Limited Business

Description

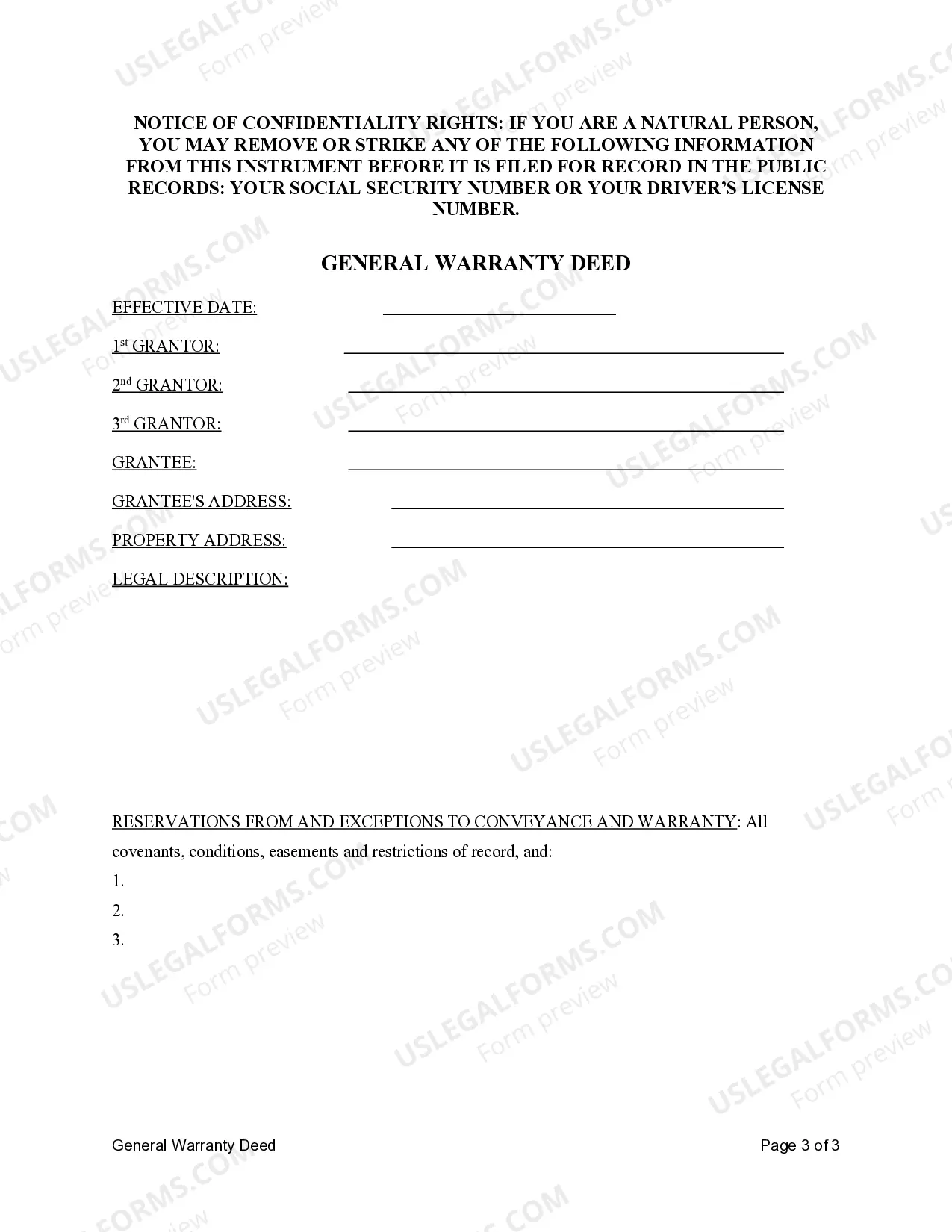

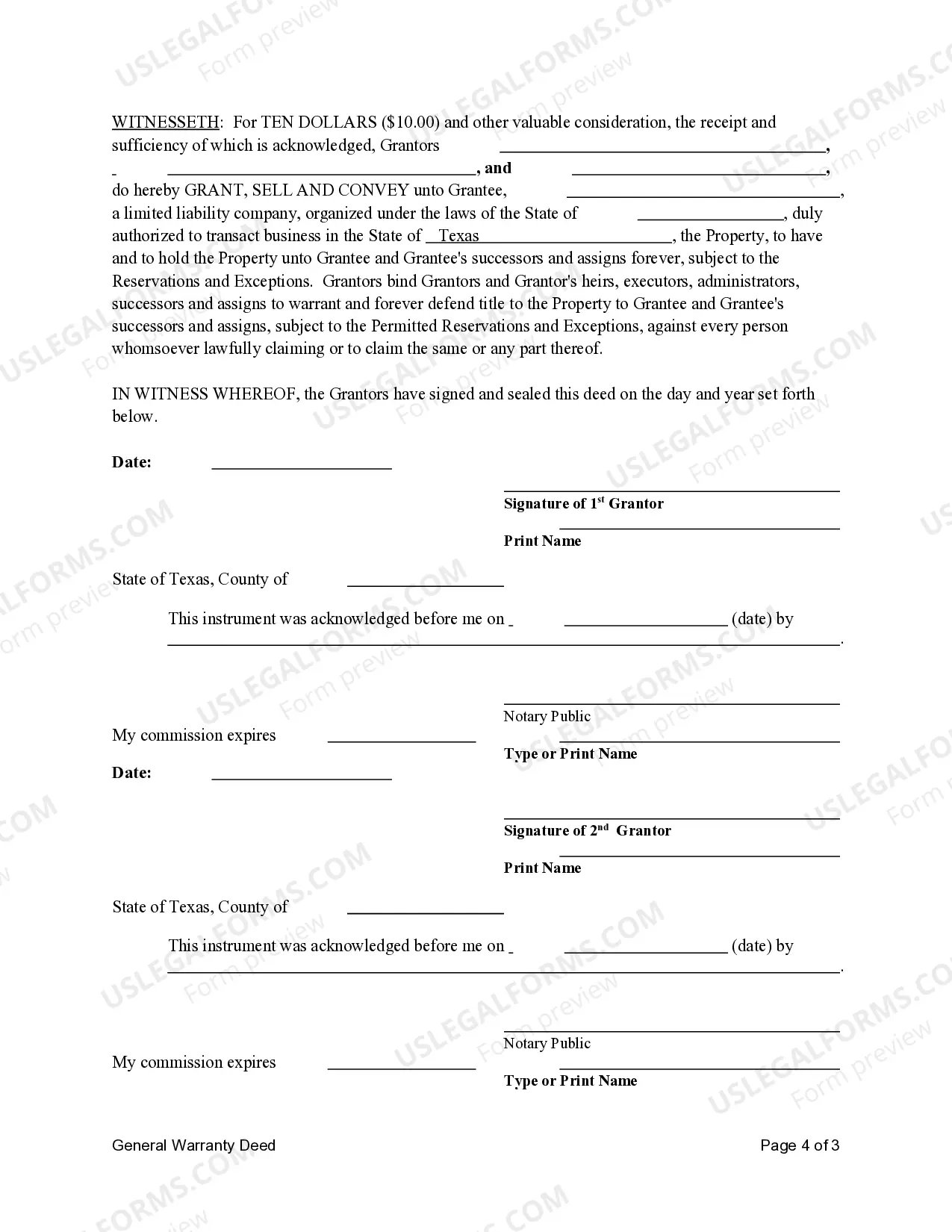

How to fill out Texas General Warranty Deed - Three Individuals To A Limited Liability Company?

- If you're a returning user, log in to access your account and download the required document from the My Forms section. Confirm that your subscription is active; if not, renew it as needed.

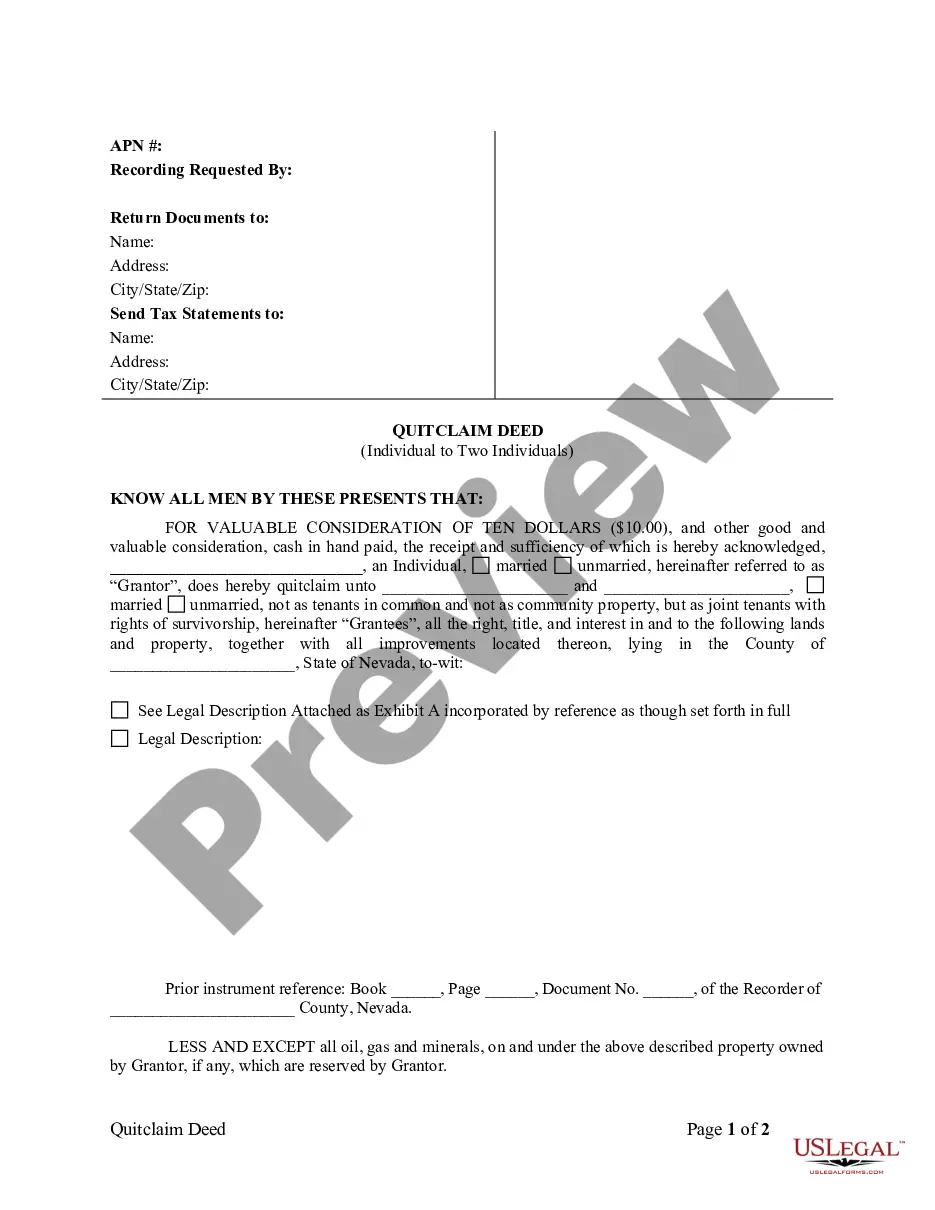

- For first-time users, start by checking the Preview mode and form description for the document that best fits your requirements and complies with your local laws.

- If the form doesn't meet your needs, use the search feature to find another suitable template. Make sure it aligns perfectly with your specifications before proceeding.

- Once you've selected the correct form, click on the Buy Now button and choose your preferred subscription plan. You will need to create an account for full access.

- Complete your purchase by entering your credit card details or selecting the PayPal option for payment.

- After payment, download the form directly to your device. You can also find it later in the My Forms section of your profile.

In conclusion, utilizing US Legal Forms simplifies the process of obtaining the necessary legal documents for your limited business needs. Their robust library and access to expert assistance ensure you have the resources to manage your legal requirements efficiently.

Start your journey today—visit US Legal Forms and unlock the power of legal documents tailored for you.

Form popularity

FAQ

You should file your taxes if you earned $400 or more self-employed, regardless of whether it is under $5,000. Reporting income ensures that your limited business complies with tax regulations. Remember to keep thorough records of all income earned.

Typically, LLCs are pass-through entities, meaning profits and losses are reported on your personal tax return. You will file your LLC income using a Schedule C along with your personal Form 1040. This structure simplifies tax processing for your limited business.

Your LLC must file taxes if it earns $400 or more in net income. Additionally, if your LLC has any employees, you must file employment taxes regardless of income level. Filing taxes correctly ensures that your limited business remains compliant.

Yes, you should report all business income, even if it is less than $600. The IRS requires all income to be reported, regardless of the amount. Keeping accurate records will help you manage your limited business finances effectively.

No, you do not need an LLC to run a small business. However, registering as an LLC can provide liability protection and may offer tax benefits. If you want to simplify your business's legal and financial structure, consider forming an LLC.

You should file taxes if your limited business earns $1,000 or more in net income during the year. This threshold applies whether you operate as a sole proprietor or an LLC. Filing your taxes promptly helps maintain your business’s good standing and avoids potential penalties.

A small business must typically report income to the IRS, regardless of the amount. However, if your limited business earns less than $400 in net income, you may not need to file a federal tax return. Always consult IRS guidelines for specific thresholds to ensure compliance.

A limited company and an LLC are both types of limited businesses, but they differ in structure and liability. A limited company typically refers to a corporation, while an LLC, or limited liability company, offers more flexibility in management and tax treatment. Both structures provide liability protection, but an LLC generally has fewer formalities compared to a limited company. If you're deciding between the two, consider the specific needs of your business, and platforms like USLegalForms can provide you with valuable guidance.

You can confirm your status as a limited company by checking your business registration documents. Look for ‘Ltd’ or ‘Limited’ in your official company name; this designation indicates that you operate as a limited business. Furthermore, review your incorporation paperwork and any published statements from your state’s business registry. If you ever find this process confusing, platforms like USLegalForms can simplify these checks for you.

A limited company is recognized as a separate legal entity, which means it protects your personal assets from business debts. To qualify, you need to register your business with the appropriate state authorities and comply with regulations. This structure allows for easier investment opportunities, as investors prefer the security limited businesses offer. Additionally, you enjoy certain tax benefits that other structures may not provide.