Tx Executors Purchase Withholding

Description

How to fill out Texas Executor's Deed - Estate To Five Beneficiaries?

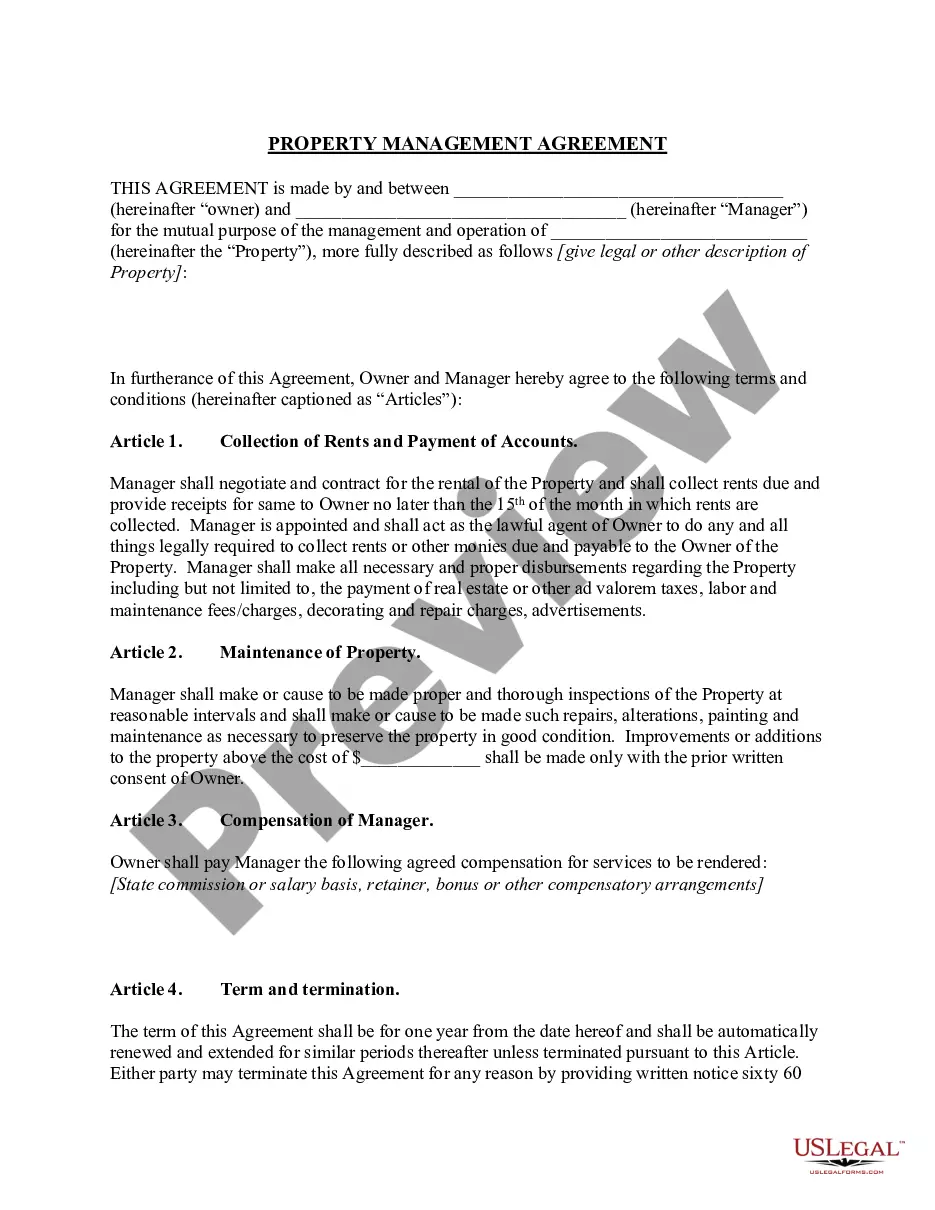

Drafting legal paperwork from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more cost-effective way of preparing Tx Executors Purchase Withholding or any other paperwork without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual library of over 85,000 up-to-date legal documents covers almost every element of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-compliant templates carefully prepared for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can easily locate and download the Tx Executors Purchase Withholding. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No worries. It takes minutes to set it up and navigate the catalog. But before jumping directly to downloading Tx Executors Purchase Withholding, follow these tips:

- Check the form preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the template you select conforms with the requirements of your state and county.

- Choose the right subscription option to buy the Tx Executors Purchase Withholding.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and transform form execution into something easy and streamlined!

Form popularity

FAQ

Under IRS regulations, the executor or administrator of the estate has the duty to pay the taxes.

An executor cannot change beneficiaries' inheritances or withhold their inheritances unless the will has expressly granted them the authority to do so. The executor also cannot stray from the terms of the will or their fiduciary duty.

Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after July 2015. This form, along with a copy of every Schedule A, is used to report values to the IRS.

When filing as an executor of estate, on the Form 1040, include only income and expense items up to the date of death. You'll also file a return for the estate on Form 1041. Include only income and expense items after the date of death.

Even without a statutory guideline on executor fees in Texas, the common understanding among legal professionals suggests that an executor can expect to receive about 2-5% of the estate's value.