Texas Estates Code Foreign Will

Description

How to fill out Texas Executor's Deed - Estate To Five Beneficiaries?

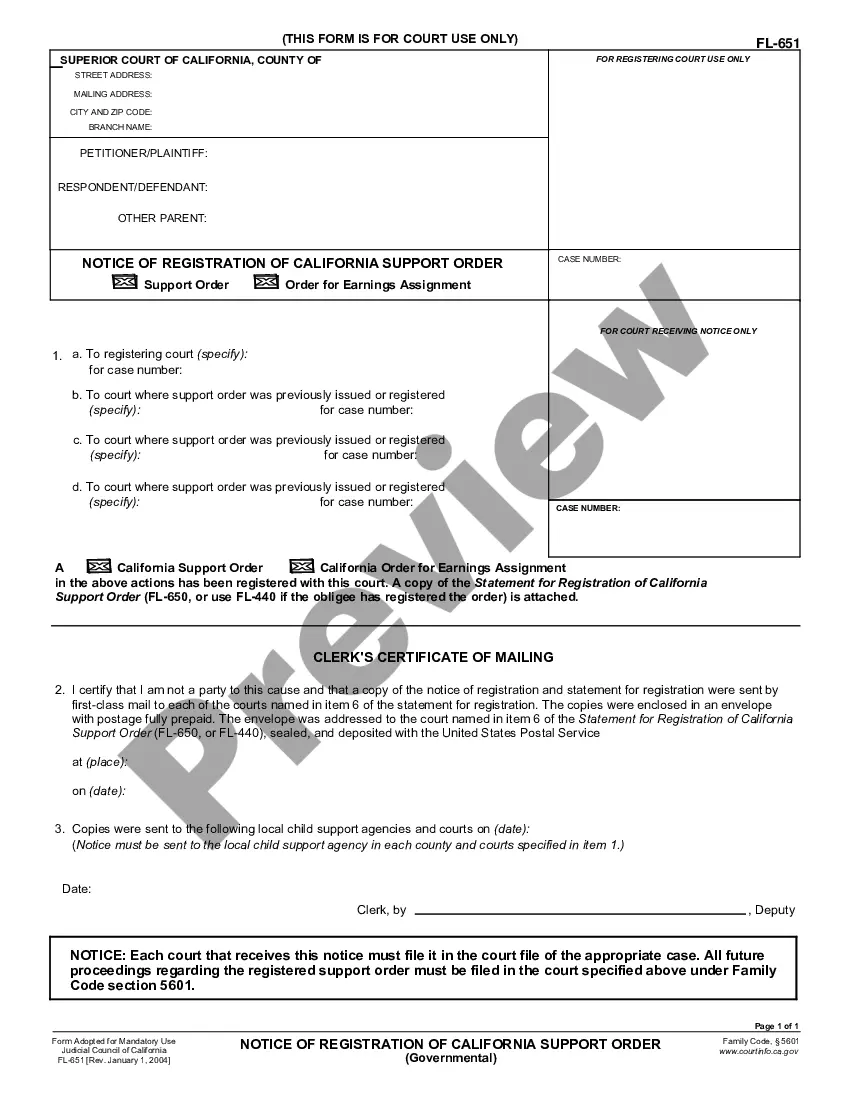

The Texas Estates Code Foreign Will displayed on this page is an adaptable legal template created by skilled lawyers in accordance with national and state regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal professionals with over 85,000 verified, state-specific documents for various business and personal circumstances.

Select the format you desire for your Texas Estates Code Foreign Will (PDF, DOCX, RTF) and store the document on your device.

- Browse for the document you require and review it.

- Look through the example you found and preview it or check the form description to ensure it meets your criteria. If it does not, utilize the search feature to discover the appropriate one. Press Buy Now once you have identified the template you need.

- Subscribe and Log In.

- Choose the pricing option that best fits your needs and create an account. Use PayPal or a credit card for a quick transaction. If you already have an account, Log In and review your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

Starting with the Utah Probate Court: Filing a Petition Decedent's will (if available). Death certificate. Nomination of a Personal Representative or Executor. Request for formal or informal probate proceedings. Once approved, a judge takes charge of the probate process.

Collection of personal property by affidavit. the claiming successor is entitled to payment or delivery of the property.

In Utah, the probate filing fees are $375.00.

After swearing an oath, the Grant Of Probate will be received by the probate registry in 3-4 weeks. After that, the process will take between 6 months to a year, with 9 months being the average length of time it takes to complete the process.

A small estate affidavit is not filed with the court. Instead, the decedent's successor fills out the form, signs it in front of a notary, and gives it to any third parties, such as the bank.

If heirs begin fighting over the distribution of property, the probate process can last longer than a year. Probate can be complicated and expensive. Because the probate process can be complicated, many individuals find it necessary to hire an experienced Utah estate planning attorney.

In Utah, probate can take anywhere from four to five months for an average estate to be settled. More complex, larger estates can of course take longer, especially if there are any objections.

Who may file. Anyone may file a probate case. To be appointed the personal representative, an applicant must be at least 21 years old. See Utah Code 75-3-203.