Survivorship Deed With Mortgage

Description

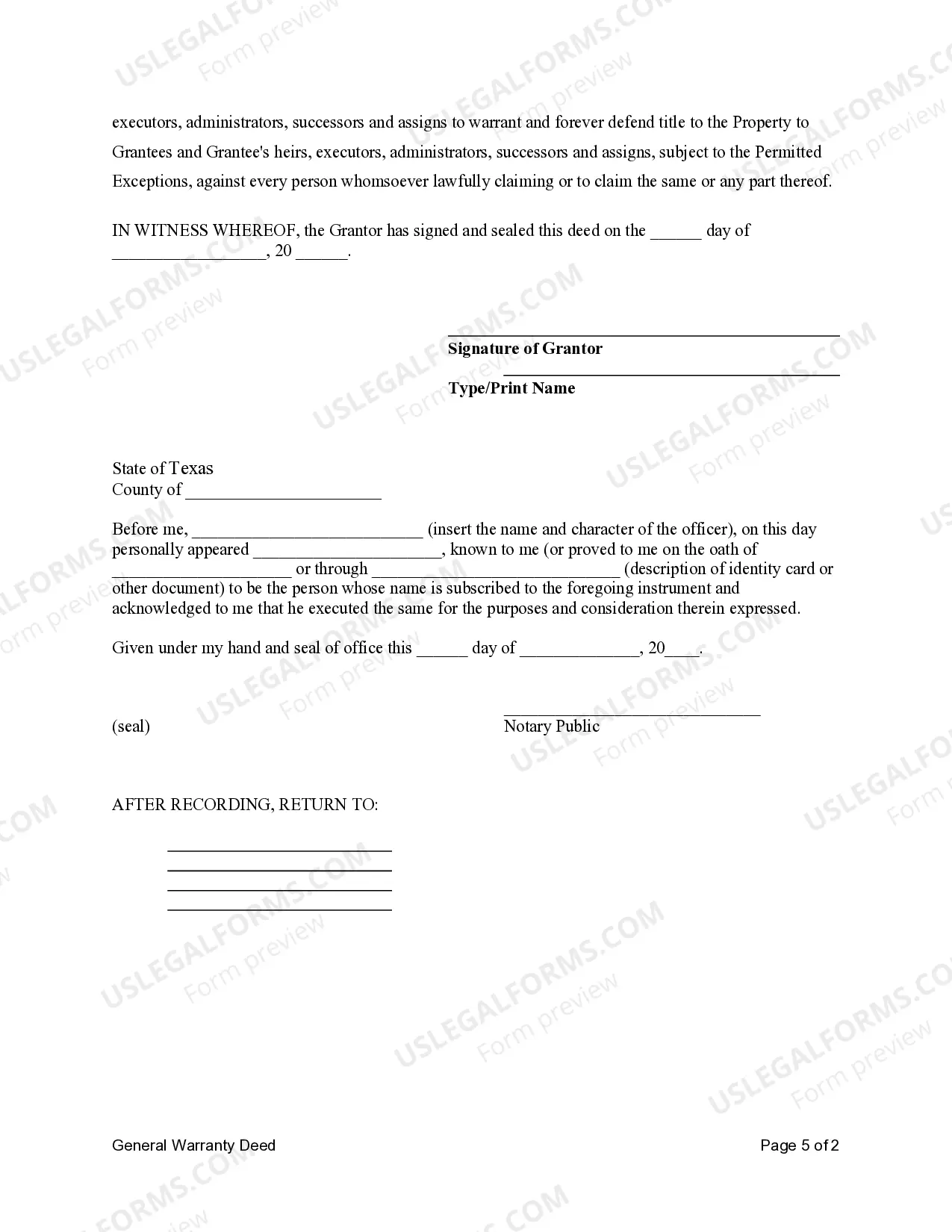

How to fill out Texas General Warranty Deed - Individual To Three Individuals?

How to acquire professional legal documents that adhere to your state regulations and prepare the Survivorship Deed With Mortgage without consulting an attorney.

Numerous services online offer templates to address various legal matters and formalities.

However, it may require time to identify which of the available examples meet both your use case and legal standards.

Download the Survivorship Deed With Mortgage by utilizing the designated button adjacent to the file name. If you lack an account with US Legal Forms, adhere to the guide below: Examine the webpage you have accessed and verify if the form meets your requirements. To do this, utilize the form description and preview options if present. Search for another example in the header that provides your state if necessary. Press the Buy Now button once you've located the suitable document. Select the most appropriate pricing plan, then Log In or pre-register for an account. Choose your payment method (by credit card or via PayPal). Select the file format for your Survivorship Deed With Mortgage and click Download. The acquired templates remain yours: you can always return to them in the My documents section of your profile. Register for our platform and create legal documents independently like a seasoned legal expert!

- US Legal Forms is a trusted platform that assists you in locating official documents crafted in line with the most recent state law updates and economize on legal support.

- US Legal Forms is not merely an ordinary web directory.

- It is a collection of over 85k validated templates for diverse business and personal scenarios.

- All documents are categorized by region and state to expedite your search process and make it more convenient.

- Additionally, it integrates with robust solutions for PDF editing and electronic signatures, allowing users with a Premium subscription to swiftly finalize their paperwork online.

- It requires minimal effort and time to obtain the necessary documentation.

- If you already possess an account, Log In and ensure your subscription is valid.

Form popularity

FAQ

Survivorship rules govern how property is transferred among joint owners upon the death of one party. Typically, the details of survivorship rights are defined in the deed, such as a survivorship deed with a mortgage. Familiarizing yourself with these rules can ensure you effectively manage your property and avoid legal complications in the future.

The inheritance of survivorship refers to the automatic transfer of property rights to a surviving joint tenant upon the death of the other tenant. This process bypasses probate, easing the burden on the surviving partner. Using a survivorship deed with a mortgage can be a smart move for couples wanting to secure their assets seamlessly.

For married couples, a survivorship deed with a mortgage is often considered the best choice. This type of deed ensures that both spouses hold equal ownership of the property and that the surviving spouse automatically receives full ownership upon the death of the other. It simplifies the estate process and provides peace of mind.

While both survivorship and inheritance deal with the transfer of property after someone's death, they are not the same. Survivorship allows joint owners to automatically inherit each other’s share, often utilizing a survivorship deed with a mortgage. Inheritance, on the other hand, follows legal protocols and may involve a broader range of heirs.

Survivorship involves the transfer of property rights to the surviving owner when one joint owner passes away. This legal concept is crucial for property ownership, especially when it involves a survivorship deed with a mortgage. Understanding survivorship can help avoid probate, ensuring a smooth transition of property ownership.

Succession and inheritance are related but distinct concepts. Succession refers to the overall process by which property is passed on after a person dies. Inheritance specifically deals with the assets that an heir receives, which can also include properties with a survivorship deed with a mortgage.

In California, it is advisable to notify the mortgage company promptly after the co-owner's death. Doing so prevents potential late fees and can help ensure that payments continue seamlessly. If the property is held under a survivorship deed with mortgage, the surviving owner should provide legal proof of the death. This helps protect your interests and streamline the process.

If your co-owner has died, you may have options depending on how the property is held. A survivorship deed with mortgage allows you to inherit full ownership without dealing with probate. However, you should confirm if any payments are still required on the mortgage. Consulting with a legal professional can help clarify your rights in this situation.

Avoiding joint ownership can be wise due to the complexity it can bring, particularly regarding debt responsibility and control over the property. Co-owners may have differing financial goals, leading to complications in decision-making. Considering a survivorship deed with mortgage can provide a clearer structure for property ownership while minimizing potential disputes.

A notable disadvantage of the right of survivorship is the potential for unintended consequences regarding estate planning. For instance, if one owner dies, their share of the property goes to the surviving owner, possibly leaving out other heirs. Using a survivorship deed with mortgage should be considered carefully to avoid any unintended disinheritance.