Texas Estate Form With You

Description

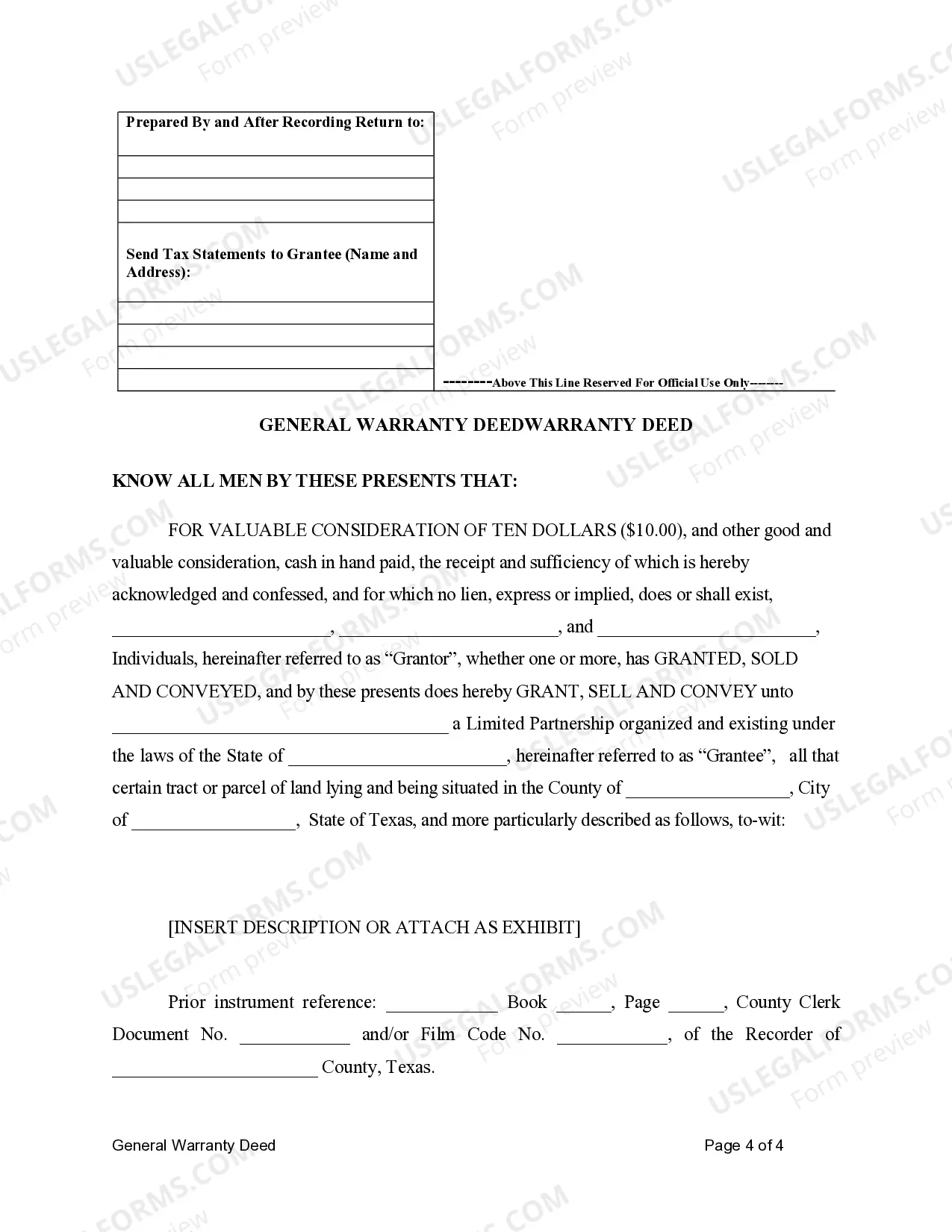

How to fill out Texas General Warranty Deed For Three Individuals To Limited Partnership?

- If you're an existing user, log into your account and click the Download button to acquire your desired estate form template. Confirm your subscription is active; if it's not, renew it based on your payment plan.

- For first-time users, start by reviewing the Preview mode and form description to ensure you select the form that aligns perfectly with your needs and adheres to local jurisdiction regulations.

- If you find any discrepancies, utilize the Search feature to locate a more suitable document that meets your requirements.

- Purchase the desired form by selecting the Buy Now button, followed by choosing your preferred subscription plan. An account registration will be necessary for full access.

- Complete your transaction by entering your credit card information or selecting your PayPal account to finalize the subscription.

- Once purchased, download the form to your device for immediate use, and access it anytime via the My Forms section within your profile.

In conclusion, US Legal Forms stands out with its extensive collection of templates and expert support, ensuring every legal document you need is just a few clicks away. With unmatched convenience, securing your Texas estate form with you is simpler than ever.

Start your journey to hassle-free legal documentation today!

Form popularity

FAQ

Filing a small estate affidavit in Texas requires you to submit the completed form to the probate court in the county where the deceased lived. Make sure to include all supporting documents, such as death certificates and any necessary identification. By using a Texas estate form with you, you streamline this process and increase the likelihood of a successful filing. Proper filing allows heirs to receive their inheritance more swiftly.

To fill out a small estate affidavit in Texas, start by providing the names and addresses of all heirs and listing the assets of the estate. Ensure that you properly detail any debts and expenses associated with the estate, as these will impact the distribution. Utilizing our Texas estate form with you ensures accuracy and compliance with local laws. This resource makes the process clearer and more manageable.

Yes, many banks in Texas accept small estate affidavits. This document allows heirs to claim assets without going through the probate process, as long as the estate qualifies. When you use a Texas estate form with you, you can rest assured that it meets the necessary requirements for financial institutions. This acceptance simplifies the process of accessing funds and managing the estate.

Filling out a small estate affidavit form involves several steps, such as gathering necessary information about the deceased's assets and debts. You will need to provide details, including the names of the heirs and the value of the estate. Using our Texas estate form with you can guide you through this process and ensure compliance with state laws. Properly completed forms expedite the transfer of assets to heirs.

In Texas, an estate must exceed $75,000 to require probate. If the estate's value is below this threshold, you can often use a Texas estate form with you to avoid the probate process entirely. This approach saves time, reduces costs, and streamlines the transfer of assets. Understanding these requirements can help you make informed decisions during estate planning.

In Texas, assets that are solely in the deceased's name and do not have a designated beneficiary typically go through probate. This includes real estate, bank accounts, and personal property that lack joint ownership or a transfer on death designation. To navigate these assets effectively, a Texas estate form with you can provide the necessary guidance and ensure compliance with state law.

Yes, in certain circumstances, an estate can be settled without probate in Texas. For example, if the estate consists solely of jointly owned assets or if it is below the $75,000 threshold, informal methods can be used. Engaging with a Texas estate form with you can provide clarity on whether your situation qualifies for a simplified process.

In Texas, if the estate's total value exceeds $75,000, it typically requires probate proceedings. However, there are exceptions for specific situations, such as small estates that meet certain criteria. Understanding the nuances of estate value can be easier when you utilize a Texas estate form with you, guiding you through the requirements.

To transfer ownership of property after a death in Texas, you generally need to go through the probate process. This includes filing the will with the probate court and possibly acquiring a court order to officially transfer title. If the estate is small, you may have options to utilize a Texas estate form with you to simplify the transfer without full probate.

In Texas, whether a will goes to probate depends on its validity and the decedent's assets. If the will is deemed valid and the estate has assets exceeding a certain value, the probate process is necessary. Additionally, if disputes arise among heirs or beneficiaries, probate may be required. A Texas estate form with you can help clarify the process and necessary decisions.