Agreed Judgment

Overview of this form

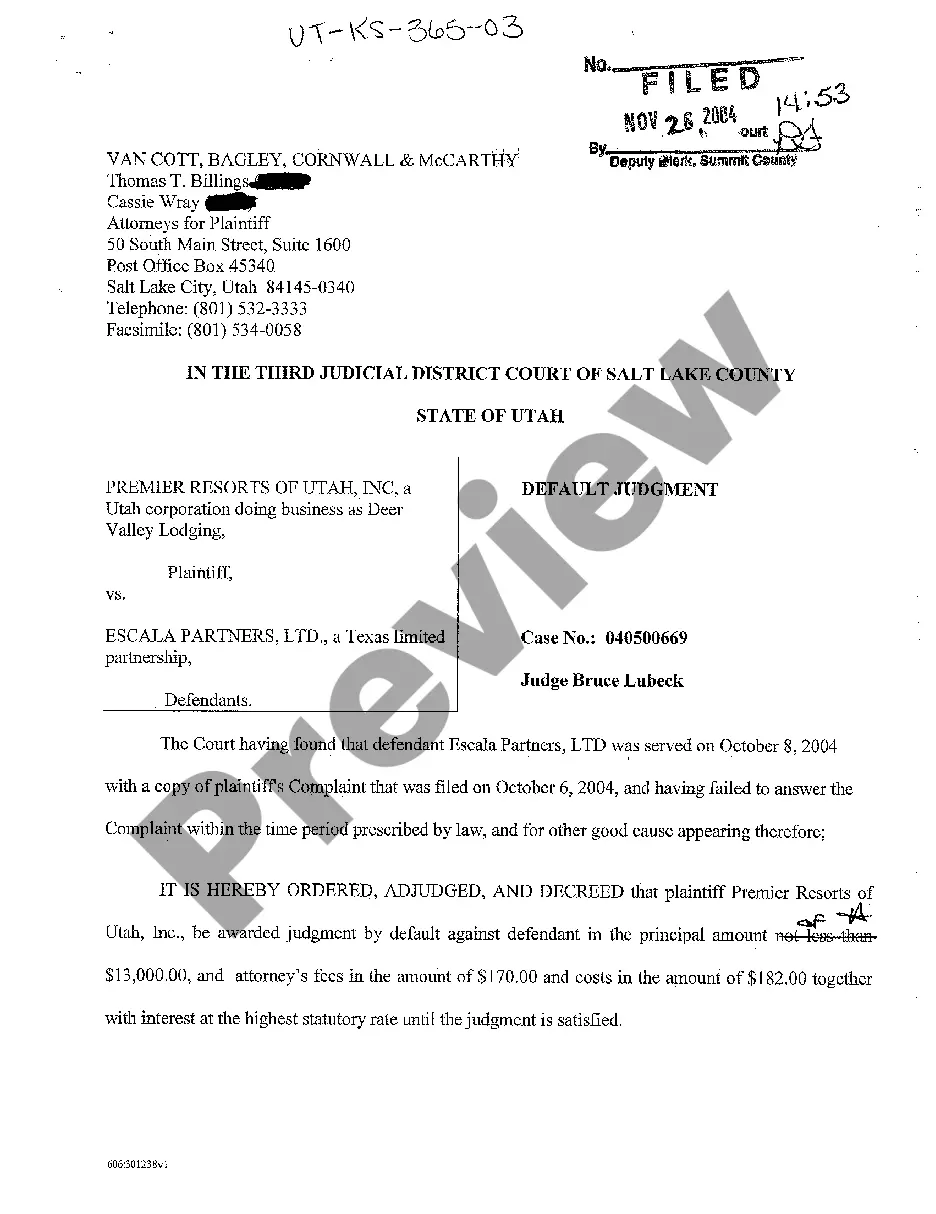

The Agreed Judgment is a legal document used after a Petition for Forfeiture has been filed. It serves as a formal agreement between the parties involved, allowing for a cash settlement where the Sheriff's office pays a specific amount to the Defendant's attorney. This form is suitable for use in all states and provides a clear outline of the agreed settlement terms, differentiating it from other legal forms such as the standard judgment or civil settlement agreements.

Form components explained

- Name of the county and date.

- Payment amount agreed upon.

- Identification of the recipient (Defendant's attorney).

- Statement on the balance retained by the Sheriff's office.

- Signatures of the Circuit Judge and District Attorney.

When to use this document

The Agreed Judgment should be used in situations where a Petition for Forfeiture has already been filed, and both parties have reached an agreement on the terms of the cash settlement. This form is typically needed in legal disputes involving seized property or cash, where an out-of-court settlement is preferable to prolonging litigation.

Who needs this form

- Defendants involved in a forfeiture case.

- Attorneys representing defendants in these cases.

- Law enforcement agencies, specifically the Sheriff's office, that are part of the agreement.

Steps to complete this form

- Enter the name of the county and the date of the agreement.

- Specify the sum to be paid to the Defendant's attorney.

- Indicate the balance that the Sheriff's office will retain.

- Have the Circuit Judge sign to approve the form.

- Obtain the signature of the District Attorney for validation.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to enter the correct names of the parties involved.

- Incorrectly specifying the payment amount.

- Neglecting to include signatures from all required parties.

- Using outdated forms or not updating dates properly.

Benefits of completing this form online

- Convenience of instant download and easy access.

- Editability to tailor the form to specific case details.

- Reliability of using professionally drafted templates by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Even after a judgment is entered against you, it is still possible to settle a debt for less than the court-approved amount.However, you may be able to negotiate a discount to the debt, in return for a lump sum payment.

An agreed judgment is a judgment which is typically entered after a memorandum of understanding, which is a written agreement shared with counsel who then incorporate it into an agreed order signed by a magistrate, the parties, and their attorneys, if applicable.

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Aim to Pay 50% or Less of Your Unsecured Debt If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt.

Whenever a civil lawsuit is filed, the plaintiff wins the case by obtaining a judgment against the Defendant. A judgment is the final determination by a court of proper jurisdiction of who wins the case.An agreed judgment, like a regular judgment, resolves the lawsuit.

A judgment is an official designation entered on a court's docket that signifies that a plaintiff has prevailed in his court case against the named defendant. A settlement is an agreement by both parties to the lawsuit that resolves their dispute prior to trial.

An Agreed Judgment is usually a settlement agreement for an extended payment plan. Payment plans are usually 12 to 36 months. Sometimes an agreed judgment is the only option if the creditor has produced enough evidence to likely win at trial and the consumer can only do a settlement with a long term payment plan.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

A creditor may agree to settle the judgment for less than you owe. This typically happens when the creditor thinks you might file bankruptcy and wipe out the debt that way. Settling can be a win-win. The creditor gets at least partial payment for the debt although it usually will require it as a lump sum.