in a motor vehicle service center; Remove license plate from the sold vehicle; Surrender the license plate, if applicable; and. File a Notice of Sale, form HSMV 82050.

The proof can be a copy of your driver license, registration or insurance card (whichever applies). The proof must show an issued date prior to the date of the ticket. For registration and insurance proof, the vehicle description must also match the vehicle described on the citation.

The Bill of Sale form HSMV 82050 includes sections for both the gift-giver/seller and gift recipient/purchaser. It also features spaces for the vehicle's details such as make/model, Certificate of Title (which proves that the gift-giver is the actual owner of the car being gifted) and more.